Business insurance in New Zealand

But how does business insurance in New Zealand work? What types of coverages does it provide and is it required by the law? Insurance Business answers these questions and more in this article. If you’re a Kiwi business owner trying to work out which insurance policies can serve your business best, this piece can serve as a handy guide. for insurance professionals in New Zealand to have clients with questions about business insurance in NZ, this could be a good article to send along to them.

There are no mandatory insurance policies in New Zealand, which means enterprises, regardless of their size, are not required by the law to take out business insurance.

The Insurance Council of New Zealand (ICNZ) Te Kāhui Inihua o Aotearoa, however, recommends that businesses, especially the smaller ones, to take out several “minimum coverages” that can protect them against common risks.

“Insurance is important for small businesses because the cost of something going wrong can be the difference between surviving and bankruptcy,” explained ICNZ chief executive Tim Grafton, in a recent interview. “Small businesses tend to run on leaner margins, so when something unexpected happens, there tends to be less capacity to absorb the cost.”

Each business comes with a different set of risks. Because of this, there is no single business insurance policy in New Zealand that can cover everything. The ICNZ, however, recommends five types of policies that are essential to protect small businesses. These are:

1. Business interruption insurance

The disruption caused by the coronavirus pandemic has given prominence to this type of coverage, which has also been the point of contention between insurers and businesses. In essence, business interruption, also called BI insurance, is designed to protect enterprises from loss of income and additional costs incurred if their operations are forced to shut down because of an unexpected event. Insurance companies, however, argue that the loss should result from “material damage caused to property.”

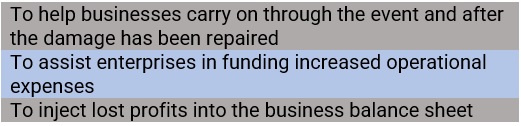

According to the ICNZ, BI insurance has three primary purposes. These are:

Business interruption policies can also be used to cover the following:

Potential revenue

Employee wages

Redundancy payments

Reinstatement of records

Business loan repayments

Mortgage or rent on commercial space

Additional operating costs, including advertisements letting customers know that you have moved to a new location

2. Commercial property insurance

If you own your business premises, this type of policy covers the damage the building sustains from a covered peril, including fire and flooding. It is one of the most common forms of business insurance in New Zealand.

Some policies may also pay out for earthquake damage, although most insurance companies impose several requirements before agreeing to provide cover. This comes in the aftermath of the 2010-11 Canterbury earthquakes, which are among the country’s costliest natural disasters. Before providing coverage, property insurers typically would want to know:

When the property was built

What strengthening work has been carried out, if any

On what ground is the property built on, (for example, reclaimed land or bedrock)

The property’s seismic rating

Meanwhile, if you’re a homeowner who wants to know if your home is covered under the Earthquake Commission’s (EQC) EQCover, you can find the answers in our comprehensive EQCover guide.

3. Commercial vehicle insurance

This type of policy works just like private motor insurance – both are not legally required, although the ICNZ advises vehicle owners to take out at least third-party coverage. This policy protects drivers financially from liability in the event they cause damage to other people’s property. Here are the three main types of commercial motor insurance policies in New Zealand:

Third party: The least expensive type of policy, this pays for damages a driver causes to another’s vehicle or property.

Third party, fire & theft: Provides the same coverage as third-party insurance but also offers financial protection in case the driver’s vehicle is stolen or catches fire.

Comprehensive: Offers the broadest coverage, including damage to a motorist’s car and costs for “salvaging your vehicle from an accident scene and towing it to a repairer.” Because of this, it is the most expensive type of policy.

Insurers also often include an uninsured motorist extension, or innocent party protection, in their policies. Under the terms of this extension, the insurance company will waive the policyholder’s excess and maintain their no claims discount if the vehicle is damaged by an uninsured driver – provided that the uninsured driver can be identified, and they acknowledge their involvement in the accident.

Commercial vehicle insurance covers company cars, business fleets, and business-use motorcycles. Another thing you should take note of is that private motor insurance will not cover a vehicle you are using for your business.

4. Cyber insurance

Cyber insurance policies in New Zealand typically provide two types of protection:

1. First-party coverage

This pays out for financial losses your business incurs due to a cyber incident, including the cost of the following:

Responding to a data breach

Restoring and recovering lost or damaged data,

Lost income resulting from business interruption

Ransomware attack payments

Risk assessment of future cyberattacks

Informing customers about the incident

Providing clients with anti-fraud services

2. Third-party coverage

This provides financial protection against lawsuits filed by third parties, including customers, employees, and vendors, for damages caused by a cyberattack on the business. Policies typically cover court and settlement fees, and regulatory fines.

With the rapid pace of digital transformation giving rise to unique and evolving cybersecurity challenges, the ICNZ is urging businesses to consider taking out a cyber insurance policy. The council reminds enterprises, however, that this type of business insurance cannot replace due diligence and good cyber hygiene as the top line of defence against cyber threats.

5. Liability insurance

Liability insurance provides financial protection against claims of injury and property damage resulting from negligence in your business activities. In New Zealand, this type of coverage takes on many forms, the most common of which are:

General liability insurance: Also called public liability, this protects your business against claims of bodily injury or property damage from your business activities.

Professional indemnity insurance: Covers legal and settlement costs arising from work-related mistakes and oversights, breach of contract, unfinished work, and budget overruns, among others.

Products liability insurance: Protects your business against lawsuits from customers claiming losses or injury because of your product. Also covers legal defence costs and compensation if you are found to be at fault.

Employers’ liability insurance: Similar to workers’ compensation insurance in other countries, this covers personal injury to your employees and may include defence costs if you are sued.

Employment practice liability insurance: Pays out for legal defence and settlement costs involving employment law breaches.

Bailees’ liability insurance: Covers third-party goods or property under your business’s care, custody, and control.

Directors’ and officers’ (D&O) liability insurance: Protects the directors and senior management of your company against financial losses resulting from business-related lawsuits. This pays out for monetary losses from these legal actions, including defence costs, settlements, and fines.

Trustees’ insurance: Works the same as D&O insurance but protects your business’ trustees.

Apart from the essential types of business insurance listed above, New Zealand businesses can access a range of policies tailored to their specific needs. These include:

Assets insurance: Pays out for repair and replacement costs for items and equipment your business owns – including computers, furniture, and stock – if these are damaged or stolen.

Contract works insurance: Covers the extra costs incurred while doing alterations to your business premises, for example, accidental damage.

Key person insurance: Covers a vital team member and provides a financial benefit to your business at the time of the employee’s death. The payout is intended to provide monetary support as the company goes through a transition period to find and train a replacement.

Marine insurance: Covers commercial vessels, such as those used for cargo and fishing.

Business travel insurance: Pays out the cost of missed flights, lost baggage, or emergency medical care for employees going overseas for business-related trips.

Transit insurance: Provides protection if an equipment or stock is damaged when you or a freight company is moving it.

Product recall insurance: As the name suggests, this covers the cost of recalling a product you manufacture or sell because it is found to be defective or dangerous.

Trade credit insurance: For those doing business overseas, this covers loss of revenue if your customer refuses to pay.

One of the biggest misconceptions preventing many home-based businesses from taking out proper business insurance in New Zealand is the belief that their standard home insurance policy already provides the protection they need. In reality, however, insurers offer this type of coverage on the assumption that the property is solely used as a residence.

If you operate your business from your home, you must inform your insurance provider or broker, so they can adjust your coverage accordingly. According to Business.govt.nz, some home insurance companies will agree to insure a property partly used for business, depending on the following factors:

The type of home business – if you are manufacturing goods, selling products, or just running an office

If clients come to your home – if so, how many and how often

The kind of materials you have on the premises that might present an increased risk of fire or burglary

The type of signage or advertising you have that might indicate the property could be targeted by theft

The kind of security and fire protection installed in your home to manage your risk

Doing so can also help you avoid these costly insurance mistakes that Kiwis often make.

Business.govt.nz also advises all businesses and self-employed people – these include sole traders – to take out the most basic liability coverage, which is general liability insurance. This type of coverage can protect you financially if you cause harm to another person or their property. If you’re a contractor, liability insurance may be included as a condition in your contract.

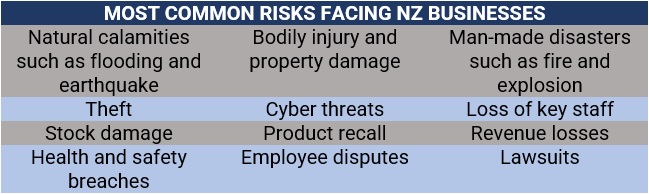

What types of risk do businesses in New Zealand face?

Each business in New Zealand faces a unique set of risks, which can depend on the industry it is in and where it is located. The table below shows the most common risks businesses across the country are exposed to, according to Business.govt.nz.

The government website also advises businesses that are trying to work out the risks they are exposed to, to answer two important questions before purchasing business insurance in New Zealand. These are:

What could go wrong at work or with my business?

Have I got it covered?

While there is no law requiring enterprises to take out business insurance in New Zealand, the nation’s government and industry bodies recommend businesses purchase certain coverages – and for good reason. If you need sound advice on what types of coverage you need for your home business, an experienced insurance agent or broker can help you make the right decision.

The purpose of business insurance is to provide your business financial protection from sudden and unexpected events that could cost you a huge portion – if not the entirety or even more – of your income. Without proper coverage, these losses can adversely impact your ability to continue operations. Thus, while it will cost you money in the form of premium payments, business insurance can be a worthwhile investment in the long run, especially if an unforeseen disaster hits your business.

Other countries make certain business insurance policies a requirement for enterprises to operate. You can learn how these coverages work in our global business insurance guide.

Do you think getting business insurance in New Zealand is worth the money? What policies do you think are necessary? Chat to us in the comments section below.