New York’s Comprehensive Insurance Disclosure Act — CIDA Light 2.0 — Passes and Is Signed

In the beginning the NYS legislature created CPLR § 3101(f). And 3101(f) thusly provided:Contents of insurance agreement. A party may obtain discovery of the existence and contents of any insurance agreement under which any person carrying on an insurance business may be liable to satisfy part or all of a judgment which may be entered in the action or to indemnify or reimburse for payments made to satisfy the judgment. Information concerning the insurance agreement is not by reason of disclosure admissible in evidence at trial. For purpose of this subdivision, an application for insurance shall not be treated as part of an insurance agreement.

And all was good.

But the personal injury plaintiff attorneys, always wanting more, cried out to their Legislature, “Defendants and their attorneys should be required to disclose more about the contents of their insurance agreements, the applications for those agreements, the limits of those agreements, any payments made under those agreements, and the persons who oversee the third-party claims made under those agreements!”

And so it came to pass that on the last day of creation in 2021, the Legislature approved S7052/A8041, New York’s Comprehensive Insurance Disclosure Act a/k/a Original Strength CIDA, transforming CPLR § 3101(f) into a set of onerous, intrusive, retroactive and affirmative disclosure requirements of the likes never seen before in New York or any other state. And on the very last day of the year in 2021, Governor Kathy Hochul signed Original Strength CIDA, stating that she “agree[d] with the intent of the bill and have reached an agreement with the Legislature to

ensure that the scope of the insurance coverage information that parties must provide is properly

tailored for the intended purpose, which is to insure that parties in a litigation are correctly

informed about the limits of potential insurance coverage.”

And so defendants and their counsel (and their liability insurers) were driven out of CPLR § 3101(f)’s reasonable place and banished to Original Strength CIDA, wailing and gnashing their teeth over its onerous and retroactive requirements.

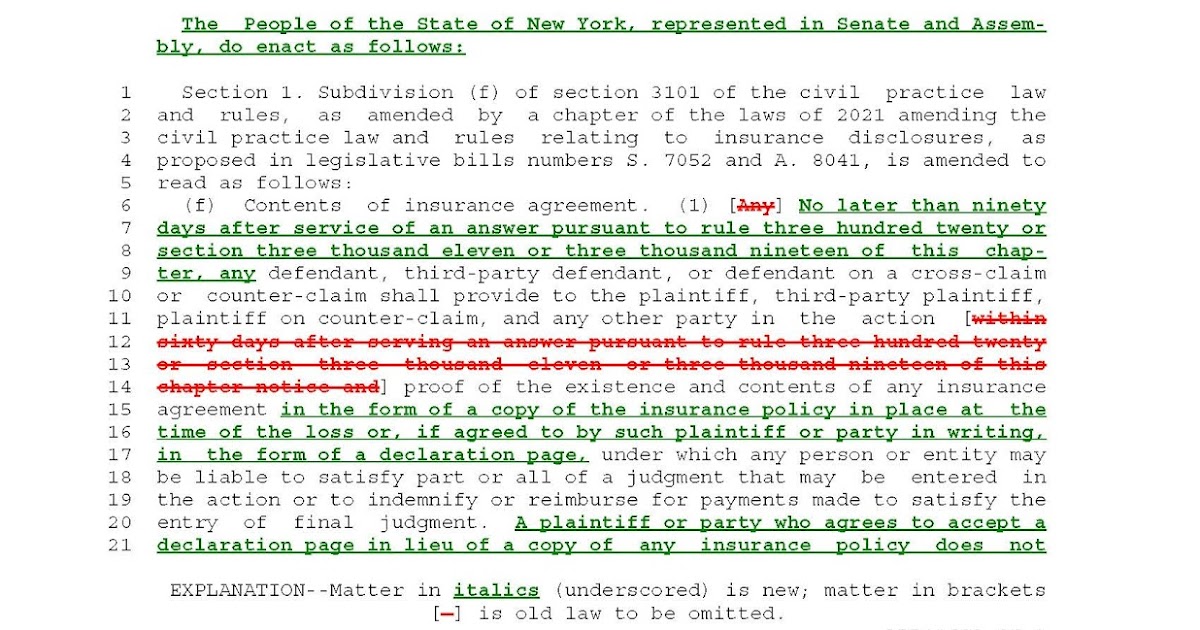

But lo, as the Governor had predicted, on the 26th day of the first month of its new creation, the Senate passed CIDA Light and delivered it to the Assembly. But the personal injury plaintiff attorneys, seeing that, caused the Senate to recall that bill and change its “sold of delivered within the state of New York” in subsection (f)(1)(ii) to “insofar as such documents relate to the claim being litigated.”And so it came to pass that on the 17th day of the second month of the new creation CIDA Light 2.0 passed and was subsequently delivered to the Governor. And on the 24th day of the second month of the new creation, the Governor signed CIDA Light 2.0, which:applies to all civil actions commenced on and after December 31, 2021; requires the affirmative disclosure (i.e., without a demand) within 90 days after service of a defendant’s answer of:copies of all insurance policies or agreements (or their declarations pages, if agreed to) under which a person or entity may be liable to satisfy part or all of a judgment in the action or to indemnify or reimburse payments made to satisfy the final judgment;the name and email address of the “assigned individual responsible for adjusting the claim at issue”; the “total limits available” under such policies or agreements, “which shall mean the actual funds, after taking into account erosion and other offsets, that can be used to satisfy a judgment described in this subdivision or to reimburse for payments made to satisfy such judgment”; andobligates defendants to “make reasonable efforts to ensure that the information remains accurate and complete, and provide updated information to any party to whom this information has been provided at the filing of the note of issue, when entering into any formal settlement negotiations conducted or supervised by the court, at a voluntary mediation, when the case is called for trial, and for sixty days after any settlement or entry of final judgment in the case inclusive of all appeals.”

One, important and bothersome vestige of Original Strength CIDA remains, however–the enactment of CPLR § 3122-b, which requires defendants and their counsel to certify that the CIDA information disclosed “is accurate and complete, and that reasonable efforts have been undertaken,…and will be undertaken, to ensue that this information remains accurate and complete.”

Ellen Melchionni, president of the New York Insurance Association, said it best when she called CIDA “a solution without a problem”.

Now get busy defense counsel. Ninety days from December 31, 2021 is Thursday, March 31, 2022. CIDA Light 2.0 disclosure is due on that day for any answers filed and served on December 31, 2021, and within 90 days of any answers served after December 31, 2021.

And I, for one and my office, will be certifying the accuracy and completeness of CIDA Light 2.0 disclosures “upon information and belief”.