US severe weather insured losses could develop to Q1 record $9.5bn: BMS

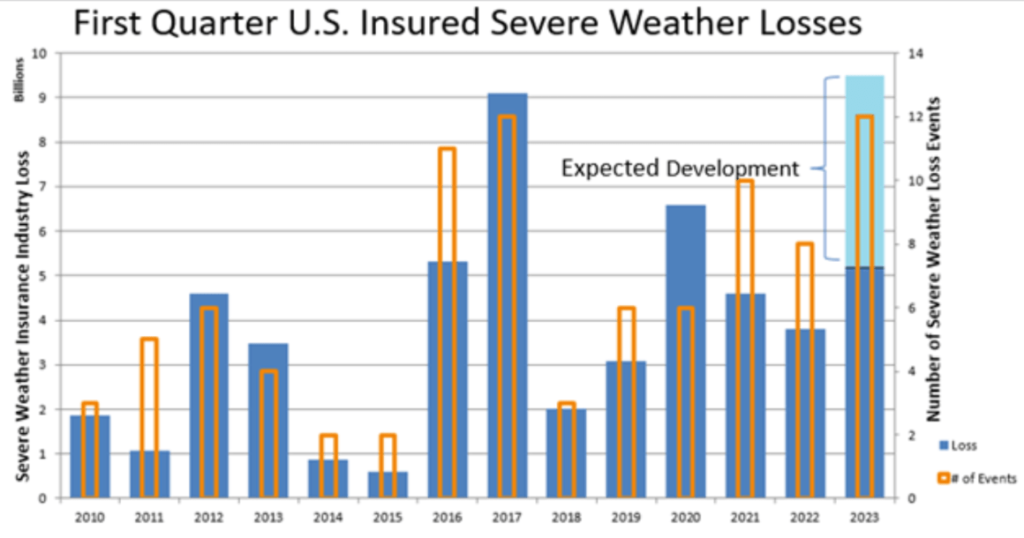

Severe and convective weather losses in the United States for the first-quarter of 2023 could develop to become the largest insurance industry loss for Q1 on record, according to a forecast from broker BMS.

According to BMS Senior Meteorologist Andrew Siffert, using data from industry sources and the firm’s reinsurance broker BMS Re, US severe weather is expected to drive an insurance industry loss of between $7 billion and $9.5 billion, once loss events are fully developed.

Siffert explained in an article, “There is no doubt that the first quarter of the U.S. insurance industry will be a costly one. According to industry claims data and estimates by BMS Re, the first quarter severe weather insured losses should come in at a range of $7B to $9.5B of insured severe thunderstorm storm losses from hail, tornado, and thunderstorm wind gusts.

“Losses are still developing, but the initial estimates provide a large aggregate loss that has occurred over 12 severe weather events since January 1st. The main loss driver is expected to be three $1 billion-plus events in March, including the Rolling Fork, MS, and Little Rock, AR, tornado weather systems that impacted a much larger area than these specific tornado tracks.”

Based on an understanding that the insurance industry is already experiencing heightened inflation, Siffert said that on an inflation-adjusted basis “the January – March first quarter U.S Severe weather losses appear to be at or close to a modern-day record.”

The graphic above shows the loss trend value (Blue) and the number of events (Orange) of severe weather industry loss since 2010, with the left axis displaying the Industry loss dollar amount in billions, and the right axis the number of severe weather loss events.

“Given the expected loss development, 2023 is expected to be a record first-quarter loss for severe weather losses surpassing 2017,” Siffert wrote.

Siffert’s article goes on to explain the climatology that has created a set-up for severe weather across the United States in early 2023.

He summarises, “Overall, the climate forcers explained above match closely with other active severe weather years like the 2011 season, which was very busy in April and May and resulted in the 2011 Tuscaloosa and Joplin tornado events.

“Therefore, due to these climate forcers, the 2023 severe weather season has been enhanced and will likely continue into later April after a brief pattern change in the central U.S. with a temporary ridge of high pressure that will provide the first warm-up to the upper Midwest and put a lid on Central Plains severe weather for a week or so.”

Siffert also reminds that it is hail that remains the primary driver of annual US severe thunderstorm losses for the insurance and ultimately reinsurance industry, while the more high-profile tornadoes drive the tail losses for re/insurance portfolios.

Looking to the coming weeks, he warns, “It does appear that the dice are loaded for a higher occurrence of severe weather this spring season.”

There have already been a number of billion dollar severe weather outbreaks, with the recent tornadic events in the last fortnight potentially set to bring two of those.

Given the reduction in aggregate covers, the increased attachments and higher per-event deductibles now enforced in reinsurance and catastrophe bonds, it seems likely the primary carriers will retain a greater share of severe weather losses in 2023, than they might have even a year ago.