Six Guiding Principles for Insurance IT in a Shifting Economy

Published on

April 6, 2023

Most people know Frank Lloyd Wright for his version of the Prairie-style residential architecture developed in the American Midwest. I grew up in Iowa where we had one of his homes in our community of Mason City, it was so unique. Its simplicity was a stark contrast to many of the European styles that had been brought across from the Atlantic.

But Wright’s contribution to architecture also included commercial designs that contributed to protective architecture. How could buildings survive common catastrophes, such as a fire and earthquake? The most famous example of this was his design of the Imperial Hotel in Tokyo which I was lucky enough to visit years ago. Wright created a floating foundation to withstand the shocks that commonly leveled Japanese buildings. He even placed fountains and pools within the building that would assist in fighting fires if they broke out. It was beautiful and amazing!

Insurers may not be growing comfortable with uncertainty or the frequency of unexpected shifts or events, but they are learning to live with them by constructing foundations that will help them flex in an uncertain world. This is important. If insurers can create a secure next-gen technology foundation for themselves and their customers, they will be able to adapt to empower long-term growth and stability.

It is time for a more resilient foundation?

Last week, in Majesco’s Strategic Priorities webinar, Game Changing Strategic Priorities Redefining Market Leaders, we discussed how, in 2023, insurers will need to strengthen business fundamentals and technology foundations, while meeting the challenges of a changing market. This year’s Strategic Priorities research from Majesco demonstrates different levels of awareness of the technology and business trends and insurers’ strategic responses to them.

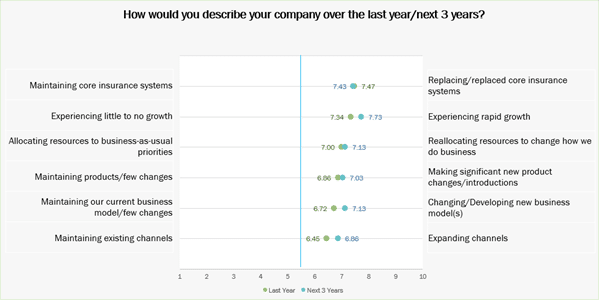

Consistent with insurers’ evaluation of their performance last year, they have even higher expectations for rapid growth over the next three years as seen in Figure 1. The key drivers of this expectation include developing new business models, introducing new products, expanding channels, replacing legacy systems, and reallocating resources to strategic initiatives. Insurance Leaders are not staying still or steady, they are taking action and executing on strategic priorities and initiatives to establish a next-gen foundation that will flex and adapt for the unknown future.

Figure 1: State of the company last year and expectations for the next 3 years

Keeping IT progress steady in the face of [insert crisis here].

The progress that insurers are making, according to Majesco’s upcoming Strategic Priorities report, could be threatened in 2023. There may come a time shortly (maybe it is already happening in your organization) that executives or business leaders might suggest that the economy, loss ratios, profitability, surplus, inflation-related claims, reinsurance costs, or investment performance may indicate a reason for pausing business and technology transformation initiatives and adopt a pause or wait-and-see attitude.

“What harm would there be if we wait — pause and reassess?”

That has been a similar reaction in the past and the logic seems innocuous. However, it flies in the face of what is needed. Insurers should react to economic changes, business performance challenges, and ESG instabilities, but a pause is the wrong kind of reaction. Because it could actually place you further behind and make it more difficult and costly to react to the next shift or challenge.

It is helpful at these times to reflect on several of insurance’s non-negotiable principles for doing business in a world of continuous change that is accelerating, not slowing down.

Six Guiding Principles for Insurance IT

When it comes to IT planning in light of uncertainty, these principles should be taken into consideration.

1. Time and technology never stand still.

While you can pause what your organization is doing with its technology transformation, but the world will not pause with you. Every day that you are NOT transforming, adopting next-gen technologies, and positioning for the future is a day that you are falling behind at least two days because it will take you one day to catch up to where you would have been and two to catch your competitors. Pause three months and you are six months behind. Huddling in the middle of the field doesn’t win the game. There are always times when insurers need to clarify objectives, but an uncertain economy and business challenges shouldn’t be an excuse to take a time out.

2. Pauses make laggards out of lag time.

Because time never stops and competition never ends, ill-timed transformation and IT pauses can create a headache for business leaders, as well as customer acquisition and retention, marketing, and product development. Product development and marketing may have seen an opportunity on the horizon to overtake competitors — perhaps through a new partnership or a channel for growth or with a new innovative product that addresses changing risk and customer needs. Underwriting may have been needing advanced capabilities and or new data-based pricing and underwriting to assess risk and drive profitability improvement. Companies that dial back their timetable of tech progress are working at cross purposes with themselves. An IT pause could slow down tech development that will improve operational cost-saving and strategic competitive initiatives. These kinds of moves aren’t just postponing the inevitable, they are repositioning the company behind competitors, causing the business to fall further behind. Next-gen solutions like Majesco’s Core, Digital, Loss Control, and Distribution solutions are built with the agility, innovation, and speed needed in today’s ever-changing world.

3. Being proactive protects insurers from having to be reactive.

Reactions aren’t bad. They often push us into the future. But does your technology foundation help the business to guide and manage its future so that you can be more proactive and less reactive? Everyone was caught off guard by the pandemic, but some companies were better prepared because they had already moved many core business operations to next-gen core systems in the cloud. Now companies are looking at everything from ecosystem participation to improved data capture and analytics capabilities to be even more proactive. It doesn’t take long for the right preparations to pay off, sometimes in ways that we didn’t imagine.

For example, those companies that have made data preparations a strategic priority will not need to be “reactive” as new data sources become available. They will be able to be proactive in bringing those sources and their data to bear upon risk decisions, claims insights, and underwriting decisions. But this acknowledges that we may not know the next great available data stream. Being proactive only happens, however, when the wheels of IT stay in motion and strategic priorities turn into strategic actions. There are many cases why IT should be proactive. Building a better data foundation is certainly one of those areas that will benefit the business — both from a long-term analytical viewpoint and a real-time decision viewpoint. This is where Majesco Analytics provides that foundation for intelligent decisioning.

4. Pauses can damage the IT operating model.

Business and technology transformations benefit from the flywheel effect. In any major initiative, a certain level of momentum builds as communication, timelines, development goals, and KPIs begin to be met. This momentum isn’t just progress-oriented. It is mental. How are the business and IT handling the challenges and expectations? Canceling or postponing projects mid-stream can do damage to how the business and IT organizations develop anything. Most executives recognize that there is a rhythm in business. Taking organizations out of its rhythm can inadvertently slow and shift the flywheel. The effects may be minor, but they can also be major. It can cause talent to leave, or waste investments in time and dollars that were already spent in pursuit of a goal. Once paused, it isn’t as easy as a switch to get the initiatives back up and running.

There comes a time in every company and in every IT department, when some investment gets wasted because of a change in direction. These necessary corrective maneuvers are sometimes important to innovating and guiding long-term investments. But, too often companies see outside circumstances as a reason to make inside corrections when the stable long-term course is to hold fast and finish the project, at which time the investment often begins paying its own way.

5. Protecting your tech assets requires vigilance.

Cybersecurity may or may not be project-based, but it can still suffer from a lack of attention. Today’s systems require vigilant oversight, robust governance, and a deep understanding of the WHOLE technology framework. Insurers should pay careful attention to the maintenance and upgrades of their cybersecurity, and they should direct all of IT toward those practices where security is bundled with the package of whole-system improvements. Cloud-native software like Majesco’s solutions on Majesco’s Cloud Platform, for example, come with their own levels of Azure security that keep insurers safe. By keeping track of APIs and data entry points, Majesco gives visibility and control back to insurers.

What’s good for cybersecurity also holds true in other areas of insurance IT. In a day and age of frequent M&As, rapid digital advancement, and legacy systems still in use, most insurers don’t ever have a complete picture of all that they are running. An accurate assessment often yields a list of redundancies and potential consolidation points. It’s easier to protect networks and systems that operate lean with a clear and simple purpose.

6. Maintain focus on tech value to the business.

Insurance IT has one question that it must ask itself every day.

“What is this [project/technology/process] doing to add operational value and competitive differentiation to our business?”

Of course, there is a follow-up question.

“Can this be done a better way?” or “Can our technology give us a better result?”

These questions are just as valid in good economic conditions and bad, with the expected or the unexpected. In either case, technology must pay its way toward profitable growth and market leadership. The answers to these questions naturally keep the business in mind. As IT builds a more resilient organization, its value to results will be easier to see across all economies and timeframes.

Keeping a focus on tech value may be last on our list at times like this, but it’s first in terms of strategy. Technology and the operating model are so closely intertwined that it may sometimes be safe to say that the technology is the operating model. A digital framework provides a digital model that serves the digital business. If insurers can remain focused on technology’s potential value, IT will always seem like the place to find a solution to a world in flux. That is IT’s real, everyday value to the business. Insurance is then free to tame the wild world, protecting people, businesses, and itself, so that the world can continue to operate smoothly, no matter what the circumstances are each day.

Modernization and innovation fix many of the issues that make the economy scary. If you wait until “recovery,” or a “good time” in which to invest, that investment won’t be ready until post-recovery or worse never get done because there is unlikely any “good time”. Risk is changing rapidly. Customers are changing. Technology is changing. And because of that the insurance business is changing, whether we want it to or not. The result…insurance leaders must keep up the pace or risk getting left behind quickly.

Is your business juggling priorities in the midst of uncertainty? Majesco has given you several easy ways to compare your own organization to other similar organizations through this research. It provides insight into the strategic priorities and technology investments needed. Those leading will accelerate their investment rather than pull back, even during challenging economic conditions, “putting the pedal to the metal.” Majesco is investing in our solutions to help our customers keep pace but more importantly, put them ahead of the curve of change with a technology foundation that will adapt to market shifts and changes.

Be sure to tune into last week’s webinar, Game Changing Strategic Priorities Redefining Market Leaders, and stay tuned for our forthcoming Strategic Priorities report.