After a flood or fire, new service helps victims still live close to home during repairs

After a flood or fire, new service helps victims still live close to home during repairs | Insurance Business Canada

Insurance News

After a flood or fire, new service helps victims still live close to home during repairs

It’s the sharing economy portal you’d rather not need, but might be glad to have

Insurance News

By

Desmond Devoy

This article was produced in partnership with SiniSTAR.

Desmond Devoy of Insurance Business Canada sat down with Alexis Vertefeuille, CEO and founder of SiniSTAR, to learn about a new service that lets homeowners bid to rent their accommodations to victims of floods or fires while their homes are being repaired.

It started as a simple act of kindness toward a friend in need.

Now it has grown into a disruptor that serves policyholders by keeping them in their neighbourhoods after a flood or fire as their home is repaired.

“In 2016, one of my friends from university, and her mother, were the victims of a fire, and they had been living in a hotel for two months,” remembered Alexis Vertefeuille (pictured below). “They were facing another four months of hotel living until their home was again habitable.”

Vertefeuille was shocked that they would have to in a hotel for so long.

He turned to another friend who said he would be able to rent out a fully furnished accommodation for the remaining four months.

“I bridged the gap between the insurance company, the policyholder and the homeowner,” he said. “I was just a guy who wanted to help a friend.”

Afterwards, he had a sudden realization – his friend was not the only flood or fire victim who did not relish living in a hotel for months on end. And his other friend was likely not the only person with spare space ready to rent to someone who suddenly needed emergency housing.

Shortly afterward, he founded SiniSTAR, based in Montreal, which acts as a more formal bridge.

“It is a unique concept that brought the home-sharing economy to insurance housing for the first time,” he said. “Before, a lot of big landlords controlled the insurance housing market, and nobody could enter it.”

His company changed that.

How does SiniSTAR work?

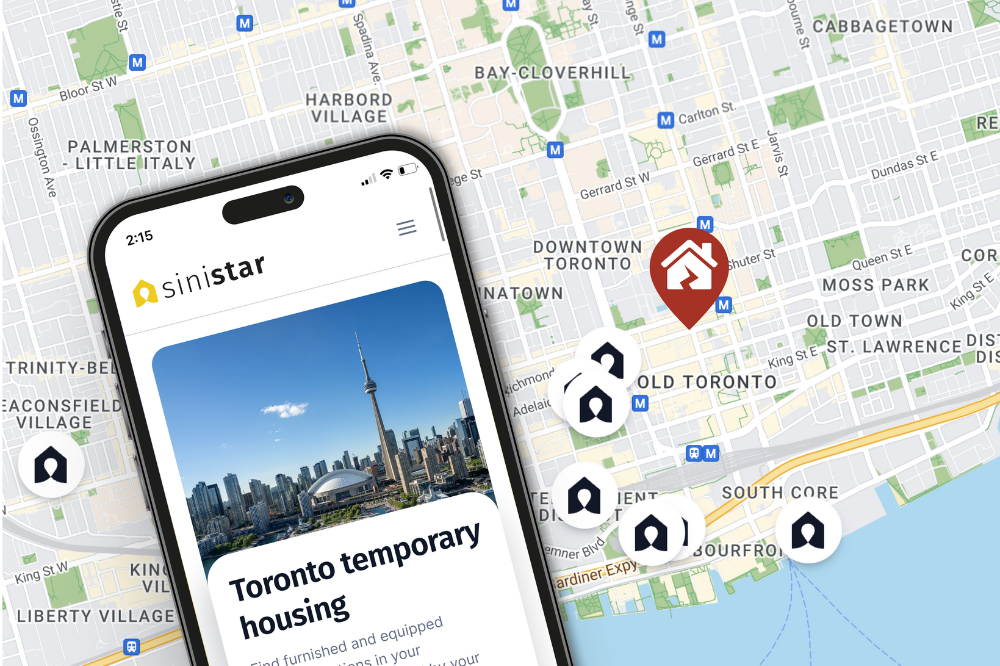

SiniSTAR is an online marketplace where temporary housing for policyholders can be listed and rented.

“Our platform is designed for the insurance housing sector, and has proprietary technology. It streamlines relocation and controls costs by acting as a bidding platform,” he said.

He stressed that it is “not a reservation platform like Airbnb or booking.com.”

In Quebec alone, there is the potential for thousands of owners of furnished homes to bid on insurance contracts for housing flood or fire victims, he said. Across Canada, clients have access to more than 5,000 similar, furnished accommodations.

When there is a flood or fire in a community, the company lets “every small homeowner in the area know that there is an incident nearby. And all those homeowners bid to win the contract,” to house the victims. “So now, it’s not a big monopoly, with the market controlled by one or two big players. A lot of other, smaller homeowners bid on and compete for the contract,” he said.

Competing bids drive the price down and “give the best price to the insurance company.” He stressed that “the adjuster always has the last word and must approve the insureds’ choice.”

SiniSTAR’s first big emergency housing test

The team’s first big test came during the flooding in Quebec and eastern Ontario in 2017. He still remembers getting phone calls from people crying tears of joy and thanking him because they did not have to relocate to a hotel or a big city far away from their neighbourhood. Instead, “they’re 250 metres from their home, their child’s school, all those places,” he said.

His company tracks “the best quality housing for insurance companies and for policyholders. The days of monopolies and inflated prices are over. With our bidding system, you always get the best value,” he said.

But how does SiniSTAR make money through this process? According to Vertefeuille, his company takes a cut on the price of winning bids. The percentage depends on the housing’s quality.

While these are SiniSTAR’s most well-known attributes, they also help as a bridge of another sort, between the claim adjuster and policyholder.

“Now, you have all of your relocation files in one place, and you benefit from a consistent process and documentation,” he said. “It’s always the same thing whether you’re in Vancouver or Halifax.”

SiniSTAR is available via email, phone, the website and a mobile app. Filling out a simple form on your device allows the company to activate its bidding technology.

The adjustor determines the stay’s length, which can be extended later as needed.

“It’s a blend of technology and human judgment that quickly finds the right accommodation,” he said. “Our algorithm makes it super simple.”

SiniSTAR’s marketplace reaction, and future plans

Many recognize that SiniSTAR is “changing day-to-day life for displaced policyholders while making communities more resilient.” Those who offer their homes online are also happy to be part of such a movement.

“I really want to help my community. I’m happy to be on your platform,” one person told him. “They often say things like that,” Vertefeuille noted.

Since 2016, his company has created a hosting community that can showcase more than 5,000 listings, help more than 3,000 policyholders, and work with more than 33 insurance companies. And it continues to grow.

Vertefeuille, who is originally from the Ottawa/Gatineau area, already has expansion plans.

“We really want to make this beautiful Canadian business work internationally, and this technology can help in the United States, France, and the UK – actually, everywhere,” he said.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!