TWIA considers ILW option for top of reinsurance tower, but Board declines

The Board of the Texas Windstorm Insurance Association (TWIA) has heard details of an industry-loss warranty (ILW) option for the top of its reinsurance tower, as the insurer of last resort considered buying more protection than its 1-in-100 requires for 2023.

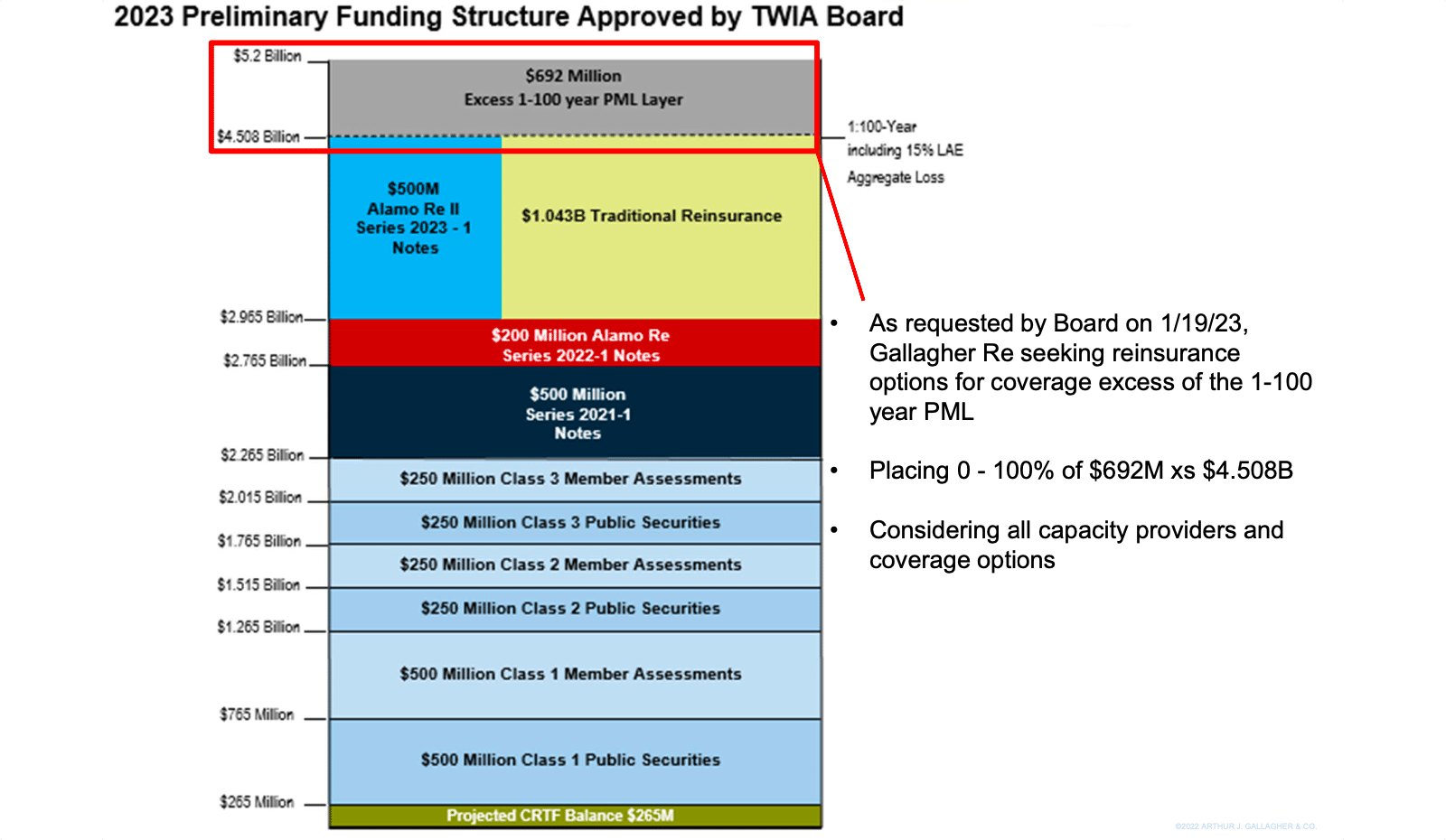

As we’d reported earlier this year, TWIA had set its minimum PML for reinsurance buying needs for 2023 at roughly $4.5 billion, including LAE.

With a stated retention and assessments covering TWIA’s reinsurance tower up to $2.265 billion of statutory capital, the insurer set a target to secure $2.243 billion of reinsurance and cat bond protection to get it to the 1-in-100 PML for 2023.

However, at that meeting the Board of TWIA also agreed to explore what it might mean and cost to add an a further almost $700 million to the top of its reinsurance tower, would would take its claims paying capacity to $5.2 billion.

TWIA has reset $700 million of existing catastrophe bonds for 2023, the $500 million of Alamo Re Ltd. (Series 2021-1) cat bonds and $200 million of Alamo Re Ltd. (Series 2022-1).

In addition and as we’ve been reporting, TWIA has now priced a new $500 million Alamo Re Ltd. (Series 2023-1) catastrophe bond, more than replacing a soon to mature $400 million cat bond from 2020.

As a result, of the at least $2.243 billion of reinsurance required for 2023, TWIA now has $1.2 billion of this on a multi-year basis from the catastrophe bond market.

Leaving it a traditional reinsurance renewal need of $1.043 billion for the 2023 tower, to take it to the 1-in-100 level of $4.508 billion.

At a Board meeting last night, the TWIA team heard from its broker Gallagher Re on options available, considering the pricing, coverage layers and options to take the tower from $4.5 billion up to $5.2 billion.

Gallagher Re has considered all forms of risk transfer and looked at indemnity, parametric and industry-loss warranties (ILW’s) to fill out the suggested additional layer at the top of the reinsurance tower.

Gallagher Re executive Allen Cashin told the TWIA Board that, as the mid-year renewals approach, the global reinsurance market is still very challenging, with the two key issues being the risk-free rate and the retrocession market, so little real change since they last spoke.

The remaining limit required to be purchased to reach the statutory 1-in-100 year PML level totals $1.043 billion of traditional reinsurance, with that limit sharing a layer from $2.965 billion to $4.508 billion of the tower, sitting alongside the new $500 million Alamo Re 2023-1 catastrophe bond.

Moving on to discuss the potential to acquire additional limit at the top of of the reinsurance tower, so above the 1-in-100, Cashin said that placing additional limit in the current reinsurance market environment is very difficult, and so requires looking at all possible products.

Hence the Gallagher Re team has focused on the ILW product, noting that there isn’t as much capacity available in the parametric market at the right price.

Cashin compared TWIA’s losses from hurricanes Ike and Harvey to the PCS industry impacts, highlighting how TWIA’s actual losses might compare to the industry impact and where the basis risk exists.

Gallagher Re laid out an indicative ILW, attaching at a $50 billion Texas named storm loss, covering TWIA to a $70 billion industry loss, for which it said a roughly 5% rate-on-line might be needed.

TWIA’s 1-in-100 year loss equates to a roughly $58 billion Texas wind only industry loss, the Gallagher Re execs said.

However, the Board was generally not keen on the idea of assuming any basis risk, with the ILW seemingly an unpopular option and most comments preferring indemnity cover.

As a result, the TWIA Board could not come to any agreement as to whether to buy above the PML limit at the top of the reinsurance tower, and the Board failed to put in place any new motion to order Gallagher Re to buy any reinsurance limit at all above the 1-in-100 level.

So, TWIA will move forwards for the 2023 hurricane season with the reinsurance tower in the diagram above, or something very similar to it, buying to the 1-in-100 level, with now $1.043 billion of fresh traditional reinsurance set to be procured at the mid-year renewal season.

You can read about all of TWIA’s Alamo Re catastrophe bonds it has ever sponsored in the Artemis Deal Directory.