Cancer Drug List Explained: What it is and How you can prepare yourself

There is no denying it: Cancer is expensive

More accurately, Cancer Treatment is expensive, and it is fast outgrowing the cost of all other drugs.

The MediShield Life Council, a group responsible for managing a healthcare insurance program in Singapore, has informed the Ministry of Health that cancer drug spending has been increasing at a rate of 20% per year, while spending on other drugs has only increased by 6%.

Additionally, the number of cancer patients seeking treatment has increased, resulting in a more than 50% increase in payouts for outpatient cancer treatments, from $109 million in 2017 to $168 million in 2020. Source: Straits Times

To underscore the magnitude of this problem, cancer patients account for 2% of all patients but cancer treatment accounts for 35% of public drug sector spending.

Why is this so?

Because Pharma Bros (our colloquial term for those running pharmaceutical firms) charge what they want, when they want.

Left unchecked, this threatens to drive up premiums for Medishield Life, eat into our national coffers, and make life that much harder when cancer strikes.

Because you need Insulin, and because I have it. And I can charge whatever I want.

Enter the Cancer Drug List to the rescue.

What is the Cancer Drug List?

It is a list of Cancer Treatments (and their allowable prices) permissible to be claimed under Medishield Life, created by MOH.

The Cancer Drug List has since come into effect from September 2022, and it specifies what medicines can be claimed from Integrated Shield Plans as well.

Drugs on the list are chosen on the basis of efficacy and cost (ie. It must work reasonably well for a particular sort of cancer, and it must not be overly expensive)

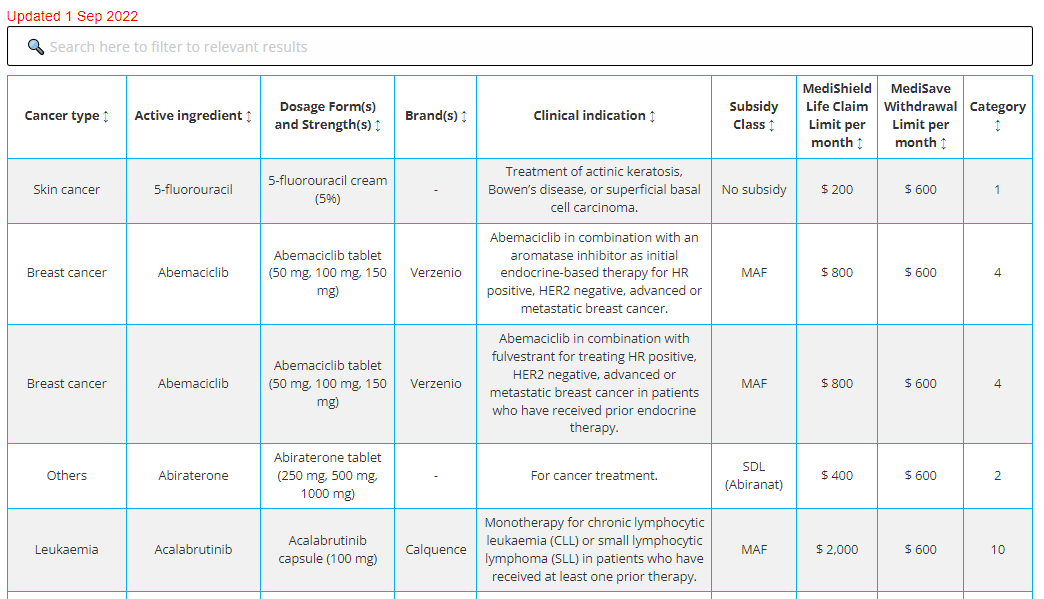

Screengrab from the Cancer Drug List, MOH:

What good does this bring us?

Primarily, better cost management.

The Cancer Drug List is there to prevent overcharging of medicines from aforementioned Pharma bros who love to practice price discrimination (charging well to do countries a lot more for the same drugs)

In theory, this should make our Medishield Life Premiums and Integrated Shield Plan premiums affordable.

What are the potential downsides?

Two that we can think of.

Much as we love to hate on the Pharma bros, they do plenty of groundbreaking research on experimental drugs. (Albeit driven by profit rather than altruism)

Many of these drugs could one day spell the difference between life and death for some cancer patients, but these experimentations are necessary for breakthroughs, and they don’t come cheap.

The OG of experimental drugs: Penicillin (News flash – all drugs start out as experimental!)

For these experimental drugs, it is not likely that they will make it to the Cancer Drug list any time soon (their efficacy is unknown and the initial cost is likely to be high)

Hence some patients might miss out on these potential life savers.

The second major downside that we see, is that the Cancer Drug list specifies right down to the type of cancer that is claimable.

For example, drug A might be claimable only if it is used to treat skin cancer, but it could also be effective for lung cancer.

Since individual reactions to drugs vary, drug A might actually work on a patient with lung cancer, but since it is not on the list specifically for lung cancer, its treatment costs cannot be claimed.

Read about a real life case of a man with brain cancer using off label drugs here:

https://www.straitstimes.com/singapore/health/brain-cancer-patient-treated-with-off-label-drug-frets-over-costs-when-insurance-coverage-stops-in-april-2023

As far as we can see, when survival is on the line, cost becomes less of a priority – especially if one has the means to pay for it.

Alright, what can I do about it?

Here’s our favourite part: Taking concrete action

Keep your Integrated Shield Plan if you already have it, or at least go get one. It is one of the most basic insurance plans that is a must have.

Review your Critical Insurance Coverage.

Ensure that you have anywhere from 3 to 7 years of Late Stage Critical Illness Cover (as a function of your annual salary), and around half that amount should be for Early Critical Illness cover

For example, Andy draws an annual income of $60,000. He decides that in the case of Critical Illness, a good buffer will be 5 years of Income. His total CI cover would that be $300,000, and he ensures that $150,000 of coverage is for Early Stage CI.

Why?

This is to ensure that even in the case of cancer and a drug is not prescribed on the Cancer Drug List, Andy can still use his ample CI coverage to pay for treatment and get well – which we assume is the top priority for any cancer stricken patient

How ClearlySurely.com can help

Sign up for an account here, and complete your Financial Discovery Journey. We will uncover what your current needs are, give you a clear view on how well insulated you are in various hypothetical (but common) scenarios.

Best of all, we link you up with the very best of Financial Advisors (those that we really trust), and we give you CASH REBATES when you purchase insurance from them.

Make it rain with Candy the Corgi, our official mascot

Our users get anywhere from $400 – $800 back in cash just in the first year alone, and those rebates continue in the subsequent years.

You get clarity, you get control, and you get cash for taking action to protect yourself

Not too shabby now, is it?

Mai tu liao, seriously.

Don’t lose out on getting cash rewards while getting covered