Everything You Need to Know about Life Insurance and Taxes

Why is Topic of Taxes Relevant for Life Insurance?

Life insurance is one of the most widely used life and living benefits insurance products, but there are still a lot of questions related to life insurance and taxes. Three different aspects play into the discussion of taxes and life insurance. It is important to understand how it all works, since Canada Revenue Agency (CRA) is involved.

First of all, an individual – a person like you or I – can hold an insurance policy, or a company can also hold a life insurance policy. In the first case, this is individual life insurance and in the second case, it is corporate-owned life insurance. There are several situations when it makes sense for an individual or a company to use a life insurance policy to mitigate risks.

Second, tax topics related to life insurance differ across various policies. The simplest policies are called term life insurance, whereas more sophisticated policies are permanent life insurance (with whole life insurance being the most frequently used). We will discuss these two policies further to understand differences.

Third, life insurance and tax topics span across various financial transactions:

Paying life insurance premiums (paying for costs of life insurance)Receiving a life insurance claim payout (when a beneficiary receives life insurance proceedings when a policyholder passes away)Cashing out a life insurance policy – this is only relevant for a whole life or other permanent insurance policies where the cash value account is leveraged separately from the death benefit.

Now, let’s dive in…

Types of Individual Life Insurance

As briefly mentioned above, there are two different policy types:

Is Life Insurance Tax Deductible?

In the vast majority of situations, life insurance premiums are not tax-deductible. An exception is if a life insurance policy is used as collateral for an investment loan. In this case, a portion of the premium may be deductible, but tread carefully here and seek professional advice.

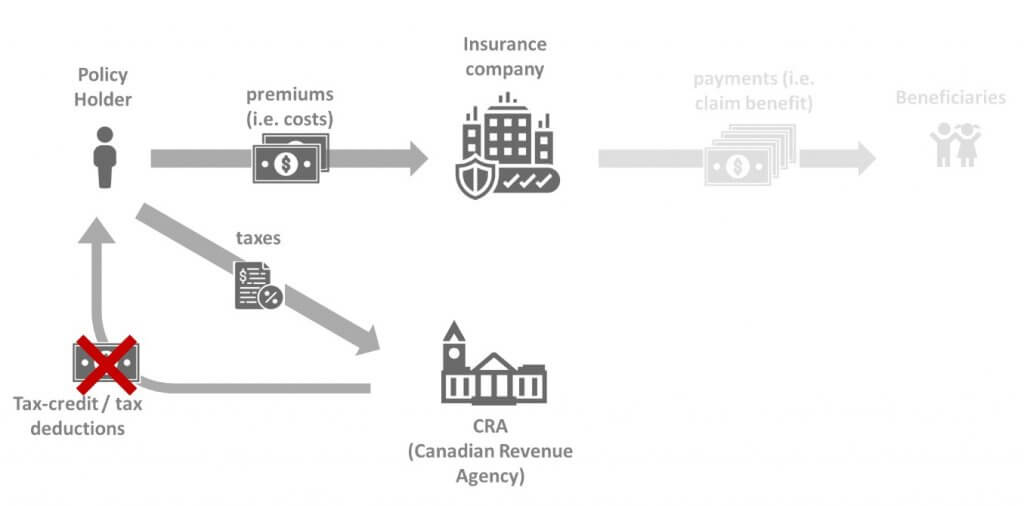

Individual Life Insurance Premiums and Taxes

The life insurance premiums that a person pays to an insurance company either on a monthly or annual basis are not tax deductible. Thus, there is no need to report this to CRA (Canadian Revenue Agency) in hopes of getting the premiums credited.

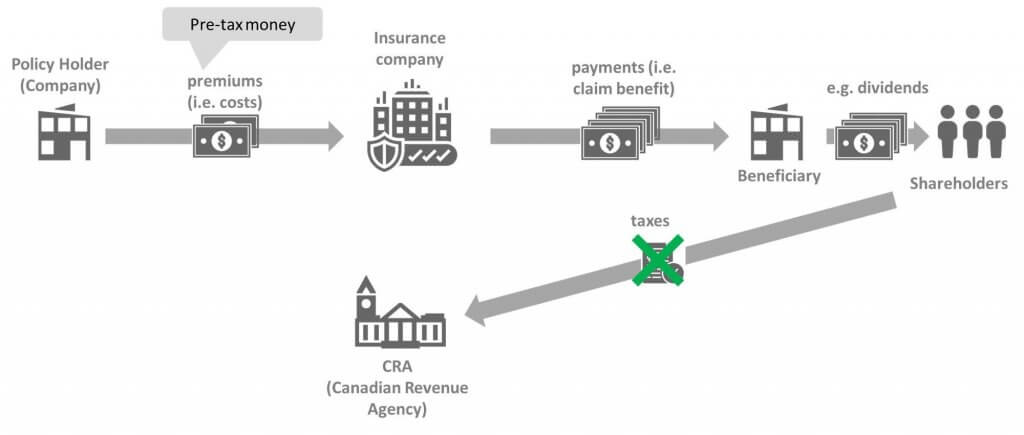

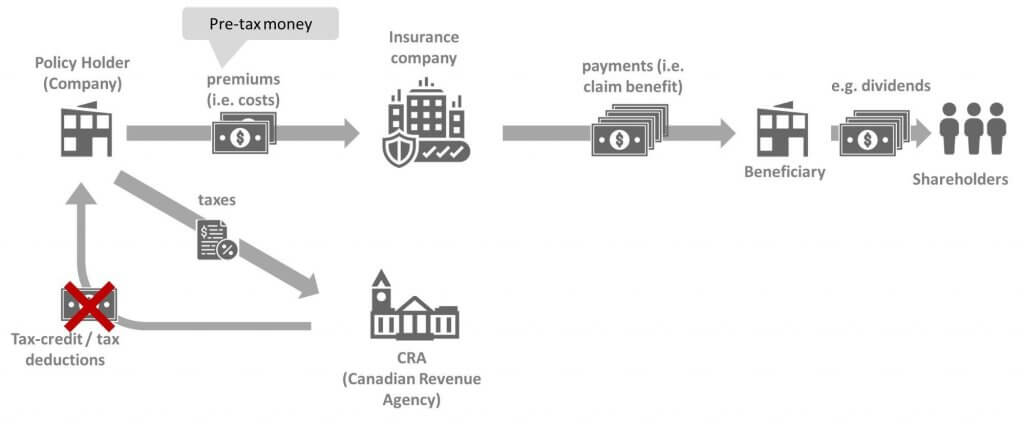

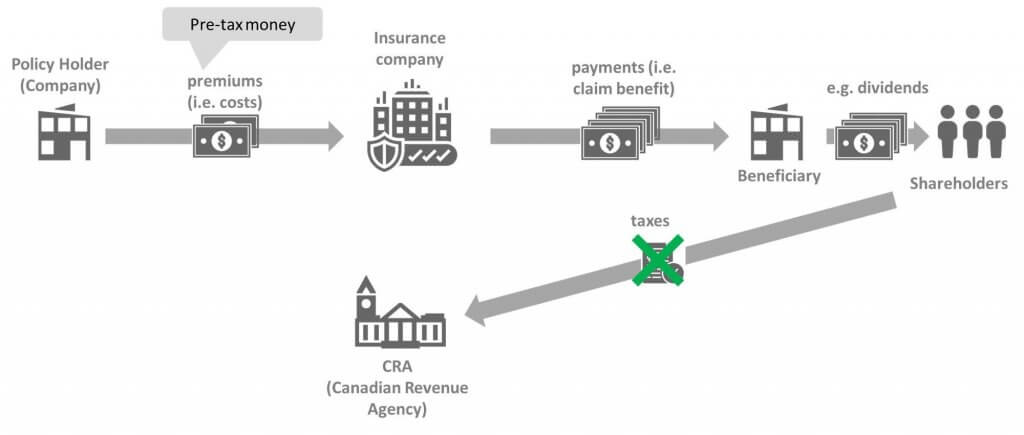

Corporate-owned Life Insurance Premiums and Taxes

Corporate-owned life insurance premiums are not tax-deductible. However, if owned by a small business, corporate ownership can still be advantageous due to the difference between the small business and personal tax rates. A company gets to use lower tax dollars to pay for the life insurance premium.

Is Life Insurance Taxable in Canada (i.e. Insurance Payments/ Claim Payouts)?

If a policyholder passes away, beneficiaries will receive a payment (also called a claim payout). In general, these payments are not taxable and a beneficiary (or beneficiaries) will receive the full amount. So, if a policy holder had a $1,000,000 life insurance policy, his or her beneficiary will get $1,000,000 in insurance payments without having to pay taxes on it. Thus, proceeds from life insurance are not taxable in Canada.

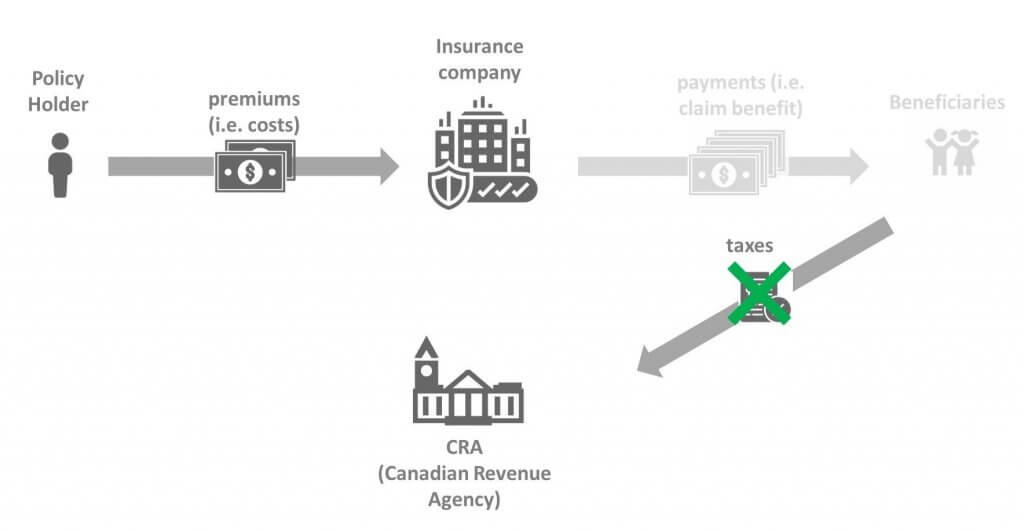

Individual Life Insurance Payments to a Beneficiary

Proceeds from life insurance are not taxable (also called life insurance payments) and the beneficiary will receive the full benefit tax-free. Thus, CRA will not be getting a part of life insurance proceeds/claim payout.

Corporate-owned Life Insurance Payments to a Beneficiary

When the beneficiary is a corporation, much of the death benefit will be able to be a dividend paid out to Canadian resident shareholders tax-free. An exception could be if a corporately owned policy (misguidedly) names a beneficiary other than the corporation. This causes tax problems.

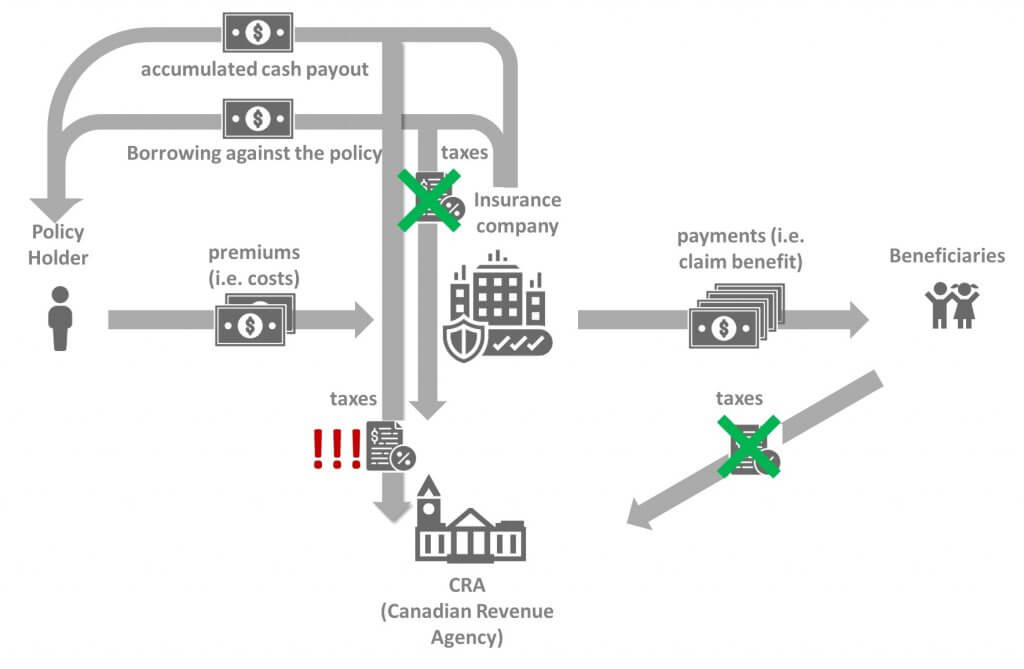

Are Life Insurance Cash Payouts from Whole Life Insurance Tax-Free?

If you take out cash from your whole life insurance policy, there is often a tax to pay. For this reason, it is often better to take out a collateral loan against the policy. This is similar tax-wise to a line of credit against a rental property – no sale means no gain and no taxes. Upon death, the loan gets paid off by the death benefit and the beneficiaries get the balance. Note: the lender must be a third party (not a policy loan) for this to be onside with CRA.

How Life Insurance Can Help with Tax Sheltering?

Life insurance as a tax sheltering tool is another tax-related topic and there are numerous ways to use permanent life insurance (such as whole life insurance) for tax-savings purposes. We have a detailed article on this topic – Whole Life Insurance and Taxes: Everything You Must Know.

Also, our experienced life insurance brokers are happy to explain you the details of life insurance products and associated tax impacts. Simply complete the quote request on the right side of your screen.