What are the benefit changes in 2023 in Covered California

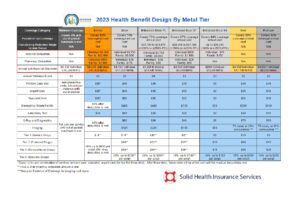

Each renewal season the ACA and Covered Covered adjust their benefit structure slightly. Whereas we saw in 2022 benefits improvements while lowering the medical and pharmacy deductible for the upcoming renewal season in 2023 we see major benefit reductions on the Silver 70 and Silver 73 benefits plans. The Silver plans are the most popular plan selection of the 4 metal tier options (Bronze, Silver, Gold & Platinum). On the Silver 70 and 73, the medical deductible is rising over $ 1050 from $3,700 in 2022 to $ 4750 for an individual in 2023. Double this amount for a family of $ 9500. Inpatient/hospitalization services do apply to the medical deductible after which a member would pay 20% coinsurance until they reach their annual out-of-pocket maximum of $8,750. for an individual. It is important to note that on the Silver 70, and 73 outpatient surgery, advanced imaging & radiology, x-rays, blood tests, and Emergency (ER) visits do not apply to the medical deductible, and will be paid with co-payments, which will be applied to the out-of-pocket maximum.

The out-of-pocket maximum for an individual will be increased from currently $ 8200 to $ 8750, for a family from $ 16,400 to $ 17500 for a family on the Silver plan.

This will be a huge burden for Californians. This will especially be a hardship for families with children under 18 years, young adults, and people over 50 who are making more than 200 percent of the Federal Income level. For an individual $ 26000 and for a family $ 53,500.

The annual prescription deductible will increase from currently $ 10 to $85 on the Silver 70 plan. Once you have met your $85 drug deductible, you would then pay the below copays for a month’s supply, depending on the drug tier (please review your insurance company’s drug formulary to find each prescription’s drug tier).

Prescription Copays in 2022 (monthly supply)

Tier 1 – $16 vs $15 in 2022

Tier 2 – $60 vs $55 in 2022

Tier 3 – $90 vs $85 in 2022

Tier 4 – 20% up to $250 for a month’s supply (same as in 2022)

There are some additional changes to the Silver 70 plan for 2023. The primary care, urgent care, and mental health visit copays are increasing from $35 to $45 while the specialist visit copay is also increasing from $70 to $85.

With the introduction of the Inflation Reduction Act, Covered California already lowered its preliminary 2023 premium increase from 6 % to a final state-wide weighted average of 5.6 % premium increase. Depending on the health insurance carrier we are seeing premium increases from 1 % – up to 14 .5% so it is critical that you shop the health insurance market during the Annual Open Enrollment Period for individual policyholders will be between November 1st to January 31st. The Renewal Period will start 2 weeks earlier on October 18th.

If you have any questions about your health insurance plan changes for next year, please do not hesitate to contact us. At Solid Health Insurance Services, we strive to find the right health, dental, vision, life, and long-term care insurance which best fits your budget and medical needs. Please contact us at info@solidhealthinsurance or at 310-909-6135 to go over your 2023 renewal options.