Incorporating Inflation into Financial Planning

Improving success in life and finances

What is inflation?

Rising inflation causes a decrease in buying power over time. It generally costs more to purchase the same goods and services.

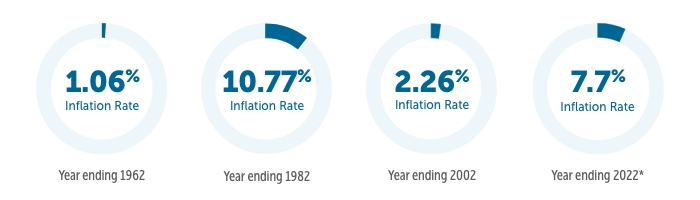

Inflation at various points in time

*year over year ending May 2022 (StatsCan and Trading Economics)

Plan for and manage inflation

Tactics for managing debt

Tactics for contingencies

Tactics for managing cash flow

Consider paying down debt or consolidating it at lower overall rates, particularly when interest rates float or are not locked-in and/or lock in lower rates when interest rates and inflation show signs of increasing.

Mortgage

Credit Cards

Line of Credit

Review the amount of life insurance and critical illness coverage you have, adjusting for higher cost of living and increased replacement cost of earnings. If inflation makes life uncomfortable while you are alive and healthy, what will it do when you’re not? Consider segregated funds that provide guarantees on deposits and may lock in growth too on death and maturity.

Life insurance

Critical Illness

Review where you spend your money. Can you reduce discretionary spending to ease pressure to pay for essentials like groceries, rent, heat and hydro? And what is really essential?

Reduce entertainment costs

Defer new purchases

Investment and Lifestyle Considerations

Investing vs. Saving

Consider how long your horizon is and take on some risk to preserve and increase the value of your investments, even in retirement which will likely last decades. Optimize the use of registered plans that allow for tax-sheltered growth and perhaps tax-deductible contributions. Both approaches may help deal with inflation over time. Consider segregated funds with their various policy guarantees to help provide you with a safety net.

Dollar-cost averaging

This tactic involves investing the same amount of money at regular intervals (e.g. Monthly) regardless of how the market is doing. It reduces risk over time and offers the opportunity to buy in when prices drop, buying more of the same investment and taking emotion and market timing out of the process.

Diversify

A properly diversified portfolio is key to managing inflation risk and providing the opportunity to achieve targeted rates of return over time that meet your goals in the future. Inflation can impact various investable assets differently and to different degrees. Ensure your investments align with your risk profile, time horizon and your various objectives.

Adjust. Adapt. Amend.

Just like inflation may affect various investments differently, it can have different impacts on various aspects of your lifestyle and choices. Build in and value flexibility. Consider adjusting travel plans or exploring experiences that cost little and provide enjoyment. Consider retiring later, working longer or part-time. Each year of delay means spending your earnings instead of your savings.

A properly structured financial plan can help provide direction, options, peace of mind, and predictability. It can help you understand the impact of inflation over time on your ability to reach your goals and do what you want to do. Be sure to periodically stress test your plans, solutions and strategies to make sure they continue to do the job they were designed to do. Adjust as necessary and enjoy your life.

![]()

This blog reflects the views of the author as of the date stated. This information should not be considered a recommendation to buy or sell nor should it be relied upon as investment, tax or legal advice. Empire Life and its affiliates does not warrant or make any representations regarding the use or the results of the information contained herein in terms of its correctness, accuracy, timeliness, reliability, or otherwise, and does not accept any responsibility for any loss or damage that results from its use.

A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a Segregated Fund is invested at the risk of the contract owner and may increase or decrease in value. Please read the information folder, contract and fund facts before investing.

This document includes forward-looking information that is based on the opinions and views of Empire Life as of the date stated and is subject to change without notice. The information contained herein is for general purposes only and is not intended to be comprehensive investment advice. We strongly recommend that investors seek professional advice prior to making any investment decisions. Empire Life and its affiliates assume no responsibility for any reliance on or misuse or omissions of the information contained herein.

September 2022