Strengthening Your Core to Handle the New Era of Life and Business

Remember The Jetsons, 2001: A Space Odyssey, and Back to the Future shows? Loved them all growing up and still like the re-runs! They all predicted technology that has come to life. We live in an era where yesterday’s science fiction is today’s reality. We have video phones in our pockets. We wear communication devices on our wrists. Our homes speak to us and we speak back. We are seeing the beginning of flying vehicles. Robotic automation and millions of databases hold our known preferences and advertise to us with what they know. Let’s face it; it is exciting, but it is also a little alarming. If we can advance this far, this fast, are we ready for what the future that is in store for us tomorrow?

That is insurance’s role. Dealing with tomorrow has always been a part of the value proposition. Insurance makes tomorrow a lot less worrisome and a lot more secure. We protect lives and businesses based on what the future may hold. If we are a part of a new era in digital understanding, then we need to effectively meet uncertainty with certainty. Our core business systems need strengthening to handle the future. In Majesco’s recent thought-leadership report, Core Modernization in the Digital Era, we look at the state of Core Modernization from within the insurance enterprise. Utilizing survey data from our strategic priorities report, we assess just how critical it is for insurers to prepare for the future.

Are you prepared for tomorrow?

With a future that moves forward with blazing speed, many insurers aren’t prepared for the unpredictable, are not attune to new and layered risks, and many are certainly not prepared for the new customer mindset that is evolving. To prove our point, let’s look at just one element of insurance preparation — digital channel growth using real-time data insights.

Today’s retail sales are using customer insights for the precision targeting of products and offers. This goes way beyond Amazon’s use of cookies and ads. Many large banks and retailers use customer purchase data (provided by banks) to understand individual purchase patterns and preferences. Any retailer interested in expanding their market share by dipping into competitive data can do that by simply subscribing to the bank data, provided through data collection companies such as Cardlytics, then using purchase histories to target the right products to the right people.

These are retail tunnels, if you will. The video phone in my pocket has now become the POP sales point for Lowe’s, Chicos, PetSmart, and Whole Foods. They have established a pipeline into my world. They go with me where I go — a thousand retailers in my one pocket.

Successful retailers know three things that will make them successful.

They need to adapt to meet my expectations.

They need to adopt the technologies that will grow their reach and business.

They need to respond to the pace of change. Sitting and waiting is not an option.

At Majesco, we frequently discuss and analyze insurance customers, technology, product placement, and responsiveness to change. How do insurers most effectively place their products in positions where they are likely to be seen, needed, and purchased? How do they embed products into the flow of life? How can we use technology to meet that accelerated pace of change?

At one time these areas of consideration existed in convenient silos. Marketing was left to the marketers and sales teams, using traditional marketing methods. Today, the question of insurance product placement no longer sits in a silo. It takes a team. It is a holistic combination of marketing innovation, data-driven underwriting, partnerships, and technology-enabled distribution/process management. It requires a wider variety of experts, partners and options.

Just as the team is more diverse, so is the technology used in creating the right environment for sales. Insurance technology is no longer the system that you place inside the organization. It is the interconnectedness of a variety of solutions and data and analytics that create the right mix of business processes to drive business growth. Insurance technology’s very definition has changed. Its new definition places a higher priority on interconnectedness. This is how insurers will meet the future — native cloud core systems with agile microservice components and rich API catalogs.

Majesco is in the process of perpetual assessment to meet insurance’s needs. What will insurers need tomorrow? Insurers, themselves, need to make regular assessments of whether or not their core will meet not just today’s but tomorrow’s demands. Is it strong enough to support the flexibility and speed needed? Is the current core “holding its own” against market trends? Even if it is, will it be able to keep up with the rapid shift from traditional purchase patterns to the new era of digital, anywhere/anytime demand? Is it able to keep pace with new options in product placement like embedded insurance? Can it use data and analytics to its fullest potential?

Assessing and strengthening the current core for future-readiness

There are hundreds of criteria that can be used to assess an organization’s need for core change. Most organizations tackle these questions periodically in a very organized fashion, enlisting help from outside transformation teams. But rather than a once and done approach, it really needs to be a continuous assessment and strengthening … no different than exercise to strengthen a body’s core. It’s crucial, though, to ask questions, gather information and continually assess the results, particularly given the pace of change.

Do our strategic priorities point to the need for a new core strategy?

Every organization is different, but when Majesco surveyed insurance executives regarding their strategic priorities, the top three clearly pointed toward the need for core transformation (Improve customer experience and engagement, Cost reduction/containment, and Developing and offering innovative products). The fourth was a direct strategic imperative acknowledging a new core strategy was needed (Scale the business on a cloud platform). (See Figure 1)

Figure 1. Strategic Initiative Priorities by Leaders, Followers and Laggard Segments

Does your core enable the transformation of data into intelligence?

Data collection, analysis, and real-time intelligence represent a tremendous hurdle for traditional on-premise core systems. The issue comes back to silos. If a claims system aggregates, assesses and reports on claims data and an underwriting system collects and utilizes requirements data, many times important claims data and insights may never cross underwriting’s desk and vice-versa. Access and management of data improves its governance, accuracy, consistency, availability, and a dozen other dynamics.

The key question, though, is about intelligence and insights. Can a next-gen SaaS core do a much better job of accessing data real-time and embedding advanced analytics to give greater intelligence and insight operationally and strategically? The answer is yes, and here’s why.

With the world speeding up and business change speeding up with it, intelligence and insights are far more crucial to identify timely shifts in markets, strategies, risks, and customers. Just as we saw with COVID, customer preferences can change on a dime. Consider how COVID increased customer interest in usage-based auto insurance (UBI). And now the macro-economic conditions of inflation and decreasing discretionary income are accelerating that demand.

But many insurers were caught off guard because their core systems were not ready to create, offer and service UBI, including the need to consume real-time telematic data for variable pricing. Those insurers with next-gen core technology, APIs and advanced analytics had the flexibility and scalability needed to deliver on UBI with speed.

Is your core able to foster our innovative ideas?

In our webinar last month, our panel of industry leaders reiterated the need to re-think and innovate insurance to meet the rapidly changing market, demand for new products and services, competitive landscape, access to new channels and fundamental changes in customers’ risk needs and expectations. This has added fuel to the focus focus on innovation initiatives that can help insurers adapt and capture the growth opportunities unfolding. Even with the macro-economic environment, the panel agreed that insurers must not pull back, but rather put the pedal to the metal. History shows that those who do, leap from and become more competitive. Just look at those who pulled back and those who moved forward following the financial crisis in 2007-2008.

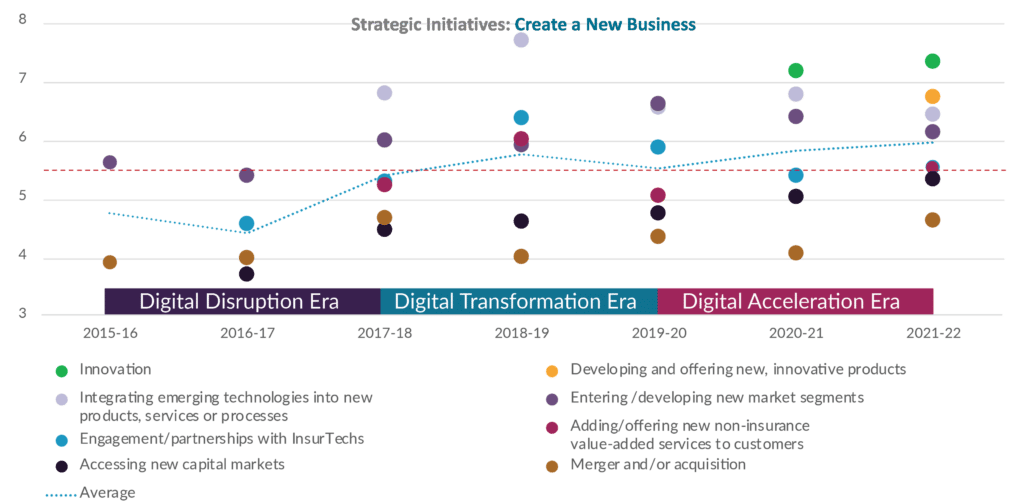

But real innovation requires next-gen SaaS core to execute on opportunities. Strategic priorities include: Integrating emerging technologies into new products, services or processes, Entering/developing new market segments, and Engagement / partnerships with InsurTechs. (See Figure 2.)

Figure 2: Seven-year Trends in Create a New Business Strategic Initiative Priorities

Does your core give a 360° view of the customer?

Research from SMA indicates that “94% of commercial lines carriers and 100% of personal lines carriers have a strategic initiative to improve the customer experience.”[i] This requires an understanding of each customer at a new level and appropriate automation to respond to their needs and wants in a timely manner. Traditional core systems lack the ability to truly understand customers and act upon that understanding. And in today’s world that is fundamental to personalization.

Is your core system prepared to meet the external challenges we worry about?

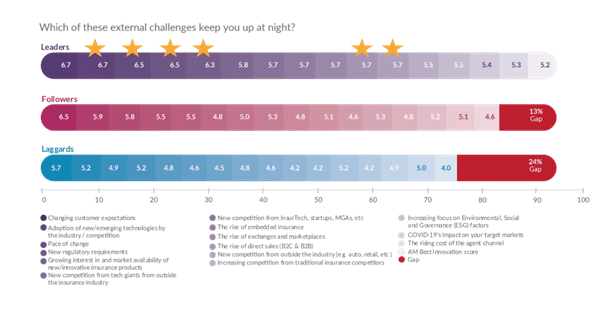

In Majesco’s Strategic Priorities report, we asked, “Which external challenges keep you up at night? (See Figure 3). The two greatest external concerns were, Changing customer expectations and Adoption of new/emerging technologies by the industry and competition. A close third was Pace of change.

This shows us that many/most insurers understand the real dilemma they face. It also shows the relationship between our three key themes from retail — customer engagement and expectation, prevalence of new technologies that insurers may or may not adopt, and responding to pace of change. In general, traditional core systems were created to run the business efficiently and effectively, not respond to a digital era of rapid change. Next-gen core platforms are designed to do both.

Figure 3: Concerns about external challenges by Leaders, Followers and Laggards segments

Can Platform technologies offer us anything that we can’t attain with traditional Core?

With the emergence of platform technologies in 2015 by many of the tech giants, FinTech and InsurTech, the weaknesses of non-platform systems became painfully apparent due to the lack of flexibility, agility, and speed to rapidly launch new products, expand channels, or offer new customer experiences. Next-generation SaaS core platform components offer insurers one of the greatest alternatives – a new architecture and technical foundation that can more readily adapt to the market with speed and scale, and do it cost-effectively. These solutions leverage microservices, APIs, cloud, artificial intelligence, machine learning, pre-configured content, new data sources, other next-gen technologies, and robust ecosystems.

A platform’s broader digital, data, and core capabilities enable insurers to optimize their business and accelerate innovation of new business models, products, services, channels, and more to meet the constantly changing market and customer demands with speed.

Moving from assessment to strategy and execution

We recognize that the questions posed highlight traditional core system constraints. Those constraints constrain the business. And while traditional on-premise core systems might be highly functional, they lack the necessary flexibility, adaptability, and scalability needed to operate with speed in today’s world.

Some insurers are replacing their traditional core with next-gen core to drive operational effectiveness. Others are standing up the new core to create new business models, products and more to accelerate innovation and growth. And some are doing both!

Regardless of which path you are taking, you need to take a new path to compete and survive. The time for assessment is now. The time for strengthening your core is now. When you see the signs every day that your core can not handle the new world of business and customer engagement — the time is now to assess, strategize and begin execution.

For a closer look at where other insurers are on the modernization journey, be sure to download Core Modernization in the Digital Era. To engage Majesco in a conversation regarding what’s possible in the realm of next-gen technologies, be sure to contact us today.

[i] Furtado, Karen and Mark Breading, Customer Experience in Action: An Approach to Customer Service in the Digital Age, SMA, April 2021