Renters insurance: Your opportunity to protect your stuff

Insurance Business digs deeper into this form of coverage in this part of our client education series. We will discuss what renters’ insurance covers and what it doesn’t, explain the reason behind the coverage gap, and give practical tips on how tenants can make the best out of their policies.

Insurance industry professionals can share this article with their clients to help them understand the real value this type of coverage offers.

Taking out renters’ insurance is not legally required, although landlords often make it a condition of the rental agreement – and for good reason. Tenant insurance can go a long way in helping renters protect themselves and personal belongings when accidents and disasters strike.

For rental properties, it is the owner’s responsibility to obtain protection for the building and its fixtures and fittings. This type of coverage – also known as landlord insurance – however, does not include the tenants’ possessions. For them to be protected, they must purchase a separate renters’ policy.

Renters’ insurance works the same way as contents coverage in a standard homeowners’ policy. It covers a tenant’s possessions, including clothing, furniture, personal electronics, and appliances. High-priced jewelry – such as wedding bands and engagement rings – expensive artwork, and other high-value items may likewise be covered by purchasing a rider.

There are two ways in which renters are paid under a tenant insurance policy:

Replacement value: Covers the full cost of replacing lost or damaged possessions with brand-new versions.

Actual cash value: Also called ACV, this reimburses what the item was worth at the time of the loss or damage.

According to many industry experts, renters’ insurance is among the cheapest and easiest type of coverage customers can obtain, making it generally a smart investment.

Standard tenant insurance policies typically include three core coverages, according to the Insurance Information Institute (Triple-I). These are:

1. Personal belongings or contents coverage

This covers personal items, including the following:

Clothing – including fashion accessories

Gadgets – laptops, mobile devices, TVs

Appliances – fridges and freezers, stoves and ovens, washing machines

Kitchenware – cookware, cutlery, dinnerware

Trinkets – toys, antiques, ornaments

Furniture – beds, dining tables, chairs, sofa sets, wardrobes

Home accents – Area rugs, curtains, cushions, bedding

Most renters’ insurance plans provide coverage for loss or damage caused by the perils listed in the table below.

Some policies also cover belongings lost or damaged while outside the rental property, like a bicycle or a laptop, for example. Others impose limits on valuable possessions such as jewelry and art collections, although full coverage through a rider can be purchased separately.

2. Liability protection

Tenant insurance provides two types of liability coverage:

Personal liability: Pays out for lawsuits and other legal expenses stemming from injuries to other people while on the rental property, including those caused by dogs and other pets. Also covers damages to other people’s property that the policyholder is responsible for.

Medical payments: Covers hospital and treatment expenses resulting from a guest’s injuries while on the property, regardless of who is at fault.

3. Additional living expenses

Also called ALE, this pays for living expenses incurred if the tenant needs alternative accommodation due to the rental property becoming uninhabitable. Coverage typically includes the following, subject to limits:

Temporary rental accommodations

Hotel stays

Food costs above the policyholder’s norm

Laundry expenses

Pet boarding

Additional fuel costs

Rental car and other transportation expenses

Storage fees

Moving costs

Apart from these standard inclusions, renters can customize their policies with endorsements that add more coverage but often at an extra cost. These include:

Scheduled personal property: Covers items that are worth more than the policy’s limit. These can include expensive jewelry, watches, and artworks.

Identity theft: Covers expenses associated with identity theft, including credit monitoring services, legal fees, and document replacement.

Water backup: Pays out for damage if the property’s sink, toilet, or other drain backs up, sending water into the unit.

Pet damage liability: Covers clean-up or repair costs for damages caused by pets.

Just like other policies, renters’ insurance has exclusions. Here are some items that are not included in this type of coverage.

The physical building, which is covered by landlord insurance

Flood damage, which can be covered by purchasing a separate flood insurance

Earthquake damage, which can be covered by buying an add-on

Sinkholes, which can be covered by getting specialty insurance

Bedbugs, mice, and other pest infestations

Roommate’s belongings, unless the policy is shared, which not all insurance companies allow

Vehicular damage and car theft, which are covered by auto insurance, although the contents inside are covered

Tenant insurance offers contents, liability, and ALE coverage for certain types of water damage. These include those caused by the following:

Accidental overflow and discharge

Burst pipes

Rain

Windstorms

Hail

Sewage or water backup

Renters’ insurance will only cover water damage if this was not due to negligence or intentionally caused, and if the policyholder did what was needed to prevent it. Coverage likewise does not extend to subletted or subleased units. In the case of toilet overflow, most policies provide cover as long as it is a one-time event.

There are five major factors that impact premium prices of a renters’ insurance policy. These are:

Coverage amount: This refers to the total value of the covered personal belongings. To help clients get an accurate estimate of how much their possessions cost, most insurance companies have online personal property calculators that customers can easily access.

Address: Different areas have different levels of risks, which can push up or drive down insurance costs. This will also dictate if the policyholders need to purchase additional riders.

Deductible: This is the amount the policyholder needs to pay out-of-pocket before coverage kicks in. Typically, the higher the deductible the lower the premiums and vice versa.

The choice between ACV and replacement cost: The latter is more expensive as it replaces old items with brand-new versions.

Discounts: Renters can avail of several discounts that can reduce their insurance costs. More on this later.

Renters’ insurance is one of the least expensive forms of coverage, but the premiums still vary depending on the region.

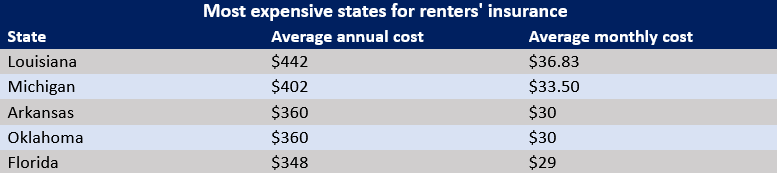

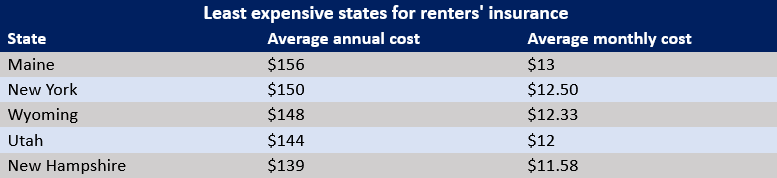

Renters insurance in the USA

The average tenant insurance premiums in the US cost $179 annually or about $15 monthly, according to Nationwide. Rates can be higher or lower depending on the state. The table below lists the top five states where premiums cost the most and the least, according to the data.

You can view the profiles of America’s best renters’ insurance providers in our ongoing Special Reports features.

Renters’ insurance in Canada

Several factors affect the cost of a tenant insurance policy in Canada, including the following:

Type of property

Where the property is located

How much the belongings are worth

Renter’s credit score, except in Newfoundland

Tenant’s claims history

Other risks associated with the rental property, including if it is in a flood-prone area

Standard premiums range between $15 and more than $40 per month or $300 and $480 annually, based on the calculations of several price comparison websites Insurance Business reviewed.

Check out the list of Canada’s best insurance companies in our ongoing Special Reports features.

Renters’ insurance in the United Kingdom

The UK’s renting population can take out contents-only coverage of a home insurance policy, which cost between £59 and £66 annually, according to research done by us at Insurance Business. This works out at about £4 to £5.50 monthly. Given the low cost, tenant insurance is worth having unless a person’s possessions are really limited.

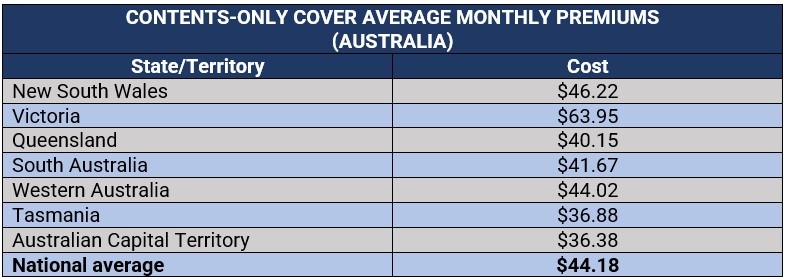

Renters’ insurance in Australia

In Australia, renters’ insurance – also called renters’ contents insurance – and contents-only cover offer basically the same protection. The main difference is that some tenant insurance policies provide coverage for accidental damage to any fixtures or fittings in the rental home – dented walls or doors, for example.

Some insurers also offer cheaper renters’ insurance policies designed to cover only loss or damage due to fire and theft. Tenants can take out a home contents insurance policy, but they must make sure that the coverage provided is adequate and fits their budget. The table below shows how much contents-only cover costs for belongings worth $100,000 in different states and territories.

Although renters’ insurance is already among the cheapest forms of coverage, insurers still give discounts to tenants, allowing them to slash insurance premiums further. Here are some ways renters can access tenant insurance discounts:

Bundling renters and auto insurance

Installing sprinklers or smoke alarms

Installing home security systems

Installing deadbolts

Being a retiree or reaching senior age

Paying premiums annually instead of monthly installments

Maintaining a good credit score

One of the most common misconceptions that keep tenants from taking out renters’ coverage is that their personal belongings are protected under their landlord’s insurance. In reality, however, this kind of policy covers the structure of the property and the contents the landlord owns within the premises such as furniture and appliances. It is up to the tenant then to take out coverage for their personal possessions.

Others skip coverage because they feel it is unnecessary as their belongings may not be worth as much. However, even the cost of small items can add up quickly if they need to be replaced all at once. For these reasons, renters’ insurance can be a smart investment, especially with accidents and disasters often occurring without warning.

What about you? Is renters’ insurance something you feel is worth purchasing? Are there other benefits or drawbacks of this type of coverage that you want to share? Feel free to use our comment box below.