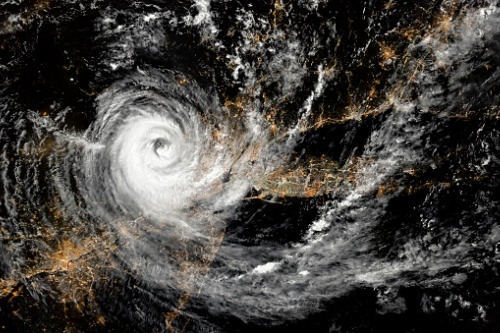

Ex-fund manager weighs in on NZ insurance future following storms

“Very risky housing”

“We’ve got a small group of insurers who, I think, are probably acting pretty responsibly at the moment,” Starks said in a podcast. “Right now, in the short and medium term, they want to keep every New Zealander insured and they want to work with government to achieve that.”

However, she noted that there will be some tough discussions in the future, especially in the wake of catastrophes that are expected to cut deep into property insurers’ profits. Starks said that while insurers are not panicking, “[what] they are saying is that we’ve got some areas of very risky housing and it’s going to get to the point where they won’t want to touch it.”

It’s part of insurers being responsible, Starks said, and these conversations on the heels of such an event will attract New Zealanders’ and the government’s attention. She said that in these situations, insurers can do one of two things.

“[They] can either refuse to quote on your property – if it’s got too much risk, you haven’t raised the floor levels, there’s no flood management in place around your house from the local council,” Starks said.

The alternative is that insurers will keep increasing the price on these customers because of the risks that their properties could flood in a one-in-20-year event.

“By increasing prices and then eventually not quoting, that’s how insurers retreat,” Starks said.

Starks said that while insurers do not want to back away from low- and medium-risk properties, conversations are already being started with the government about managing people away from high-risk areas, or putting mitigation in place to reduce the overall risk.

That said, something that’s already set in stone for the future of insurance following the storms is rising premiums, and they are only going to keep up, according to Consumer NZ investigative writer Rebecca Styles. The non-profit’s most recent survey found that premiums for house and contents insurance jumped by between 5% and 17%, despite the government’s efforts to bring them down through increases to the EQC levy. Due to this, some New Zealanders have started cancelling their contents insurance.

“A lot of renters, a lot of younger people in Auckland I’ve been hearing anecdotal stories of, they just don’t have contents insurance, so they’re stuck with having to find somewhere else to live and replace the washing machine, the fridge, all of this stuff,” Styles said.

Cyclone Gabrielle’s aftermath raised concerns about insurance companies quoting to rebuild or repair homes, despite some of them being in high-risk areas. To this, Starks said that insurance companies are dealing “in black and white.” She noted that all insurers can do is deliver whatever contract homeowners bought from them.

“If you’re sitting there and there’s a house which only needs a repair, it may be blatantly obvious to an engineer that the floor level needs raising so this doesn’t happen again,” she said. “All the insurer can deliver for you is clinically what needs doing, the repair on the house, it’s simply not a write-off. They don’t insure your land, so they can’t make you move or even suggest that you move – that’s not their role in society.”

What are your thoughts on this story? Please feel free to share your comments below.