How Inflation Affects P&C Rates & How It Doesn’t

Triple-I fields a lot of questions from consumers and the media as to exactly how inflation affects insurance premium rates. As we explain in a new Issues Brief, the relationship between inflation and rates is, in one sense, straightforward – and yet the outcomes are not necessarily what you might expect.

As material and labor costs rise, the cost to repair and replace damaged homes and vehicles increases. If premium rates didn’t reflect these increased costs, insurers would quickly exhaust the funds they set aside – “policyholder surplus” – to ensure that they can afford to keep their promises to pay all claims. If losses and expenses exceed revenues by too much for too long, they risk insolvency.

But insurers do more than pay claims: They employ people (labor costs) and conduct business operations (supplies and energy costs); and, if they are to remain in business, they have to earn a reasonable profit.

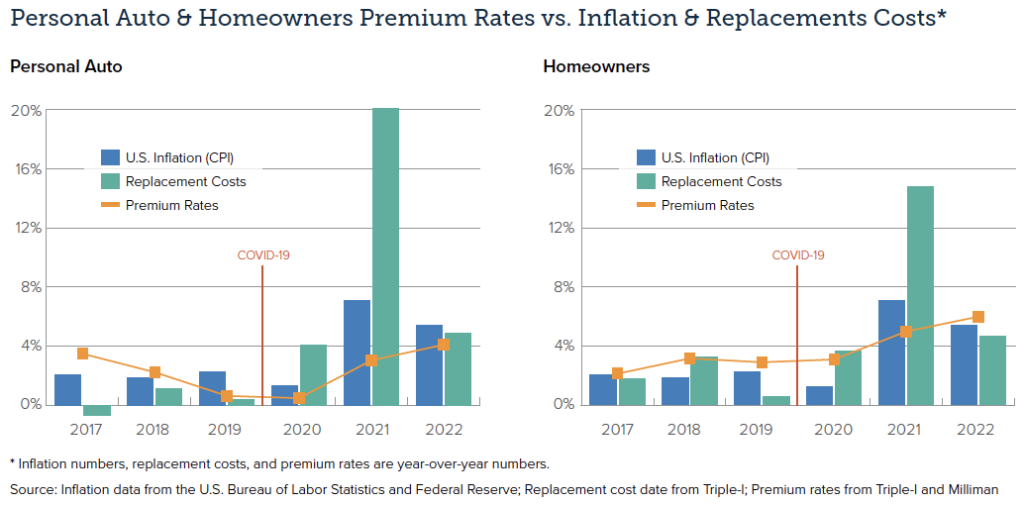

So, when inflation and replacement costs rise, one might reasonably expect a proportionate increase in auto and homeowners insurance premium rates. But, as the charts below show, rates remained relatively flat during 2021’s sharply higher costs that coincided with the height of the COVID-19 pandemic.

In addition to not increasing rates proportionately to rising costs, personal auto insurers – expecting reduced losses as fewer drivers were on the road during lockdown – returned about $14 billion to policyholders through cash refunds and account credits. While loss ratios fell briefly and sharply in 2020, they have since climbed steadily to exceed pre-pandemic levels.

With drivers fully on the road again, this loss trend is expected to continue.

It’s important to remember that the decreases in CPI and replacement costs indicated above do not represent cost declines but, rather, reduced rates of growth. These and other forces – such as unfavorable accident fatality trends and population shifts into disaster-prone regions – will continue to apply upward pressure on premium rates.

Learn More:

Inflation Trends Shine Some Light for P&C, But Underwriting Profits Still Elude Most Lines

Monetary Policy Drives Economic Prospects; Geopolitics Limits Infation Improvement