ILS fund Index delivers second-highest Q1 returns on record

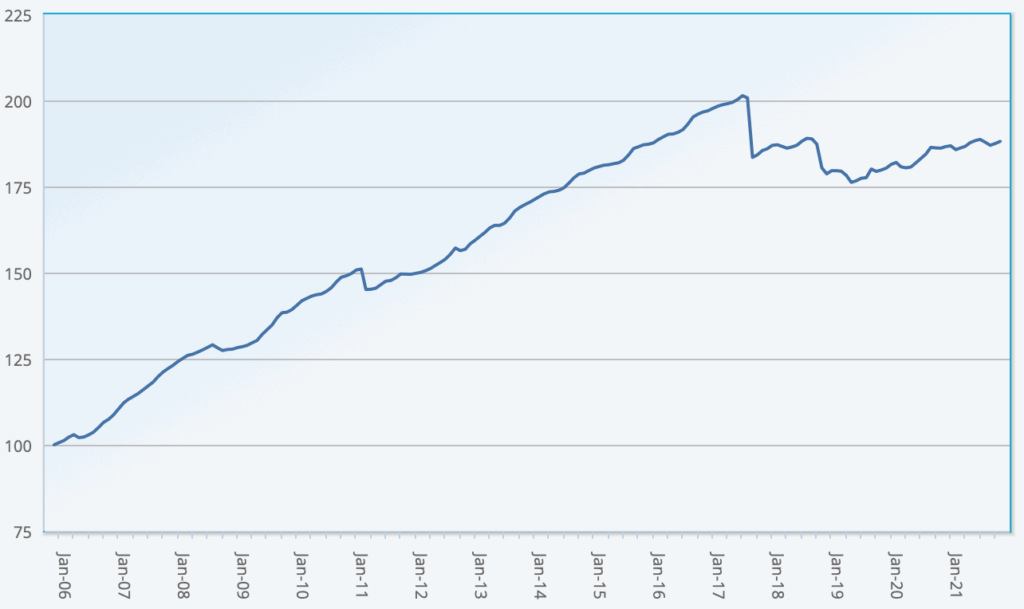

Demonstrating the attactiveness of insurance-linked securities (ILS) investments at this time, the Eurekahedge ILS Advisers Index has delivered its highest returns for a first-quarter of any year since 2007.

March 2023 saw the average return of ILS funds tracked by the Index reach +1.12%.

That is the highest ever March performance, since this Index of ILS funds began tracking the sector back in 2006.

Just as impressive is the first-quarter 2023 performance, with the average ILS fund return according to the Index reported as +3.08% for Q1 of this year.

The only time the first-quarter has seen higher ILS fund performance, according to this Index, was way back in 2007 when average ILS returns were 4.08%.

So, the very strong start to 2023 has continued for insurance-linked securities (ILS) investment fund strategies, although once again it is the pure catastrophe bond funds that saw the strongest performance.

According to the Eurekahedge ILS Advisers Index data, pure cat bond funds as a group were up +1.27% in March.

The sub-group of ILS funds whose strategies include private ILS and collateralised reinsurance investments gained slightly less at +0.98%.

Every ILS fund tracked by the Eurekahedge ILS Advisers Index was positive for March 2023.

The performance range was still quite wide, at between +0.24% to +1.84% for the month.

For the first three months of 2023, pure cat bond funds delivered a +3.48% return, while those funds invested in private ILS and collateralised reinsurance averaged +2.81%.

At +3.08% for the first-quarter, already 2023 has seen ILS funds measured by this Index deliver their second best return since 2016, beaten only slightly by 2020’s full-year return of 3.48%, a figure which will be eclipsed once April’s data is available.

It’s the second strongest start to a year on-record for the Eurekahedge ILS Advisors Index, reflecting the strong ILS and catastrophe bond pricing seen in recent months, as well as the elevated return from the risk-free rate on collateral as well.

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 26 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.