The Anatomy of an Impossible Scam – Why do outrageous claims work exceptionally well, especially with glaring typos

Along with death and taxes, the most certain thing in life is to receive scam propositions.

More often than not, they come from Nigerian royalty (always via email), or from companies that promise ridiculous returns (think gold buy back schemes promising 24% per annum returns).

https://www.channelnewsasia.com/singapore/gold-label-jailed-ponzi-scheme-buyback-court-ex-directors-2932621

On hindsight, everyone (well, almost everyone) can look at these propositions and laugh them off. “I’ll never fall into such a harebrained scheme, its so shady and non-professional”

Today we are going to see that an essential part of a good scam, is actually to appear as shady and non-professional as possible.

Mindboggling? You bet.

True? You bet as well.

Let’s start by examining the two main ways a scam can position itself.

Two main approaches to an investment scam

Investment scams offer a high return on their investment in order to entice them to give you their money. The two main options for the returns are:

1. A high, but realistically plausible return

2. An insanely high, impossible rate of return.

The first approach was used by Bernie Madoff in his Ponzi scheme.

This approach can be successful in attracting sophisticated investors who are convinced that the promised returns are plausible, despite flawed due diligence. Madoff was able to raise a significant amount of money from wealthy individuals and funds-of-funds, enabling his scheme to continue for an extended period of time.

Bernie Madoff, whose victim list include – Steven Spielberg, Kevin Bacon, John Malkovich, and many other ordinary investors

In short, the first type of scam attracts the “sophisticated” but not overly smart investors.

The second strategy for conducting an investment scam involves promising extremely high returns in order to attract a large number of investors.

This approach has the advantage of appealing to people’s desire for high returns and can also help to exclude sophisticated investors, who are far more difficult to trick.

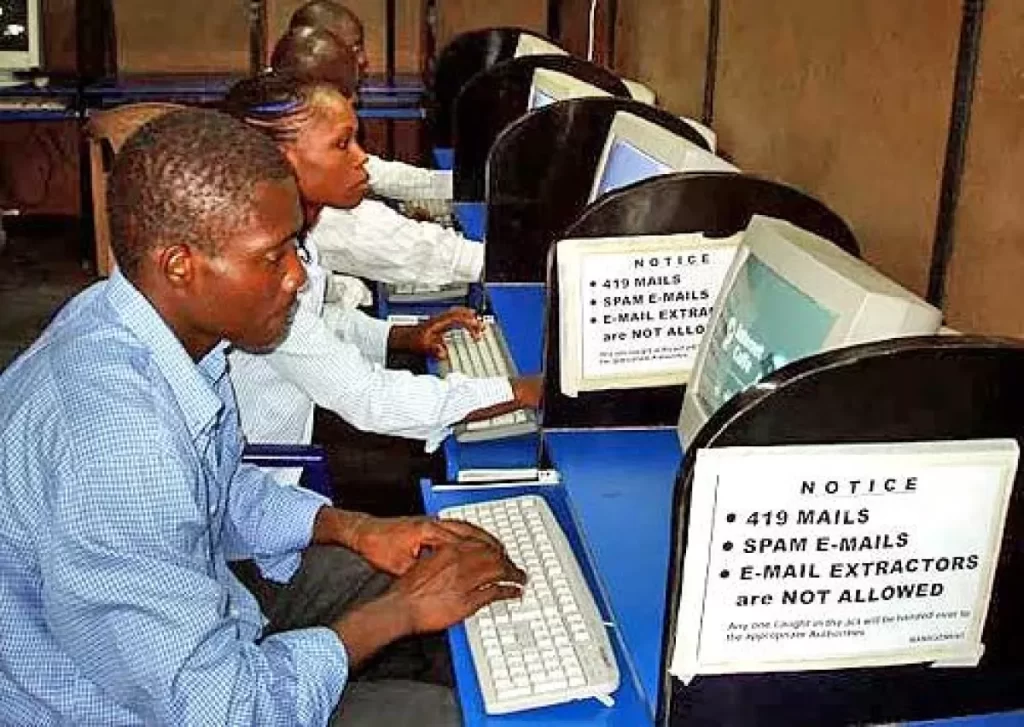

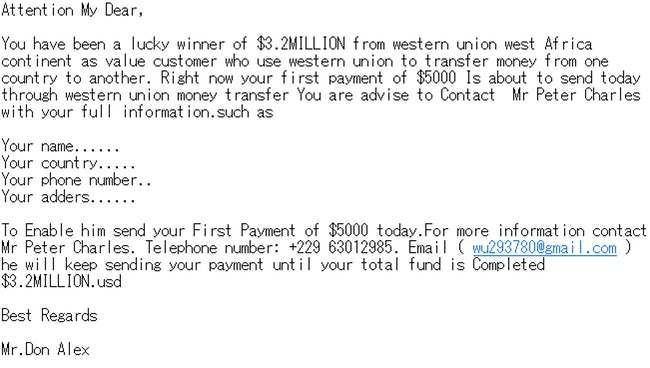

This email has made Nigerian scammers close to a billion dollars over a decade

By promising unrealistic returns, the scam can target only the most gullible individuals. The scammed returns are far higher as compared to the first type, which is why the second approach is more popular.

The Genius of typos and unrealistic returns

Why then do emails promising hundreds of millions of dollars still work today, and why are they still filled with typo errors and implausible stories (“relative of a Nigerian royalty that has to keep this transaction a secret”)?

It turns out that these obvious mistakes and stories help filter out the “false positives” – people that are exposed to the scam, interact with the scammers, but ultimately do not pay up.

Because scammers are human like us, and hate to do work without promise of a return. These false positives are the ones that drain the most time and effort of the scammers, hence false positives are the ones they want to avoid the most.

Rolls Royces don’t pay for themselves

By sending an email that so obvious in its shortcomings, the scammers are targeting only the most gullible of targets. If you delete their emails without a second thought (or after a chuckle or two), they don’t mind at all.

They don’t want you, someone that is smart enough not to fall for their scam. They want people who, faced with a ridiculous proposition, still don’t recognize its illegitimacy. This saves them time from dealing with false positives and ensures that their efforts will be well rewarded.

Scammers leave us with an unpleasant truth

Even if you have never fallen for a Nigerian Email scam (and never will), there is always a scam out there that is catered to your sophistication level.

There are plenty of scams to for one to fall under: Job scams, love scams, investment scams, crypto scams, you name it.

Some scammers are willing to chat and interact for months with their mark, in order to gain their trust and win the ultimate prize.

They are always able to prey on our weaknesses – because we all have them, be it gullibility, greed, fear of missing out and loneliness.

He knew this better than most

How then do we protect ourselves

Always dress yourself up with a degree of healthy skepticism – ask more questions, and always be sure of the mechanics or the process before you place your money down.

And remember, if its too good to be true, then it almost always is.

Stay safe out there!

If you’ve liked this article, please remember to share it with the people around you that are important.

It could make the difference between a good laugh or a heart wrenching experience of losing their life’s savings.