How employee sentiment impacts new working models

My first post in this series analyzed data to show how different job functions (HR, operations, technology and sales) viewed working models differently—and how leaders should take that into account when deciding on work-from-home or in-office policies. In this blog, I want to focus again on those four groups, but look at employee sentiment and how that could affect employee response to new working models. I will also compare the insurance industry with banking and capital markets, where relevant.

Employee support impacts working model decisions

Part of our Return to Work research included asking if employees felt supported overall by their employer in the insurance industry. Across all four categories, the majority said they felt “quite well supported,” with sales saying this the most. “Not well supported” and “not at all well supported” were low—except for operations, where 44% said one of these.

And yet, in banking, only 20% of operations selected one of these options, and only 11% in capital markets. It’s clear the insurance industry is having difficulty supporting their operations compared to other financial services industries, which could be due to how far behind the insurance industry is in their digital transformations compared to banking and capital markets.

Click/tap to view a larger image.

Employee challenges in culture and training

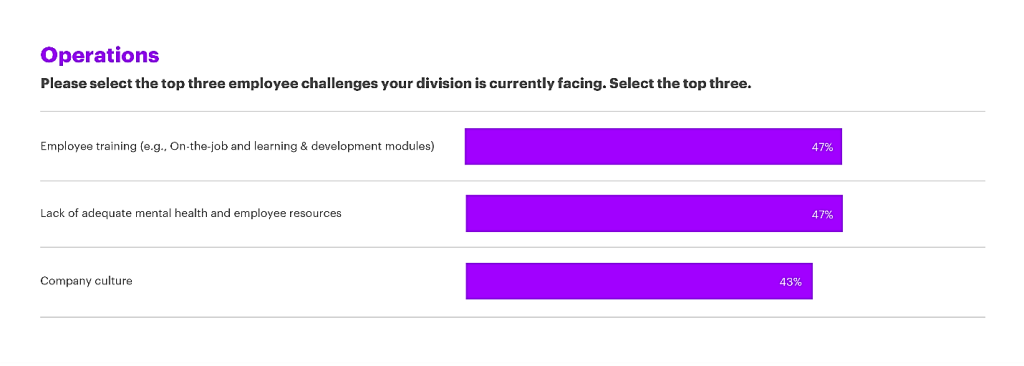

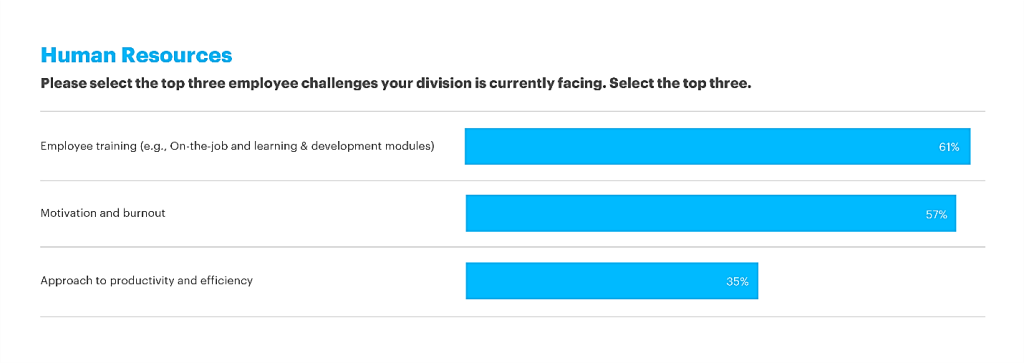

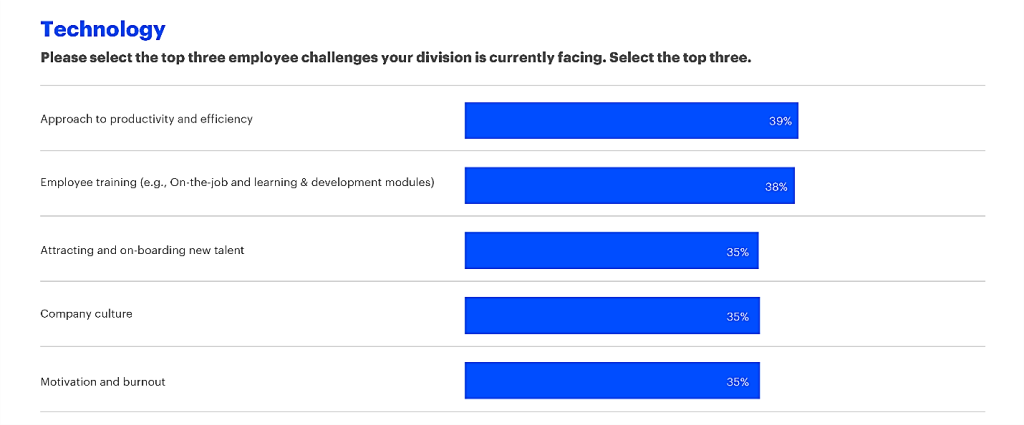

We also asked participants to select the top three employee challenges their division was facing. All four groups in insurance marked “employee training” as number one or number two. Remote work’s impact on training is significant, and it needs to be a consideration when determining any hybrid working model. Strategies like bit-sized training videos, gamification and even virtual reality are ways to address this concern.

Click/tap to view a larger image.

Click/tap to view a larger image.

There were many insights related to culture and talent that would impact a new working model as well. For 43% of operations, “company culture” was the third top challenge. Digital transformations have had a huge impact on operations, but company culture is also influenced by the reality that legacy insurers have been around for a long time and are very office-focused with many layers of leaders. Newer carriers like Root or Lemonade likely have less of a culture challenge. Legacy companies need to evolve their cultures to allow for more hybrid working by embracing modern technology and embedding agile philosophies to their operations.

Click/tap to view a larger image.

Click/tap to view a larger image.

Click/tap to view a larger image.

Click/tap to view a larger image.

This concern about culture and its related implications can be seen in sales, technology and HR. Sales put “lack of adequate mental health and employee resources” in its top three challenges (40%), and HR put “motivation and burnout” as a top-two concern (57%).

Click/tap to view a larger image.

Click/tap to view a larger image.

Technology teams are the only group to not rank “employee training” as number one. Instead, their top concern is the “approach to productivity and efficiency.” Technology teams often bare the brunt of productivity initiatives—as many of these changes are driven by digital transformations and new tech. In many ways, this can be viewed as an umbrella that is connected to the other more culture-related concerns (including the three-way tie for third place). For example: Improving productivity can’t happen without training employees effectively, attracting new talent, establishing a culture that embraces change and offering breaks to avoid burnout and keep motivation high.

When comparing banking and capital markets to insurance, the same patterns emerge. The takeaway here is that rapid digital transformations and shifts in working due to COVID-19 have taken a toll on employees. It’s imperative for the entire financial services industry to ensure they are supporting their employees both in terms of mental well-being and also in terms of work, such as having enough talent to execute on goals and leveraging new technology.

Employees highlight talent challenges

The final part of the research I want to highlight is around statements related to talent challenges that we asked participants to agree or disagree with. Talent strategies are directly impacted by new working models, as a focus on in-office working will limit companies to local candidates, while remote working can make training more difficult. Example statements included:

Current elastic HR policies (flexible hours, mandatory vacation time, lax location options) will remain in place once employees are called back to the office

I’m having difficulty in aligning my location and talent strategy

Virtual training sessions are not as effective as in-person sessions

The biggest takeaway here was a shift in alignment. My previous blog showed that sales and technology teams were aligned towards remote work compared to HR and operations, which leaned more towards in-office work. When exploring these statements around talent challenges, this alignment shifted where technology and HR were more aligned in agreeing with these statements, compared to operations and sales that selected “unsure” for many of them.

This makes sense. The statements were focused on talent challenges and strategies, which is the bread and butter of HR. And technology teams are dealing with talent issues more than ever before. Therefore, it’s logical that HR and technology participants would agree with many of these talent challenges. This is compared to operations and sales, many of whom selected “unsure,” indicating that while their group might be experiencing some talent challenges, it’s having less of a direct impact on them individually.

What does this all mean?

Insurance companies are on the move to become nimbler and alleviate the age-old silos between business and technology. Carriers’ ability to navigate a working model that recognizes the complexities of what each company division is tackling is hugely important to future success. This shift is having a strong impact on employee sentiment, which will naturally cascade to how employees respond to different working models. Operations is struggling with feeling supported and the culture shift, while technology is concerned about talent and morale. HR has concerns about motivation and burnout, while sales is feeling the pressure and need better mental health and employee resources and a more focused approach to productivity and efficiency.

Support. Culture. Talent. These three are the undercurrents that will directly impact a new working model. What is clear is that across these four groups—operations, sales, technology and HR—there are significant differences in how they are feeling and where they prefer to work. Not only is there no one-size-fits-all when it comes to working models for the insurance industry, but there is also no one-size-fits-all within a company itself. Of course, it’s unlikely you’ll be able to make everyone happy. But it’s worthwhile to consider less of a blanket approach to where, how and when people work, and instead focus on what working arrangement is best suited for that job function. You could end up with more satisfied—and therefore, more motivated—employees.

Get the latest insurance industry insights, news, and research delivered straight to your inbox.