2023 Federal Budget @ your fingertips

2023 FEDERAL BUDGET

@ your fingertips

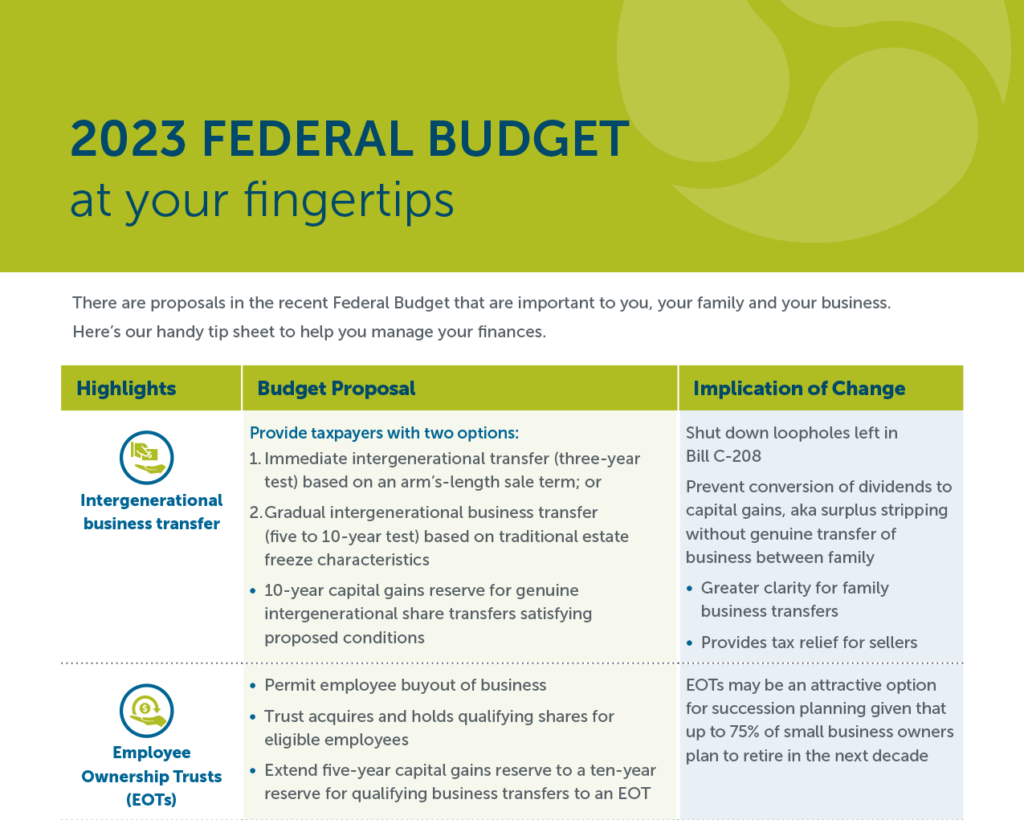

There are proposals in the recent Federal Budget that are important to you, your family and your business. Here’s

our handy tip sheet to help you manage your finances.

![]()

Highlights

Budget Proposal

Implication of Change

![]()

Intergenerational business transfer

Provide taxpayers with two options:

Immediate intergenerational transfer (three-year

test) based on an arm’s-length sale term; or

Gradual intergenerational business transfer (five to 10-year test) based on traditional estate freeze characteristics

10-year capital gains reserve for genuine intergenerational share transfers satisfying proposed conditions

Shut down loopholes left in Bill C-208

Prevent conversion of dividends to capital gains, aka surplus stripping without genuine transfer of business between family

![]()

Employee Ownership Trusts (EOTs)

Permit employee buyout of business

Trust acquires and holds qualifying shares for eligible employees

Extend five-year capital gains reserve to a ten-year reserve for qualifying business transfers to an EOT

EOTs may be an attractive option for succession planning given that up to 75% of small business owners plan to retire in the next decade

![]()

General Anti Avoidance Rule (GAAR)

Create interpretive rules

Lower requirements to be avoidance transaction

Introduce GAAR penalty = 25% of tax benefit

Extend GAAR reassessment period by 3 years

New rule would apply where transaction lacks economic substance

Introduces more clarity and broadens potential transactions caught by the rule

![]()

Healthcare

$13 billion over 5 years to implement the Canadian Dental Care Plan

Start providing dental coverage for uninsured Canadians with annual family income of < $90,000

![]()

Automatic tax filing

Increase number of eligible Canadians to two million by 2025, nearly tripling current numbers. CRA will pilot a new automatic filing service to help vulnerable Canadians receive eligible tax benefits

An effort to increase the eligible number of low-income taxpayers who file their annual tax returns for automated service

![]()

Alternative Minimum Tax (AMT)

Increasing AMT rate from 15% to 20.5%

Increasing exemption from $40,000 to $173,000 indexed

Includes larger share of taxpayer income and reduces or denies deductions

Reduces tax credits which would reduce AMT

Budget aims to broaden the AMT base

Targeting high income individuals

Proposed changes can result in extra provincial AMT for individuals unless provinces introduce changes to their AMT rules

Amendments expected to generate ~ $3 billion in revenue over five years beginning in 2024 tax year

![]()

Energy transition

Introduce or expand a variety of measures to help with the Government’s energy transition strategies

Tax credits for:

Clean Electricity Clean Technology Investment

Clean Technology Manufacturing

Clean Hydrogen Investment

Carbon Capture, Utilization, and Storage

Flow-Through Shares and Critical Mineral Exploration

![]()

Registered Disability Savings Plan (RDSP)

Extend measure allowing qualifying family members to open RDSP for an adult beneficiary whose contractual capacity is in doubt and who does not have a legal representative to Dec. 31, 2026

Broaden definition of “qualifying family member” to include an adult brother or sister of the beneficiary

Will enable a sibling to establish an RDSP for an adult with mental disabilities

![]()

Registered Education Savings Plan (RESP)

Increase withdrawals

Full-time from maximum $5,000 to $8,000, and

Part-time from maximum $2,500 to $4,000 in educational assistance payments during 1st semester of post secondary education

Proposed changes so divorced and separated parents can open joint RESPs for their children

![]()

“Grocery rebate”

One time payout:

$153 per adult +

$81 per child

And $81 for childless singles

Not tied to actual grocery bills; administered through GST rebate system

![]()

Helping the Trades

Double the maximum employment deduction for tradespeople’s tools from $500 to $1,000

10% or more of the total labour performed by Red Seal trades to be performed by registered apprentices

Talk to your advisor for more advice and information on managing your finances.

Source: A Made-in-Canada Plan: Strong Middle Class, Affordable Economy, Healthy Future, Federal Budget 2023

This document is for information purposes only and is not meant to provide legal, financial, tax, or any other advice. Although care was taken in the preparation of this document, The Empire Life Insurance Company assumes no responsibility for any reliance on or misuse or omissions of the information contained in this document and cannot be held responsible for damages or losses arising from the use of this information. Please seek professional advice before making any decisions.

This blog reflects the views of the author as of the date stated. This information should not be considered a recommendation to buy or sell nor should it be relied upon as investment, tax or legal advice. Empire Life and its affiliates does not warrant or make any representations regarding the use or the results of the information contained herein in terms of its correctness, accuracy, timeliness, reliability, or otherwise, and does not accept any responsibility for any loss or damage that results from its use.

April 2023