Distribution Technology: Where Personal Lines Insurers Are Investing Today

New SMA Blog by Mark Breading, Partner, Strategy Meets Action —

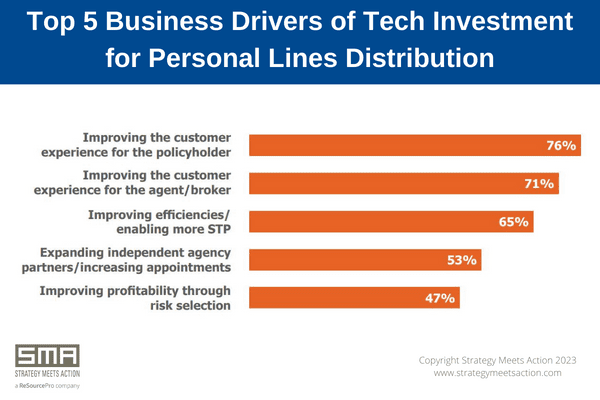

We say it often here at SMA – the personal lines segment frequently leads the insurance industry with deploying new innovations, particularly within distribution. Over the next five years, insurers focused on personal lines will likely continue to spearhead the distribution revolution through new technologies and channel strategies. Where insurers invest today to support distributors will set the stage for their channel partnerships in the future, either building solid bonds with agents/brokers and others or de-emphasizing some channel partners.

SMA’s new research report, Distribution Technologies for Personal Lines: Carrier Plans in 2023 and Beyond, details findings from a survey of executives on the current state of digital capabilities offered to distribution partners, an assessment of the challenges and barriers to deploying new capabilities, and carriers’ plans to put new digital sales and servicing capabilities into the market.

Two key themes emerge when analyzing carriers’ top investments in digital sales technologies for personal lines: increasing automation and improving efficiencies between insurers and distributors. Seven out of ten insurers identified data pre-fill as one of their top investments for sales, enabling them to gather more reliable information for quoting while also minimizing the back and forth between underwriters and agents. The second-highest investment area, e-Signature capabilities, also improves efficiencies by streamlining the binding and policy issuance process. In contrast, the research also reveals where insurers are investing the least. In the area of digital sales capabilities, insurers are focusing the least on proposal tools, which only 6% of insurers say they prioritize today.

Within digital servicing investments, research shows self-service capabilities are leading insurers’ priority lists. Most insurers say they are investing in servicing portals for agents and over half are also investing in capabilities such as online file-a-claim or pay-a-bill capabilities. On the other hand, no insurer indicated investing in an agent mobile app.

In a market such as personal lines where customers and agents expect on-demand service, it’s critical for insurers to continually invest in digital offerings and maintain nimble technology roadmaps. Understanding the needs of stakeholders and allocating investments accordingly to enhance digital capabilities not only improves the customer experience of agents and policyholders but also delivers greater efficiencies internally.

For more information on personal lines distribution technology strategies and investments, see our recent research report, Distribution Technologies for Personal Lines: Carrier Plans in 2023 and Beyond. This report is part of SMA’s research series based on surveys and interviews of insurers, agencies, brokers, MGAs, and others in the distribution channel, including insights from ReSource Pro’s extensive footprint of distribution clients. Contact the author for more information on this new research and advisory services for distribution.

Contact the author for more information.

About The Author

Mark Breading is known for his insights on the future of the insurance industry and innovative uses of technology. Mark consults with insurers and technology companies on forward-thinking strategies for success in the digital age. His inventive methodologies, fresh ideas, creative conceptualizations, and ability to incorporate InsurTech and transformational tech in business strategies are unparalleled. He also leads SMA’s research program, publishing 25-30 research reports per year and conducting various custom research projects for insurer and vendor clients. His thought leadership in the areas of InsurTech, transformational technologies, customer experience, and digital strategies has earned him a ranking of one of the “Top Global Influencers in InsurTech” by InsurTech News and Onalytica and a place in the ten finalists for the “Top Global IoT in Insurance Influencer Award.”

Before joining SMA in 2009, Mark spent 25 years with IBM in roles including the Global Insurance Strategist and Director of Global Financial Services Executive Conferences in addition to leadership roles in consulting and marketing. Mark co-developed IBM’s Account Based Marketing program and led the global project office to implement ABM across all industry verticals worldwide. Mark has held both technical and business roles in sales, consulting, marketing, and business strategy and has advised insurers around the world for almost 30 years.

About SMA, a ReSource Pro company

At Strategy Meets Action, our clients advance their strategic initiatives and accelerate their transformational journeys by leveraging our forward-thinking insights, deep vendor knowledge, and vast industry expertise. Strategy Meets Action is an advisory firm that works exclusively with insurers, MGAs, and vendors in the P&C market. For more information, visit www.strategymeetsaction.com.

About ReSource Pro

ReSource Pro brings integrated operational solutions to insurance organizations to improve growth, profitability and insurance outcomes. Headquartered in New York, ReSource Pro’s global service centers address client operational needs around the clock. Recognized as an industry thought leader and listed as one of Inc. 5000 Fastest Growing Private Companies annually since 2009, the company is renowned for its focus on innovation, service excellence and trusted partnerships, and its unique productivity platform for insurance operations. More than 5,000 ReSource Pro employees provide dedicated support to hundreds of insurance organizations, consistently achieving a +97% client retention rate over a decade. For more information, visit www.resourcepro.com.

SOURCE: Strategy Meets Action (SMA)

Tags: carriers, Mark Breading, personal lines, Strategy Meets Action (SMA), technology investment