ILS funds average 1.18% in January, as higher premium & collateral yield flows

Insurance-linked securities (ILS) funds as a group have delivered a strong start to 2023, with an average ILS fund return of 1.18% for January, the second strongest performance for the month in the record of the Eurekahedge ILS Advisers Index.

The strong start to the year has been helped as higher premiums, rates and money market yields are beginning to flow to the benefit of ILS funds and their investors.

The new reinsurance rate environment and the much-higher spreads of catastrophe bonds, promise to deliver a strong performance through the coming months, catastrophe loss activity allowing of course.

Overall, the ILS funds tracked by the Eurekahedge ILS Advisers Index averaged 1.18% for the month of January 2023.

Perhaps more impressive is the fact that since October 2022, right after hurricane Ian, the average ILS fund return across the four months tracked so far has now reached a very impressive 4.73%.

ILS Advisers explained, on ILS fund performance for January 2023, “Performance was particularly strong for an off-wind season month. It was actually the second best month of January since the index inception in 2006.

“After January contract renewals, ILS investments are starting to benefit from both the higher insurance premiums and higher money market yields.

“There was also some additional recovery in selected positions exposed to Florida, as more loss information from hurricane Ian confirmed losses at the low-end of the range.”

The catastrophe bond market was again particularly strong in January, with a total return of 1.71% for the Swiss Re Global Cat Bond Index.

This helped cat bond funds as a group outperform the private ILS strategies again.

Pure cat bond funds as a group rose +1.21% in January, while the subgroup of funds whose strategies include private ILS and collateralized reinsurance or retrocession gained +1.15%, ILS Advisers said.

Every fund that reported returns for January 2023 was positive, with the range of performance a spread from 0.29% to +2.12%.

As higher reinsurance premiums and cat bond pricing begins to flow to ILS funds, while the risk-free rate of return on collateral is so elevated as well (compared to recent years), investors are positioned to make very good returns while the market remains free from major losses.

While the performance potential is currently high, the risk-level has decreased for many strategies, given the elevation of reinsurance attachments and tightening up of terms and conditions.

All of which means the post-Ian return environment is looking particularly strong right now, which is helping to build investor confidence in the asset class and in making new allocations to it.

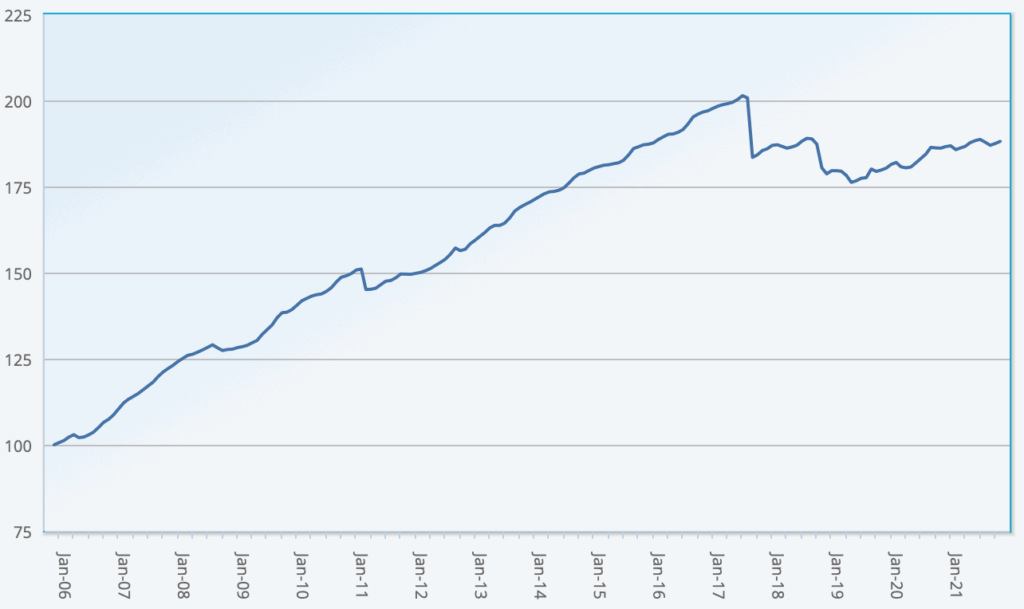

You can track the Eurekahedge ILS Advisers Index here on Artemis, including the USD hedged version of the index. It comprises an equally weighted index of 26 constituent insurance-linked investment funds which tracks their performance and is the first benchmark that allows a comparison between different insurance-linked securities fund managers in the ILS, reinsurance-linked and catastrophe bond investment space.