What Is Guaranteed Universal Life Insurance?

As with other traditional life insurance products, you will be fully underwritten when you apply for guaranteed universal life insurance. By fully underwritten, we mean your age, gender, smoking status, family history, and health and lifestyle factors will all be evaluated to determine your risk class—in addition to having a medical exam done.

Your risk class is what determines the price you pay for life insurance. Essentially, the riskier you are for the insurance company to insure, the higher your premiums are.

How much guaranteed coverage you want to purchase also affects the cost of a GUL policy. Again, your GUL coverage can last your entire life so whatever coverage amount you choose is the guaranteed death benefit amount your beneficiary will receive when you die.

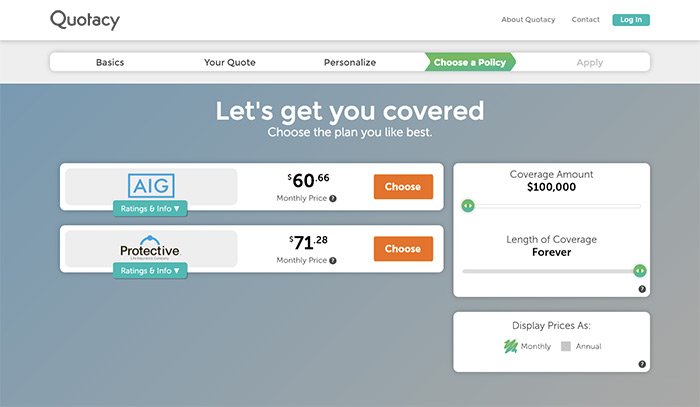

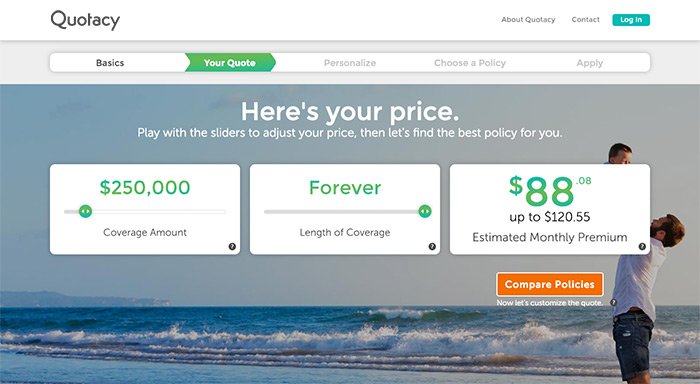

I ran a couple quotes for a healthy non-smoking 40-year-old woman. As you can see in the screenshots below, the cost of a GUL with $500,000 of guaranteed death benefit is much more expensive than a GUL with $100,000.

Laddering Life Insurance Policies: A Different Strategy

For individuals who want whole life insurance over term life insurance, it’s often because they want to leave behind some money no matter when they die. With term insurance, the coverage only lasts a specified period of time (often 10, 20, 30, or even 40 years) and if you don’t die within that time, your beneficiaries don’t receive a payout.

Term life insurance is a great product for families. It’s affordable and provides protection for your loved ones during their most financially-vulnerable years, the years when you’re paying a mortgage, saving for retirement, and raising children.

However, if you want life insurance to last until you die, not if you die, term life insurance isn’t going to cut it.

One option is to ladder different types of life insurance policies.

» Compare: Guaranteed universal life insurance quotes

Purchase a term life insurance policy with enough coverage to replace approximately 10 times your income and pay off all the big ticket items if you died unexpectedly, for example, the mortgage and your children’s college tuition. Then, in addition, buy a small guaranteed universal life insurance policy to provide funds for your funeral, end-of-life expenses, and a small inheritance.

Let’s look at an example.

John Smith is 35 years old. He’s married, has two young children, and is a homeowner.

He’s healthy and plans on living for a long time, but should the unexpected happen, he wants to ensure his wife and their children can remain in their home and that their children can attend college without financial struggle.

He hopes to live a long, happy life and die peacefully in his bed at an old age. If this happens, he still wants to leave behind supplemental income for his wife and some money for his children.

John can accomplish his goals by purchasing both a term life insurance policy and a guaranteed universal life insurance policy.

He purchases a $750,000 30-year term life insurance policy for $55 per month and also buys a $150,000 guaranteed universal life insurance policy for $100 per month.

If John dies before he turns age 65, his family receives $900,000 in total death benefit proceeds. If he lives past age 65, his family will receive $150,000 no matter what age he dies.

Who Should Consider Guaranteed Universal Life Insurance?

Honestly, most families only need term life insurance. But GUL insurance is a great option for those who would like lifelong protection but their budget doesn’t allow for a whole life insurance policy.

If you:

Have a special needs dependent

Own a small business

Have debt that is expected to last until or into retirement

Need estate tax protection

Want to leave an inheritance

Are older and your term policy ended but you still want coverage

then look into guaranteed universal life insurance.

Since GUL insurance is less complex than whole life insurance, you can run quotes yourself instantly on Quotacy.com.

Easily compare the costs of term life insurance and GUL insurance with our quoting tool. Simply go to our quoting tool, insert your basic information, and on the second page, move the Length of Coverage slider all the way to the right to “Forever”. Compare prices anonymously and then apply online in just minutes.