Tremor launches cross-placement optimisation tools for reinsurance buyers

Tremor Technologies, the insurtech operator of a programmatic risk transfer marketplace, has unveiled a range of cross-placement optimisation tools which it says enables buyers of reinsurance protection to achieve best execution for all of their reinsurance placements at the same time.

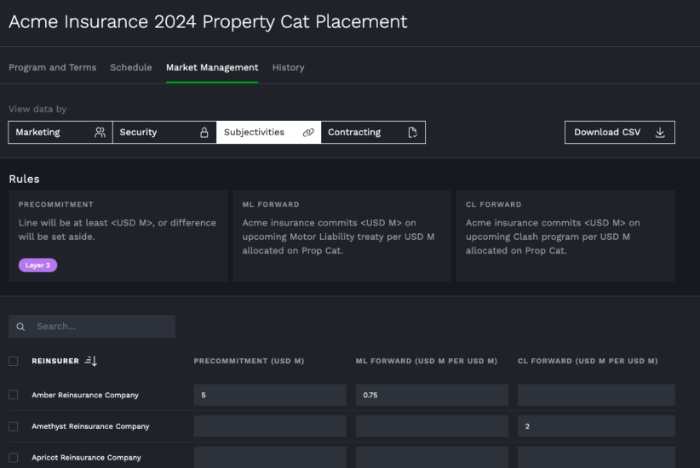

The new tools announced by the company today includes Tremor Multiplace, which determines prices and allocations for multiple placements simultaneously while automatically managing cross-placement concerns, and Tremor Forwards, a tool which helps manage commitments across placements that have different renewal periods.

“Reinsuring a risk or treaty is never contemplated in isolation. Every decision to transfer risk is made considering the overall portfolios of both the insurer ceding the risk and the reinsurer taking it on. Most reinsurers prefer to take on a diverse slice of a cedent’s risk, and most cedents need reinsurance across their entire portfolio,” said Sean Bourgeois, Tremor’s Chief Executive Officer (CEO).

“Since our goal at Tremor is to improve the allocation of risk – not just the syndication of individual placements but the allocation across placements as well – we are excited to announce powerful additions to our platform that accomplish this,” he added.

Expanding on the different tools, Tremor explains that when it comes to multi-treaty reinsurance placements, it’s vital to consider promises the cedent has made as well as the cedent’s overall need for protection.

With Tremor Multiplace, cedents are able to indicate that limit should be reserved on one or more treaties and can also require cross-treaty participation. As an example, Tremor explains that a cedent can indicate that $5 million will be reserved for a specific reinsurer across two placements and can also require that a specific reinsurer participate on say the property cat treaty, and that another reinsurer participate on the motor program.

“Participation constraints can be per-reinsurer or global, and they help the cedent guarantee participation across both popular and unpopular treaties powered by technology,” notes Tremor.

Further, when multiple treaties are placed at the same time, Tremor explains that reinsurers have tools to express contingencies as part of their authorisation. As an example, the firm says that a reinsurer could add a subjectivity to indicate that at most 50% of its overall allocation is on the cedent’s property cat treaty.

“Tremor ensures that everyone’s final lines meet their subjectivities powered by optimization technology, even contemplating subsidies between placements when necessary so that all programs are placed optimally,” says the firm.

With Tremor Forwards, the goal is to capture informal commitments between cedents and reinsurers, and integrate them within the overall placement process on Tremor’s Panorama platform.

When treaties are placed at different times, Tremor says that it helps cedents capture the commitments they have made and will make in the future.

“When a cedent has already promised a line to a reinsurer, they can indicate a precommitment and Tremor will reserve capacity for them,” says Tremor.

Additionally, when a cedent wants to make a promise going forward, Tremor’s new tool allows them to indicate that they will set aside limit in the future based on participation now. For every $1 of coverage the reinsurers provides now, the cedent will set aside a certain amount on a designated future treaty, explains the firm.

“When insurers make forward promises, they can track and manage them in Panorama. Alongside the risk they are placing now, they can see the total amount, by program, that they are promising to reinsurers as a result of the placement,” notes Tremor.

The company adds that insurers can also cap it by indicating that they do not want to commit more than a certain amount on an upcoming treaty, and Tremor will then make sure that they do not overcommit.

“Providing powerful cross-placement optimization capabilities like these is a revolutionary addition to the Tremor Panorama reinsurance platform. Cedents no longer need to accept suboptimal placement across “attractive” and “less attractive” placements and reinsurers can express rich preferences across them. These tools further Tremor’s goal of truly improving the allocation of risk for the entire industry, best matching risk to capital powered by modern technology,” says Tremor.