Life Insurance with High Cholesterol

Can you Get Mortgage Protection with High Cholesterol?

Raised cholesterol and high blood pressure/hypertension are the two health issues that cause my clients to go

Jeez, I never expected this to be a problem

Unfortunately, both conditions can cause issues.

It’s rare for an insurer to refuse cover due to high cholesterol or blood pressure.

But it’s common for an insurer to request a medical report from your GP.

And a medical report can delay the whole process by months.

Generally speaking, life insurance providers and their underwriters regard a cholesterol level of 6.0 mmol/L or below as normal.

If you’re in this range, you shouldn’t have anything to worry about assuming you have no underlying conditions (see below) or “cardiovascular risk factors” like a high BMI or a family history of heart issues.

What is Cholesterol?

Cholesterol is a fatty substance found in the cells of your body and blood.

Everyone has a level of cholesterol in their blood but some people suffer from higher cholesterol than others.

Diet and lifestyle can lead to higher cholesterol numbers as can certain conditions,

e.g.

In others, a very high level of cholesterol runs in the family due to an inherited genetic problem with the way cholesterol is made.

One example is called familial hypercholesterolaemia.

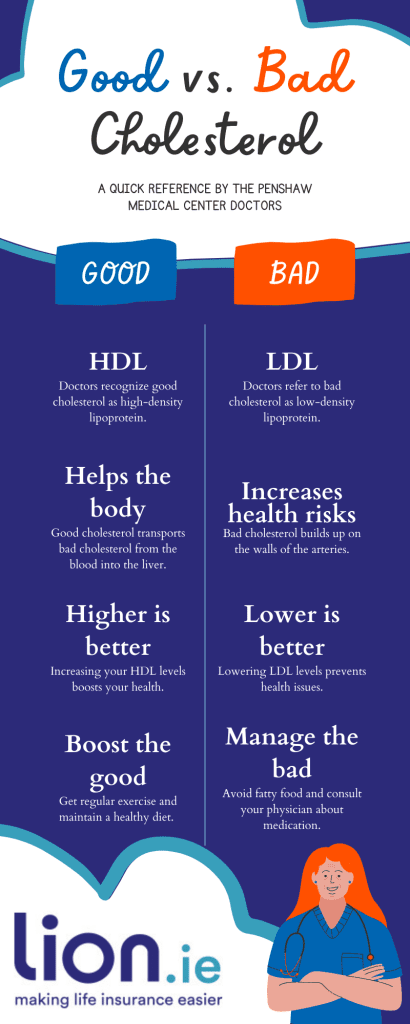

What is Good and Bad Cholesterol?

You can think of LDL (bad cholesterol) and HDL (good cholesterol) as twins.

Low-density lipoprotein (LDL) is the evil one, and High-density lipoprotein (HDL) is the angelic one.

LDL comes to your party empty-handed, savages all your food, gets smashed on your booze and pukes all over your carpet.

HDL is the designated driver who arrives to collect his brother, flush him out with water and even clean your carpet.

You should pick foods higher in HDL to undo the damage caused by that fecker LDL.

What is a Normal Cholesterol Range?

The following levels are generally regarded as desirable:

Total cholesterol (TC)

5.0 mmol/l or less

(LDL) cholesterol after an overnight fast:

3.0 mmol/l or less

(HDL) cholesterol:

1.2 mmol/l or more

TC/HDL ratio:

We get this figure by dividing total cholesterol / HDL cholesterol

The insurers like it to be 4.5 or less.

In other words, the more HDL you have the better.

Avoid the evil twin!

What Information will the Insurers Need?

The underwriters will need to know:

When were you diagnosed?

Why did you have your cholesterol read at that time? (routine or due to symptoms)

What was reading at diagnosis?

What are your latest readings?

Have you had any tests as a result of high cholesterol?

Are you on medication?

Are you being treated by a specialist?

Have you had a urine test?

Do you smoke?

Do you have any other health issues?

How effective is your treatment? (are your levels in the normal range)

Are you overweight?

Do you suffer from hypertension?

Are there any other risk factors – e.g family history of early heart disease or diabetes?

If you can answer “no” to all of these questions, then we should be able to get you cover at the normal price without the need for a medical report.

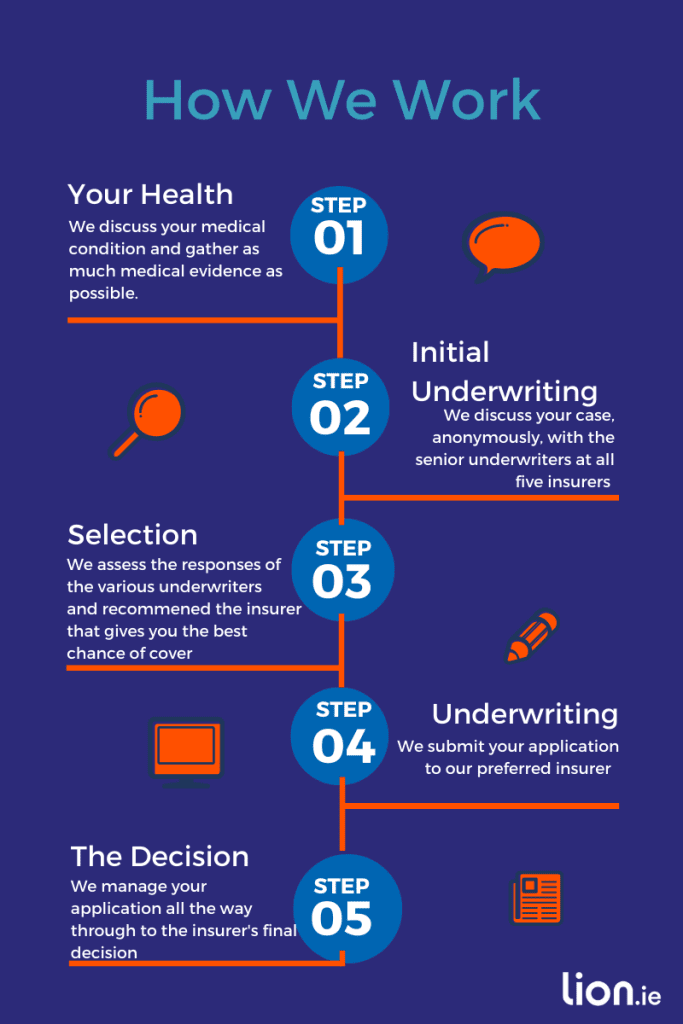

However, if you find yourself nodding yes to any of those questions, I recommend you complete this questionnaire so I can discuss your case anonymously with my panel of underwriters:

Depending on your responses, I may still be able to get you the normal price at one of my providers without the need for a medical report.

However, if the insurer still isn’t happy to make a decision, they will write to your GP for a medical report.

After reviewing your medical report the insurer will make a final decision to offer cover at a higher premium, postpone offering cover for a period or decline to offer cover.

Will the Underwriter Require a Cholesterol test as part of the Application Process?

A cholesterol test isn’t routine when applying for life insurance or mortgage protection.

However, if the insurer requests that you attend a Nurse Medical Screening, part of this exam will involve blood tests to check your cholesterol levels.

What Happens if you can’t get Mortgage Protection?

If two or more insurers refuse to offer you cover, you can request a mortgage protection waiver from your lender.

How much is Mortgage Protection if you have High Cholesterol?

If your cholesterol is under control with medication, we’ll be able to get you the normal price assuming you have none of the other factors mentioned above.

Loadings (increases) can range from +50% to +400%.

Generally, it is the underlying issues like high BMI that trigger the loading rather than the high cholesterol itself.

Over to you…

If you’re worried about applying for life insurance with high cholesterol, let me help.

Simply complete this high cholesterol questionnaire so I can speak with my underwriters anonymously to find the best home for your cover.

You have no obligation to proceed if you don’t want to.

Choosing the most suitable insurer and packaging your application correctly is a very important first step.

I know the insurers who are more lenient when it comes to assessing life insurance with high cholesterol.

And try not to worry, getting life insurance with high cholesterol can be easy enough once you know what you’re doing.

Thanks for reading

Nick

lion.ie | Protection Broker of The Year 🏆

This blog was first published in 2017 and has been regularly updated since.