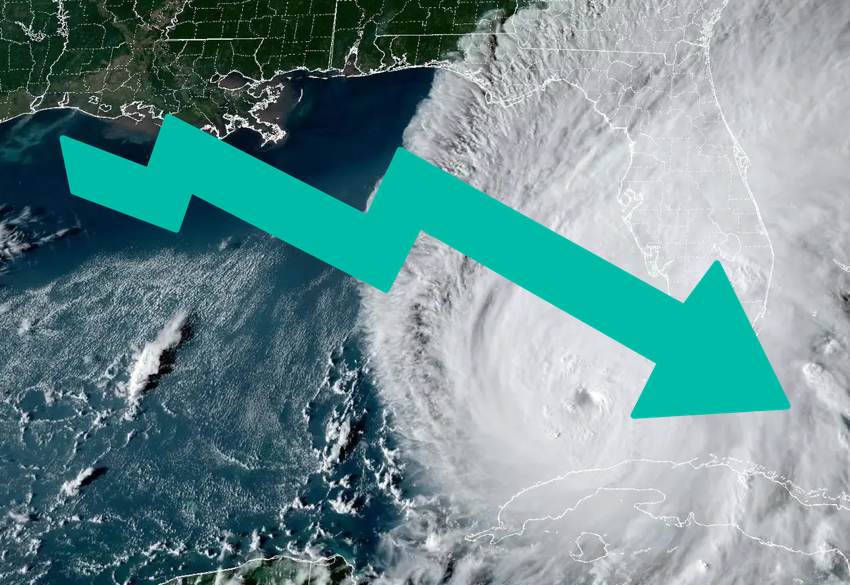

Stone Ridge mutual cat bond & ILS funds lose another ~5% on Ian

It feels a little negative to focus on just two ILS fund strategies in this way, but as the Stone Ridge Asset Management mutual insurance-linked securities (ILS) and catastrophe bond funds are the only ones that are priced on a daily basis, they are providing valuable insights for the rest of the ILS market in the wake of hurricane Ian.

Having fallen already on hurricane Ian, Stone Ridge’s two flagship mutual cat bond and ILS focused funds have each declined by more than another 5% at yesterday’s pricing.

We first reported on Wednesday, while major hurricane Ian was coming ashore in Florida and causing significant devastation, that some of the mutual ILS funds had tumbled on the approach of the storm, with Stone Ridge Asset Management’s strategies seeming to fall the most.

Then yesterday, we reported again on these strategies, finding that Stone Ridge’s mutual cat bond and ILS funds had declined again.

It’s clear that these are the only two regularly (daily) priced ILS funds in the market, as even the other mutual funds aren’t really moving, despite the fact they definitely have exposure to losses from hurricane Ian.

It’s also clear that, as more information on the scale of the loss facing the insurance, reinsurance and ILS market has emerged, these funds have slipped further as the market’s expectation of losses gets priced in.

Stone Ridge’s Reinsurance Risk Premium Interval Fund, which invests across the spectrum of sidecars, private quota shares, collateralized reinsurance and some catastrophe bonds, is still the worst affected.

It has declined by 3.8% from mid-September to the mark available from September 27th, before dropping a further 4.8% the next day. Now, at yesterday’s pricing, this mutual ILS fund was down a further 5.6%, taking it to now be down a significant 13.6% since the level it was priced at prior to hurricane Ian becoming a threat.

Stone Ridge Asset Management’s other mutual ILS fund, the Stone Ridge High Yield Reinsurance Risk Premium Fund, which is not an interval structure and is largely catastrophe bond focused, was down 2.6% the first time we looked after pricing on the 27th, but then fell another 4% the next day.

Now, this ILS fund of Stone Ridge’s has dropped another 5.1% at yesterday’s pricing, taking it to 11.2% down since before hurricane Ian threatened Florida.

These are significant declines, although it is a little surprising that the High Yield, more catastrophe bond strategy, is down almost as much as the interval ILS fund.

We’d expect the Stone Ridge Interval ILS fund to have much broader exposure to losses from hurricane Ian, given its participation in many private sidecars and quota shares.

It will likely take some time for these ILS funds to find a level and for the more cat bond focused, it won’t be until there are marks available from pricing sheets, later today, that it may be able to recover slightly. However that could take some weeks, as we still think today’s pricing sheets may be marked down quite hard given the uncertainty over hurricane Ian, but expectation it will be a really costly hurricane loss event for the industry.

Finally, it’s again worth noting the performance of some of the insurance and reinsurance share price indices

Yesterday we noted that the Stoxx Europe 600 Insurance Index was down almost 10% since mid-September, the Solactive Global Reinsurance Index was down almost 7%, and the Dow Jones US Reinsurance Index had fallen by almost 7% but then recovered slightly since.

Now, as of 15:00 BST on Friday September 30th, the Stoxx Europe 600 Insurance Index has fallen further and is now down 11.7% since mid-September, the Solactive Index is for some reason not available on its website today so no updates there, while the Dow Jones US Reinsurance Index is still down over 6%.

One additional benchmark data point, is the RISX, or ICMR (Re)Insurance Specialty Index, which tracks specialty re/insurers and is a good way to view the value of underwriters such as in the Lloyd’s market.

The RISX had also fallen by 10% from mid-September to hurricane Ian’s landfall and still seems to be down roughly 9.5%.

There are other factors likely at play, in terms of the macro environment with these broader re/insurance market indices.

But, if you consider the clear catastrophe risk focused strategies of the Stone Ridge mutual ILS funds, they haven’t perhaps fallen as far as you’d think, given how much some of these broader re/insurance market equity benchmarks have also fallen.

Of course, the question really is, how long does it take to recover back to those mid-September levels and is there any further to drop as more clarity emerges over the industry loss from hurricane Ian?

Also read:

– Hurricane Ian industry loss estimated up to $40bn by Fitch.

– Hurricane Ian to force a reevaluation: Millette, Hudson Structured.

– Hurricane Ian to cause Florida indemnity & FloodSmart cat bond losses: Twelve.

– Hurricane Ian Florida insured wind & surge losses $28bn – $47bn: CoreLogic.

– Hurricane Ian economic loss in Florida around $65bn: RMSI.

– Hurricane Ian: A historic hit for Florida, no matter the quantum of loss.

– Hurricane Ian to impact cat bond funds. Plenum says hit to be “limited”.

– Hurricane Ian to add reinsurance rate momentum, disrupt Florida market: KBW.

– A particularly broad cat bond mark-down this Friday?

– Cat modeller data hinted at hurricane Ian’s $50bn+ industry loss potential.

– Hurricane Ian: Rapid weakening may see losses nearer $32.5b, says KBW.