How Does Inflation Affect Your Business Insurance Coverage and Premium?

How Does Inflation Affect Your Business Insurance Coverage and Premium?

Inflation impacts all our daily lives, both personally and professionally. Business insurance rates are expected to increase across most lines of coverage this year, with many sectors likely experiencing double-digit hikes.

According to the Boston-based brokerage’s “State of the Market” report, no lines of coverage are expected to see rate decreases, and only a few lines, such as workers compensation and surety, are expected to see flat renewals. “The biggest rate hikes are expected for cyber liability, with increases of 30% or more projected, on top of average 50% increases last year”, said Risk Strategies, the trading name of RSC Insurance Brokerage Inc.

It is also predicted to see rates for an average quality property risk with some catastrophe exposures to rise between 10% and 20%, with unfavorable, high-risk properties expecting to see rate increases upward of 25% or more. We may also see general liability and auto liability up 5% to 10%; umbrella rates up 10% to 20%; private company management liability up 10% to 30% as well as public company management liability up 5% to 30%.

If you have any questions, contact our office at 413.475.7283 or complete our online quote form for an insurance review today!

Other Factors that increase insurance costs

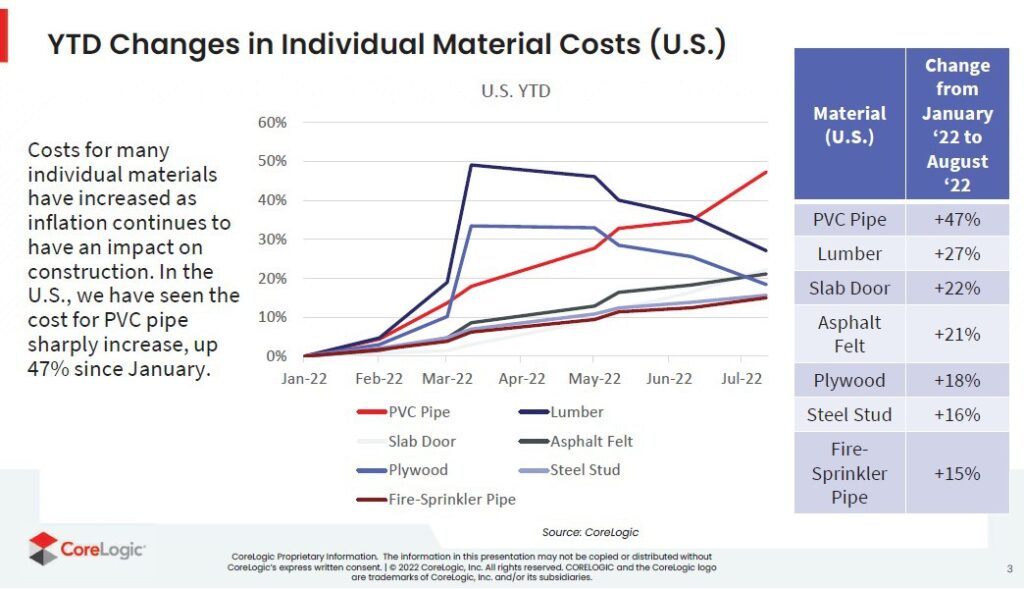

You have probably noticed higher prices in many areas of your life. From groceries, and gas, to building materials. Unfortunately the insurance industry is not immune to this trend. These factors are out of your control, as well as your agent’s and insurance company’s. In the event of a loss there may be materials and labor that are necessary for the repairs. With the price of building materials — such as drywall, shingles, lumber, and copper wiring — up an average of 26%, repairs have become more expensive to fix and replace.

Ways to help reduce your insurance premium

Reviewing your insurance annually will ensure you have the right coverage and help identify where you may be able save some money. Here are 8 considerations when reviewing your business insurance.

The importance to evaluate policies annually

It may be tempting to see your policy renewal, automatically make the payment, and let it roll. As an entrepreneur, you have a lot on your plate, and reviewing insurance coverage may not be a high priority.

As daunting as it may seem, it’s in your best interest to sit down and carefully review your policy. It’s important to always speak with your agent and ask questions about changes in your business, adjustments to your business model, or even rate changes if you see them. Your Encharter agent is more than happy to review any questions or concerns.

Keep in mind, this is also another opportunity to make sure you are protecting your business to the best of your ability and only paying for what you need.

Minimize risks

To effectively reduce risks a safety training program or risk management review will help reduce the possibility that you’ll ever need to make a claim, therefore ensuring that your premiums should avoid uncontrollable rate hikes.

Classify employees properly

There are many industries with high instances of worker injury, and if you or your employees are inadvertently placed in one of these categories, you may find yourself paying unnecessarily high premiums.

Resist the temptation to downplay possible dangers. Consult with your agent to convey any risks you have so they can offer coverage for all of your exposures.

Improve security protections

Security systems, fire sprinkler systems, worker safety programs, and driver training programs are a few methods that can reduce insurance costs.

If you or your team members deal with sensitive customer data, it’s pertinent to maintain robust security protocols to reduce your exposure to cybercrime. Insurance carriers evaluate risk and your insurance agent or broker should be able to help you identify problem areas, so that you can institute a program that works for your business. Ask your Encharter agent about cyber insurance.

Modify your deductible

Its simple math: increase your deductible, lower your premium. But, you need to determine what your company can reasonably afford in the event it becomes necessary to make a claim. Larger companies may comfortably manage deductibles in the many thousands while smaller businesses may operate on a tighter margin and desire more limited expenses.

There is no set rule in regards to deductibles. Each company will have to independently evaluate its needs, and determine how large a deductible it can afford that works best for their budget.

Pay your premium up front

You can reduce your final costs by paying up front. If you’ve been on a payment plan, you probably have been paying a fee for this privilege.

Look for discounts

Don’t be afraid to ask for discounts. Do you have all of your policies with one agent? Some companies offer a discount for multiple lines of business. Talk with your Encharter agent about what discounts might be available.

Buy sufficient coverage

Not all coverage is the same. Your Encharter agent will help you must look for coverage that fits your unique business needs. Purchase too much coverage, and you’re paying for something you’ll never use, but too little coverage could leave you with gaps that needlessly expose you for a loss. With your insurance agent’s help they will provide detailed explanations and safeguard against too little or too much coverage.

These are all ways to make sure you are safe guarding your business to the best of your ability to help reduce unnecessary costs.

It’s important to do business with an insurance agent who has access to a broad array of insurance companies that you trust and who have excellent references. It is always good business practice to do your research and invest wisely when it comes to spending your money, and buying insurance is no different.

Have you reviewed your Business-owners insurance recently? Chat with an Encharter agent today: 413.475.7283

or schedule an appointment here.

Source: https://www.businessinsurance.com/article/20221026/NEWS06/912353340?template=printart

Source: https://articles.bplans.com/9-ways-to-lower-your-business-insurance-costs/

Read More

auto, auto insurance, Auto Liability, Beauty Salon Insurance, boat, boat insurance, business, business insurance, Business Insurance Coverage, car, car insurance, commercial auto, commercial auto insurance, commercial property insurance, Condo, condo insurance, Deductible, discounts, Employee Surety Bond Insurance, encharter, Encharter Express, Encharter Insurance, Excess Liability Insurance, flood insurance, General Business Liability, General Contractor Insurance, general liability, Home Based Business Insurance, home insurance, homeowners, homeowners insurance, Increase Insurance Costs, Independent Insurance Agency, Inflation, insurance, Insurance Agency, Insurance Agent, insurance premium, Material Costs, motorcycle, motorcycle insurance, personal insurance, Personal Umbrella, Renters, renters insurance, restaurant insurance, Security Protections, small business insurance, specialty insurance, State of the Market, Sufficient Coverage, Umbrella, umbrella insurance, Umbrella Rates, Watercraft, watercraft insurance, workers comp, Workers Compensation Insurance