Record April issuance boosts cat bond trading, as pipeline builds

Trading of catastrophe bond notes in the secondary market has picked up in the last few weeks as cat bond fund managers and investors look to adjust their portfolios to accommodate the brisk flow of newly issued deals, helped in part by a record over $2 billion of issuance in April 2023, by Artemis’ numbers.

We’ve been tracking catastrophe bond issuance since the market began in the Artemis Deal Directory and the $2.05 billion of new cat bond issuance that we recorded in April 2023 was a record.

You can track catastrophe bond issuance by year, as well as by type of transaction and year, and also by month and year, using Artemis’ extensive range of charts and visualisations.

The catastrophe bond and related ILS market did not set any records through the first-quarter of the year, although issuance was healthy.

But, then in April 2023, we saw the cat bond market pipeline expand significantly, with the largest number of deals coming to market that month that we have ever recorded in our Deal Directory.

The result was $2.05 billion of new issuance recorded by Artemis, all of which was property catastrophe reinsurance linked and with a good deal of diversity, in terms of perils and regions securitized during the month.

Now, with momentum in the catastrophe bond market continuing apace, we have a strong pipeline already built for the month of May 2023, with another significant month of new cat bond issuance expected.

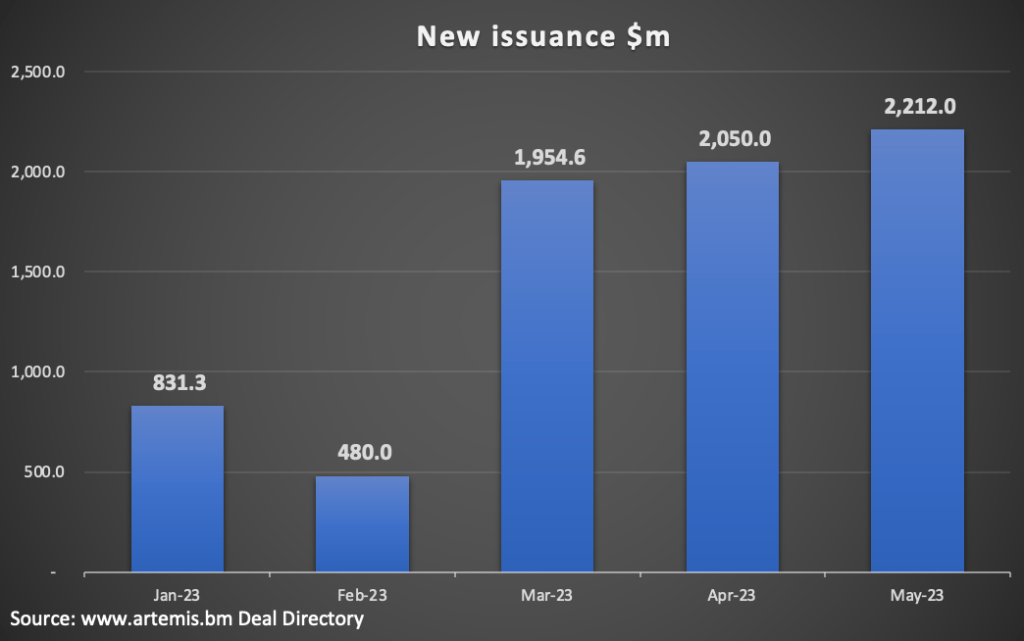

The chart below shows catastrophe bond and related ILS issuance tracked by Artemis so far in 2023, by month (click on the chart to access an interactive and historical version).

The chart above shows that May 2023 is already building into a very active month of new catastrophe bond issuance, with currently more than $2.2 billion in the pipeline, across 14 transactions, two of which are recently added private deals we’ve discovered.

Even without the private cat bond deals, new catastrophe bond issuance for May 2023 already stands at a projected almost $2.2 billion.

With a number of these cat bonds expected to upsize and plenty of time for additional new deals to come to market and complete by the end of the month, May could become a very strong month.

Historically, of course, May is the strongest month for catastrophe bond issuance, with the record of $3.4 billion issued in May 2017, while $3.275 billion of new cat bonds were issued in May 2021 and almost $2.7 billion in May 2022.

Right now, should upsizing occur at a similar pace to April, it looks like the active cat bond pipeline could result in may 2023 getting close to, or surpassing last year.

One side effect of the very active cat bond issuance market in April and the growing forward-pipeline of new cat bond deals, is that secondary market trading is also increasing in the last few weeks.

As we understand it, cat bond trading activity in the secondary market had already been quite brisk through April.

But, as the new issuance pipeline continues to build for May, cat bond trading activity picked up significantly again in the first week of May 2023.

Our sources say to expect secondary trading of cat bonds to pick up again this week and that while the new issue pipeline remains strong, cat bond trading is likely to stay brisk as investment managers adjust their holdings to accommodate new positions.

All of Artemis’ catastrophe bond market charts and visualisations are kept up-to-date as new cat bonds are issued.