Best Insurance Brokerage Firms | IB Fast Brokerages 2023

Jump to winners | Jump to methodology

An outbreak of excellence

The pandemic was a double-edged sword for the Australian insurance market.

The government disbursed hundreds of billions of dollars in economic support, fuelling exponential growth in provincial areas, but a range of other factors created a challenging market to grow a brokerage successfully.

“It put us on the front foot during that period,” says Levi Thurston, director of NLT Insurance Brokers, a 2023 Insurance Business Fast Brokerages award winner based in Bathurst, NSW. “But at the same time, we were experiencing hard market conditions as well.”

“We are pleased that we have exceeded the financial goals we originally set by 100%, and we are getting some really healthy growth with existing clients and consistently getting new clients on board”

Sarah Gardiner-Smith, Smith & Lane

Simon Pelletier, partner at PwC Australia, underlines how firms, like IB’s Fast Brokerages, have a high threshold to succeed.

“There has been a big shift in the industry as brokers with decades of knowledge and experience retire, and a new generation of young brokers come through the ranks,” he says. “However, due to recent regulatory changes, brokers are now held to a higher professional standard, evidenced by license requirements for brokerages.”

Pelletier lists the key areas for brokerages to excel:

Integrity – being able to earn clients’ trust in their advice and financial skills

Knowledge of products – being able to deliver the best outcomes for clients

Reliability – being able to connect with clients, which can help brokers stand out

Revenue

From 2021 to 2022, IB considered gains for the Fast Brokerages awards. To win, brokers had to achieve over 30% combined growth in GWP and revenue over that period.

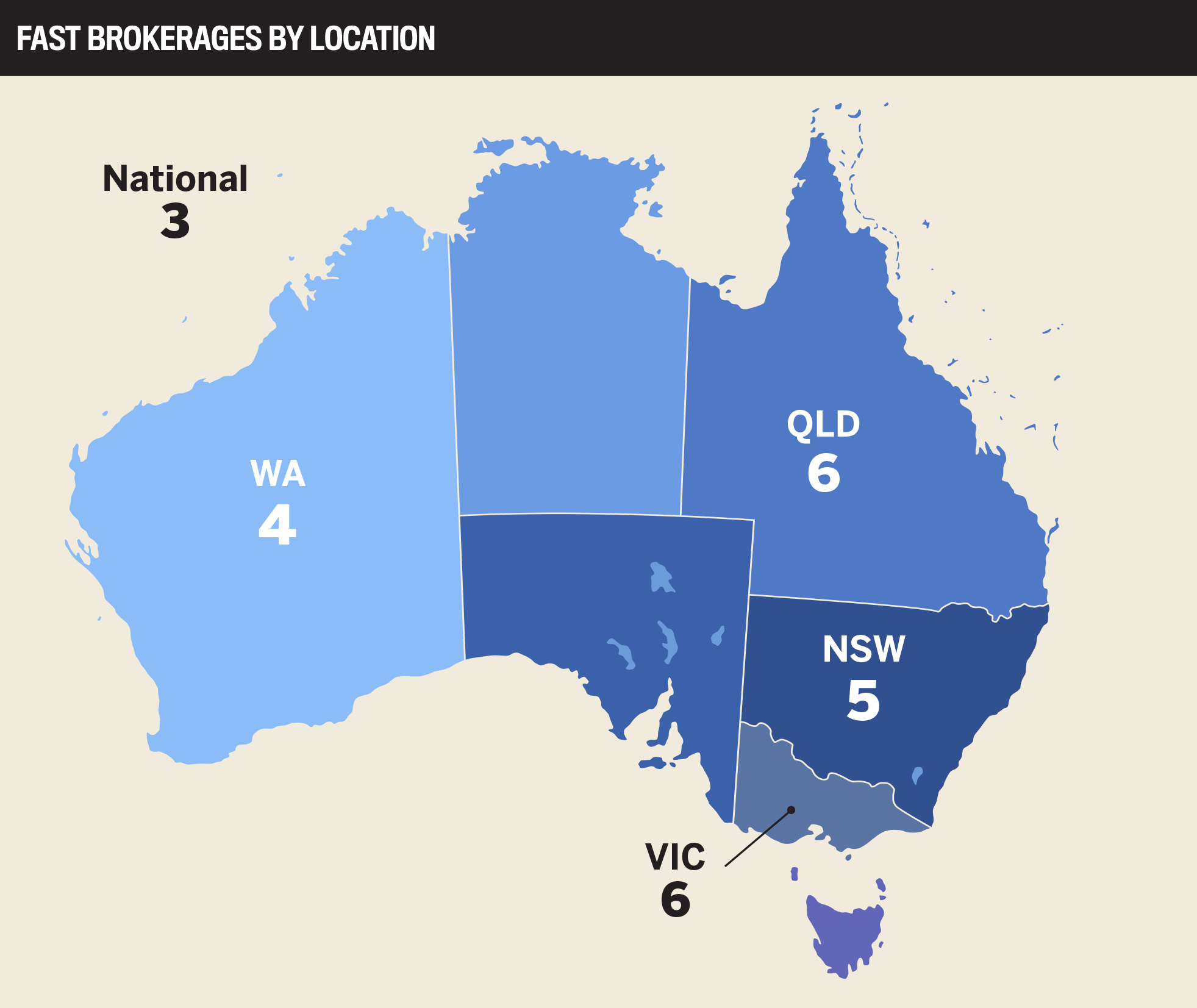

IB congratulates the 24 who made the cut – some of the best insurance brokerage firms in Australia.

Milestones and growth areas

When determining the best insurance brokerage firms, IB considered milestones and growth areas.

Award winner Smith & Lane onboarded two employees, enabled them to spend more time with their families, and quickly built up a strong business over the past 18 months.

“We are pleased that we have exceeded the financial goals we originally set by 100%, and we are getting some really healthy growth with existing clients and consistently getting new clients on board,” says Sarah Gardiner-Smith, principal and director.

Regarding growth, Gardiner-Smith says they’ve turbocharged referrals: “Clients are screaming – sometimes literally – for service, and if you can get this right, it really sets you apart.”

Lachlan Lee, an account manager with award winner Stonewell Insurance Brokers, has also added staff in the past 18 months – going from two guys in a garage to a team of six – and thus optimising their administrative and claims operations.

“In 2022, we had over 2,300 new business transactions,” says Lee. “So, that was definitely our biggest year as of yet. That was an important milestone for us.”

Stonewell Insurance Brokers’ growth is centred on the commercial motor space. Like Gardiner-Smith, Lee attributes that to referrals – in this case, across the transport, earth moving, and mining sectors. “Lots of people will tell their mates it they get a good deal and are getting great service,” he adds.

Meanwhile, Thurston cites sustained growth as a milestone for NLT Insurance. “We wanted to be able to increase our percentage of growth in GWP and revenue over the previous two years. Also, we grew from two to three staff and are now just about to bring on a fourth,” he says.

He also states the importance of word-of-mouth referrals, adding that NLT Insurance’s big growth area is general liability for the mining sector. Over the past 12 to 18 months, the company has written more than 400 liability policies.

“Your reputation will precede you when people understand that they can rely on you as a trusted advisor to their business”

Levi Thurston, NLT Insurance Brokers

Levi Thurston, NLT Insurance Brokers

What makes for a Fast Starter?

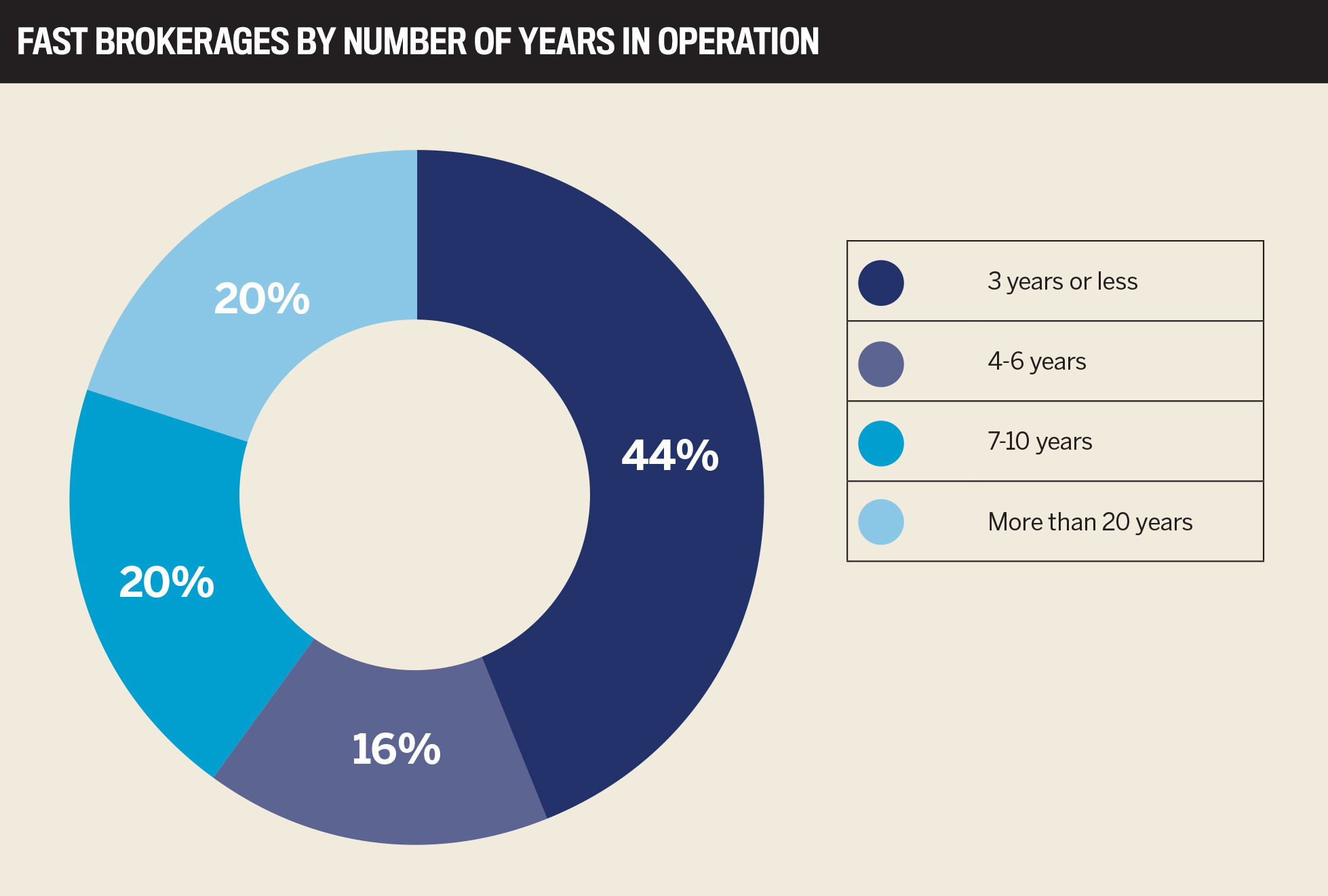

IB selected 11 of the 24 Fast Brokerages to be Fast Starters – great insurance brokerage firms that met the Fast Brokerage criteria but have been in business for only three years or less.

For Pelletier at PwC Australia, it’s about sticking to basics.

“For anyone starting or early in their career, it will be important to take up further insurance studies, for example through ANZIIF, as it will teach brokers the basics of insurance, which is commonly disregarded by junior brokers,” he says. “These additional studies will allow them to truly understand their clients and their activities to enable them to provide the best service and tailored insurance products.”

Fast Starter Stonewell Insurance Brokers have a more nuanced view.

“The most important aspect of having a successful insurance business is just being accessible, providing great service and just building trust and being transparent with your customers,” says Lee. “At the end of the day, not many people like to think about insurance, so if we can build a business making renewal and claims simple and stress-free for our clients, and they’re going to have a service that our customers are happy to pay for, they’re going to stay with us.”

To establish Smith & Lane as a Fast Starter, Gardiner-Smith and her partner:

Created a goal-setting strategy based on weekly and 90-day checks

Established a business framework and training tools to facilitate scalability

Utilised technology to streamline processes and procedures

Consistently performed quarterly portfolio reviews to sustain excellence

Nurtured a culture celebrating the free exchange of ideas

“The most important aspect of having a successful insurance business is just being accessible, providing great service and just building trust and being transparent with your customers”

Lachlan Lee, Stonewell Insurance Brokers

Lachlan Lee, Stonewell Insurance Brokers

So, you want to become one of the best brokerages?

The Fast Brokerages represent the level of success that can be achieved in insurance, whether by a young professional starting out or by an entrepreneur entering the industry.

On starting a brokerage, Thurston recommends, “Be detail-oriented and be there for your clients. That personalised service is going to be the strategic advantage. The business will come to you.” And he adds, “Your reputation will precede you when people understand that they can rely on you as a trusted advisor to their business.”

Lee emphasises the need to know one’s niche thoroughly. “Be prepared to become an expert in your target market. It’s good to be able to do everything, but it’s important to have one or two products that you know everything about – back to front. If you can build that space, you’re going to get all the other stuff along the way as well.”

Gardiner-Smith shares valuable insight on how she started. “Be prepared for the first couple of years to be tough financially,” she says. “The safety of your weekly salary is no longer there and you need to have a stockpile to get you through the tough times. You want to maximise your chance of succeeding, and the less financial stress you have, the better position you will be in to push forward.

“In our experience, there is a fine line between the planning phase and taking the leap. It is important that you have a certain framework in place before starting your brokerage, but at some point you need to put one foot in front of the other and get started. The first year can be scary, but it was also one of the most rewarding times of my career.”

Commenting on the overall landscape for Fast Brokerages, Kaise Stephan, partner with Deloitte Australia, says trends include:

Increasing prices related to inflationary pressures impacting attritional and larger claims, the prevalence of natural catastrophes, and reinsurance rate hardening

Greater trust in brokers from the SME market due to COVID

Growth in interest in purchasing additional insurance due to COVID

Further digitisation of customer acquisition, renewals, and claims management processes

More interest in cyber insurance due to recent cyber attacks

Revenue

There’s a range of opportunities and threats emerging [from these] broker industry trends,” Stephan says. “Brokers who cater for all these factors and meet their customers’ needs proactively across all the trends will make a strong impact on their customers’ organisations.

Fast Brokerages

AIC Insurance Brokers

Apollo Risk Services

Bresland Insurance & Risk Specialists

CCM Insurance Group

Cornerstone Risk Group

Grace Insurance

GT Insurance Brokers

Imperium Insurance and Financial Solutions

Integrity First Insurance Solutions

Knightsbridge Insurance Group

Labrador Insurance Brokers

Macedon Ranges Insurance

Macleay Insurance

McLardy McShane Group

MeyerInsure

Morgan Insurance Brokers

Pillar Brokerage

PSC Reliance Partners Baulkham Hills

RCA Insurance Services

Smith & Lane Insurance

Spencer & Bennett – Yenda Prods

Fast Starters

AIC Insurance Brokers

Bresland Insurance & Risk Specialists

Integrity First Insurance Solutions

Labrador Insurance Brokers

Macedon Ranges Insurance

Macleay Insurance

MeyerInsure

Pillar Brokerage

RCA Insurance Services

Smith & Lane Insurance