Allstate lowers top of reinsurance tower, as cat bonds fill more of upper layers

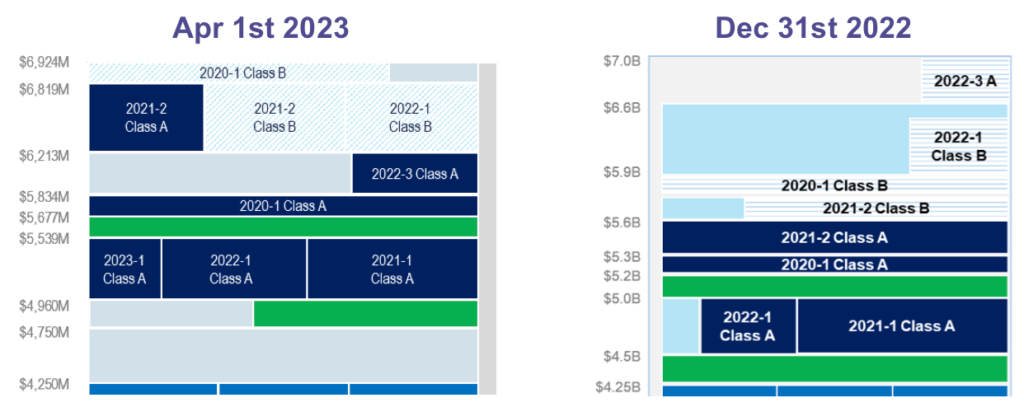

US primary insurer Allstate has brought down the top of its Nationwide excess catastrophe reinsurance tower a little, at its latest renewal, with the program now only extending to $6.924 billion of losses, compared to $7.01 billion at the end of 2022.

At the same time, Allstate has filled out more of the upper-layers of the catastrophe reinsurance tower, with its Sanders catastrophe bonds assisting in this, as the insurer has reset them all at higher attachment points.

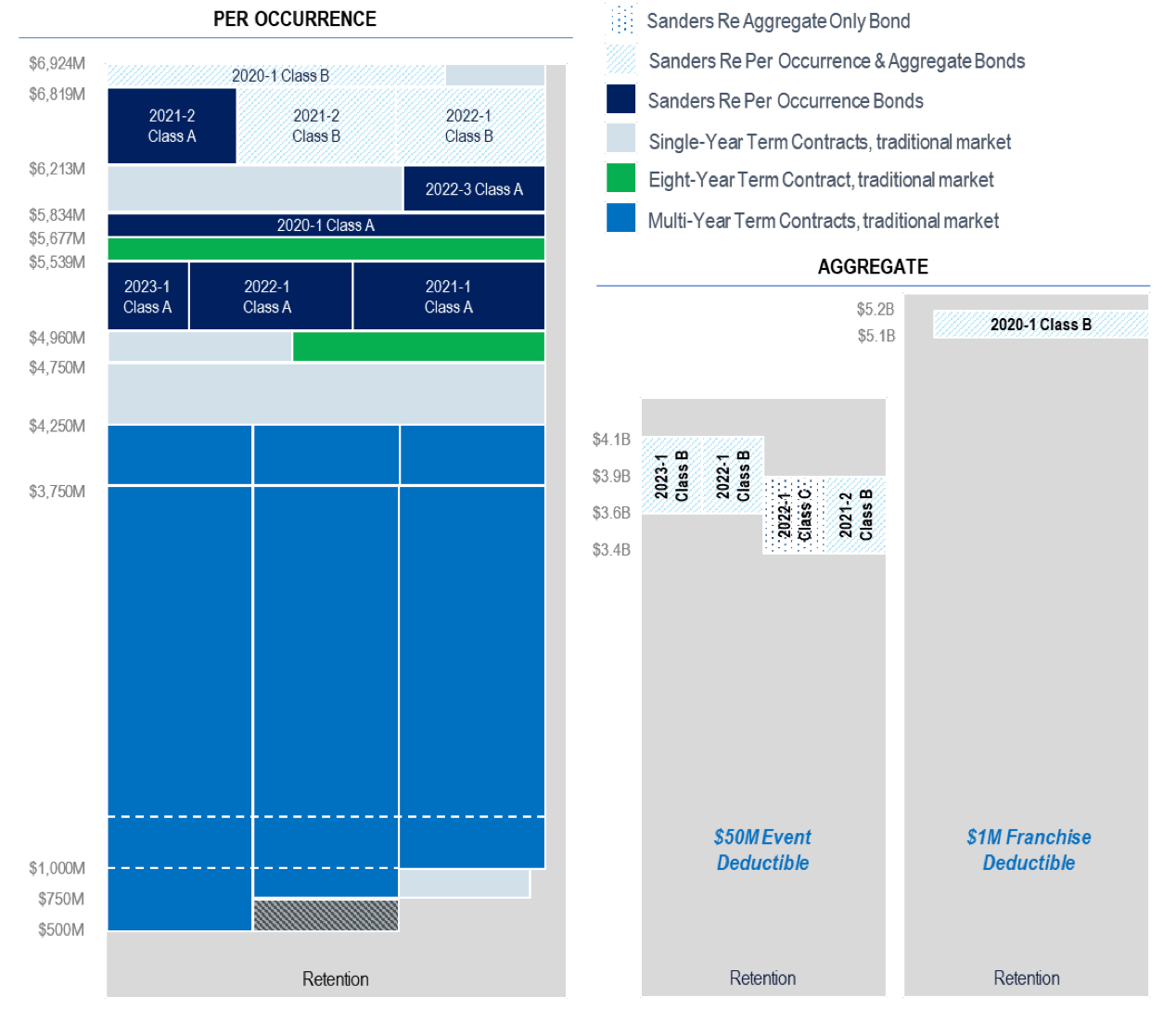

In addition, Allstate has also reset its aggregate catastrophe bond attachments at higher levels for the 2023/4 annual aggregate year, with the lowest attaching aggregate Sanders cat bond now attaching at $3.4 billion, which is considerably higher than the last risk period’s $2.7 billion.

There have been quite a few changes to Allstates Nationwide catastrophe reinsurance program in the first-quarter of 2023 and at the April renewal and limited information available makes it a little challenging to compare the actual limit coverage provided, which has certainly increased at the higher-layers, but has reduced somewhat at the bottom of the tower.

Allstate’s Nationwide catastrophe reinsurance arrangements are incrementally filled throughout the year, making the best comparison its last disclosure for the end of December 2022.

At that time the tower extended to $7.01 billion of cover, but the upper-layer of $400 million was only partially filled by a single cat bond tranche, meaning roughly 80% of that layer would have been retained had losses run that high up the tower for Allstate.

Now, the top of the Allstate Nationwide excess catastrophe reinsurance tower is slightly lower at $6.924 billion, but each layer is now 90% placed to that level, thanks in the main to its catastrophe bonds having been reset higher, as well as the purchase of one new traditional layer to fill out the very top.

You can compare the top of the Allstate Nationwide per-occurrence excess catastrophe reinsurance tower below:

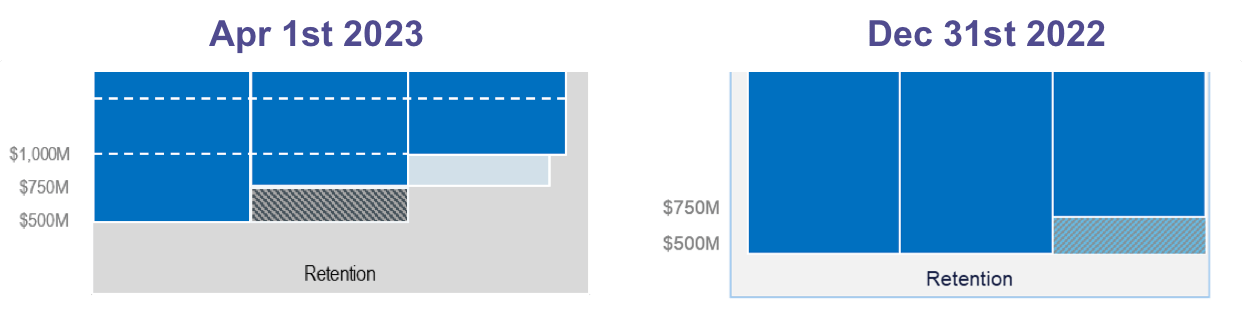

At the lower end of the Nationwide per-occurrence catastrophe reinsurance tower, it looks like some additional risk is now being retained, which likely reflects the challenging reinsurance market environment and higher prices that need to be paid for riskier working layers of reinsurance programs.

You can compare the bottom of the Allstate Nationwide per-occurrence excess catastrophe reinsurance tower below:

Allstate has purchased new traditional reinsurance and catastrophe bonds as part of its efforts to fill out the per-occurrence tower more, especially at the upper-levels.

This includes the Class A notes from Allstate’s recent Sanders Re III Ltd. (Series 2023-1) catastrophe bond on the per-occurrence side, and Class B notes on for the aggregate tower.

Overall, Allstate has experienced a significant increase in reinsurance costs, saying that the total cost of its property catastrophe reinsurance programs, excluding reinstatement premiums, reached $219 million for the first-quarter of 2023, up from $144 million in the prior year.

The total costs of Allstate’s catastrophe reinsurance for full-year 2022 was $788 million, for comparison.

The reset features of the Sanders Re catastrophe bonds has been used to full-effect on both the per-occurrence and aggregate reinsurance sides of Allstate’s program, providing additional flexibility and of course the multi-year pricing certainty that will have been so valuable this year in the hard reinsurance market environment.

For the risk period starting April 1st, the aggregate cat bond attachment point is now $3.4 billion, much higher than the last risk period’s $2.7 billion.

As we reported recently, there remains some uncertainty over whether aggregate catastrophe losses from the April 2022 to March 31st 2023 risk period could trouble the cat bonds, at their lower reset levels of a $2.7 billion attachment point.

However, Allstate made no mention of this possibility in its results yesterday evening and there haven’t been any downwards moves in the pricing of the aggregate Sanders cat bonds yet, suggesting the qualifying level of aggregate losses may have fallen short, perhaps helped by the fact the per-event deductible moved to the $50 million event based, rather than $1 million franchise based deductible structure in recent years.

The full Allstate Nationwide catastrophe reinsurance tower can be seen below, as it stands today. You can see the full comparison as at December 31st 2022 in this article.

It’s also worth noting that Allstate is back in the catastrophe bond market right now with a new Florida focused cat bond under its Sanders Re program of deals.

.