Is the Insurance Industry Ready for The Great Wealth Transfer?

This post is part of a series sponsored by AgentSync.

Insurance carriers and agencies should start considering how to court the next generation of clients, as baby boomers will be leaving record-breaking levels of wealth to their heirs over the next two decades in what’s been termed “The Great Wealth Transfer.”

It’s also an ideal time to make sure your house is in order before an influx of new business opportunities crop up. With new wealth, new opportunities will arise for insurance agencies, carriers, and individual producers. Why not make sure your operations are streamlined and your organization is a well-oiled machine ready to jump on whatever prospects come your way?

What is The Great Wealth Transfer?

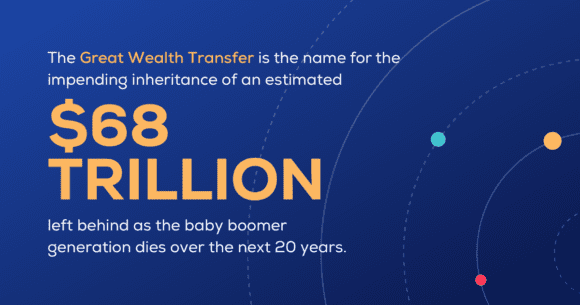

The Great Wealth Transfer is the name for the impending inheritance of an estimated $68 trillion left behind as the baby boomer generation dies over the next 20 years. It’s no secret that baby boomers have accumulated a lot of wealth over their lifetimes. As of March 2022, this generation holds a cumulative $71 trillion in assets! This makes baby boomers the wealthiest living generation by a wide margin. While not true for every individual baby boomer, the cumulative wealth held by this generation is more than has ever been accumulated in recorded history. It also means they have more money to leave their children and grandchildren than any generation before them.

Hence: The Great Wealth Transfer.

Why are baby boomers so wealthy?

The state of American economics since World War II, including low interest rates, a thriving stock market, and an inflated real estate market, has made the baby boomer generation the wealthiest to ever exist in the U.S. Baby boomers, defined as those born between 1946 and 1964, currently hold an estimated $71 trillion in wealth. This means they’re an astonishing eight times as wealthy as millennials, and also hold almost double the wealth of the entire Gen-X population.

Sure, this generation still has its issues, and not every single baby boomer is living it up in their golden years. But collectively, the baby boomer generation has reaped the rewards of the U.S.’s post-World War II emergence as a global economic superpower and the general upward trend of industry, technology, and the stock market over the last 60 years.

Insurance across the generations

It makes sense that people with more wealth, and more valuable assets, will also have more insurance policies to protect said wealth and assets. Across the insurance industry, experts talk about differences in insurance purchasing behavior across generations, including perpetuating the (possibly false) belief that younger generations are averse to insurance products.

While some wealth transfers will trigger insurance purchases by default (homes, cars, boats, etc.), the recipients of new wealth may seek out life insurance policies as a way to protect that wealth and to pass it along to their own children. But only if they’re aware of the benefits, which is where insurance companies and agents can come into play. Let’s look at some considerations for each generation involved in the ongoing Great Wealth Transfer.

Baby boomers and insurance

The majority of the baby boomer population is currently Medicare-eligible, with only the youngest boomers still under age 65. So Medicare Supplements aside, health insurance for the elderly may not be the most booming market.

On the other hand, baby boomers do have quite a lot of property to insure, as they own more real estate than any other generation, after snatching that distinction away from the Silent Generation in 2001. As more and more boomers are opting to “age in place” instead of relocating to a nursing home or assisted living facility, their real estate holdings are likely to be a large part of what they transfer to the next generation.

Carriers and agents look out! There could be a mass influx of new property owners who could either stick with the insurance policy (and agent) grandpa’s had for 50 years, or be open to working with a company that provides a more tech-forward experience. Case-in-point: Seventy percent of digital native insurance carrier Lemonade’s customer base was under age 35 in 2021.

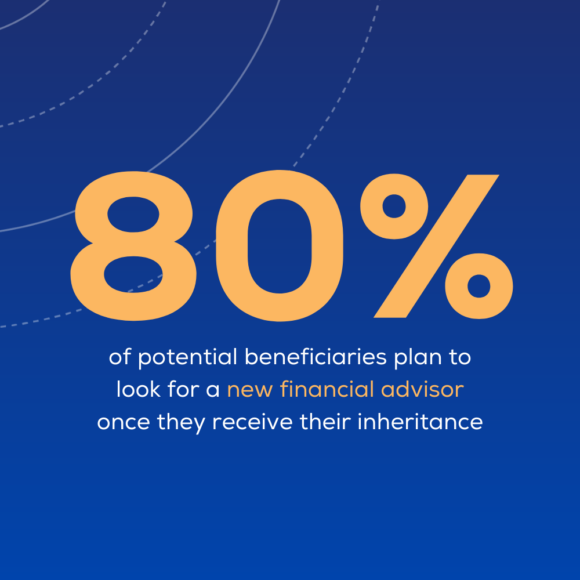

Studies in the financial industry have shown around 80 percent of potential beneficiaries plan to look for a new financial advisor once they receive their inheritance. While there’s no guarantee this trend will hold true within insurance, if it does, this would be a large shakeup and a large opportunity for savvy agencies and producers to go after a whole new client base.

Boomers are also great consumers of life insurance policies. While logic would dictate purchasing a life insurance policy while you’re young and healthy, many people begin thinking about life insurance only once they’re old enough to have a family and earn a significant income. Baby boomers have been in that place for decades, so they’re more likely to own a life insurance policy. On top of that, 66 percent of Americans say they purchase a life insurance policy to help them transfer wealth to their descendents.

This means there’s a lot of boomer-held life insurance policies that will begin paying out tax-free money to beneficiaries over the next couple of decades. Not only will the beneficiaries have more money to buy their own homes, cars, and other insurable assets; they might have a newfound appreciation for the value of a life insurance policy and seek out one for themselves.

All in all, baby boomers are a highly-insured population, who’ve helped the insurance industry thrive over the past 50 years. A study by Deloitte Consulting calls boomers “historically the most reliable customer base” for insurance, particularly life insurance. But, the study notes, this is changing. Millennials and Gen Z will soon outpace baby boomers as the industry’s top customers, as long as insurance companies and agents can prove themselves valuable to younger generations.

Gen-X and insurance

Gen-X, those born between the late 1960s and early 1980s, have different needs than baby boomers when it comes to insurance (and almost everything else). While this generation is reaching middle age, they aren’t yet closing in on retirement or nearing the end of their lives.

Generation-X stands to gain a lot in The Great Wealth Transfer as many of them are the children of baby boomers who can almost see their inheritance right around the corner. On average, members of Gen-X aren’t nearly as well off as baby boomers, but they’re doing better than millennials with a cumulative wealth of around $42 trillion. That’s more than 50 percent the worth of the boomer generation, and still almost five times as much as what millennials have accrued.

While insurance companies, agencies, and agents may want to pay particular attention to millenials and Gen-Z over the next 10 to 20 years, they would be smart to pay close attention to Gen-X right now. This is because:

Millennials and insurance

Millennials, those born roughly between 1981 and 1997, are now the largest generation in the U.S. This inherently means they have a lot of purchasing power as consumers, including as consumers of insurance. Their need and desire for insurance will only continue to grow as they go through life events like marriage, home ownership, and childbirth that have historically prompted people to seek out greater financial protection. And on top of that, as we’ve mentioned, they could soon be the richest generation in American history thanks to the transfer of their parents’ and grandparents’ assets.

There’s a lot of conflicting information out there about how much millennials dislike and distrust insurance (and agents). But other, more optimistic studies show that in fact millennials largely do purchase their insurance through an agent, even if they begin their shopping experience online.

As this generation prefers to do their research and begin their interaction with brands and products via social media and the internet, it will only become more important for insurance agents to be fluent in digital media as millennials’ appetite for insurance grows.

Another common (but likely false) belief about millennials is that they’re primarily driven by price and simply want the cheapest possible insurance policy. Again, research shows millennials are not actually more sensitive to pricing than other generations. However, they do want to get the best coverage they can at the best price, and often value the guidance of a licensed insurance agent when shopping.

How will The Great Wealth Transfer impact the insurance industry?

As a result of The Great Wealth Transfer, younger generations (namely Gen-Xers and millennials) will have more money, and more assets to protect as they inherit them from their boomer generation parents and grandparents. Logically, they should use some of that money to buy insurance policies to protect some of their newfound assets.

Despite some common misconceptions, millennials aren’t exactly strangers to insurance products. As of 2019, one study found 45 percent of millennials owned a house, and 80 percent owned a car. This equates to around 58 million cars (requiring car insurance) and 32 million homes (likely requiring homeowners insurance). Still, those numbers are small compared to the number of cars, houses, and other insurable assets held by baby boomers. Not to mention, boomers are much more likely to have life insurance and long-term care insurance policies than millennials and Gen-Zers. But this could dramatically change if and when these generations are the beneficiaries of their predecessors’ massive wealth.

Insurance professionals have reason to be optimistic that, with the inheritance of assets and wealth, millennials will put an even greater emphasis on protecting what they’ve got and preserving it for their own children. This means there’s great potential for insurance carriers, agencies, and individual producers to increase revenue by proving the value of their products and services to the next generation.

Will The Great Wealth Transfer actually happen?

Most sources agree that there’s an impending, massive transfer of wealth from older generations to younger ones. However, the jury’s still out on how significant it will truly be, given a few complicating factors at play. While we stand by our assertion that insurance professionals need to prepare for The Great Wealth Transfer, here are a few reasons it might not be as “great” as predicted.

Baby boomers are spending more of their own money

It used to be pretty much a given that parents who spent their entire lives building wealth would leave their children a substantial inheritance. This is no longer the case. The baby boomer generation may be the first we’ve seen opting to spend their money on living their best lives while they can.

It’s not all about frivolous spending either. The COVID-19 pandemic kept boomers away from their children and grandchildren for years. Now that most feel they can safely travel and see family again, boomers have largely decided spending money on creating experiences with their loved ones is a larger priority than leaving that money behind.

Another impact of COVID-19 was that people nearing retirement age decided to retire earlier than planned rather than stay in a job that wasn’t fulfilling, or perhaps put them at greater risk of infection. In some cases, people close to (or even past) retirement age lost jobs because of COVID-19 shut-downs and realized they really didn’t want to go back! Surveys show boomers largely would rather live modest retirement lifestyles than continue working additional years to support more luxurious retirements or adding more money to their estates.

Baby boomers are leaving money to their grandchildren or to charity

Millennials shouldn’t count on large inheritances just yet, according to some studies. Many boomers surveyed indicate they plan to give most of their money to charities and/or set up funds for their grandchildren and even unborn future great-grandchildren, rather than following the traditional model of leaving everything to their immediate heirs.

There are a variety of reasons behind this shift in mentality, from motivating their own children to go out and build wealth for themselves to intentionally denying funds to their purportedly “entitled” millennial children. Whatever the reasons, boomer-aged parents seem to feel confident their children will do OK without their inheritance, and are considering alternatives to passing massive wealth along to them.

Baby boomers have a long and expensive retirement ahead of them

As of 2022, baby boomers have a life expectancy of anywhere from the high 70s to mid 80s, depending on the source. While this is longer than previous generations’ life expectancies, we also know there’s more chronic illness and need for expensive long-term care in the aging population than ever before.

With long-term care insurance fizzling out (though there are some alternative ways to help pay for those needs), baby boomers will rely more on their retirement savings to fund their extended lifespans, including nursing homes, assisted living facilities, and in-home caretakers. All of this costs money, and with 20 years or more yet to live, it’s easy for today’s “wealthy” 65-year-old to deplete most of their savings before passing away.

How can the insurance industry prepare for The Great Wealth Transfer?

The Great Wealth Transfer is most likely already happening, and will continue to happen for the next 25 years. So, what can today’s insurance professionals do to make sure they’re ready to take advantage when the opportunity strikes?

Shore up your internal processes and operations

At the same time as the insurance industry will experience a new pool of potential clients, it’s also losing a large number of seasoned employees.

Fewer professionals focusing on more consumers means insurance carriers and agencies need to have their systems dialed in. Because these new consumers and their wealth won’t stick around if companies have bloated operating expenses that get passed along to the client. Nor will millennials stand for slow and poor customer service.

It’s also worth noting that one of the greatest challenges for insurance industry organizations will be attracting and retaining employees to care for tomorrow’s insurance consumers. Getting your house in order by adopting systems that make employee’s lives easier will make your organization more competitive to potential talent.

Embrace modern technology to provide the seamless client experience that millennials demand

Focusing on internal systems is a crucial first step. But don’t discount the importance of client-facing technology as well. We already know millennials still value human relationships and are likely to use insurance agents as trusted advisors, but at the same time, they prefer to initiate contact and complete tasks digitally – including via mobile devices. Making sure your insurance company or agency not only has an online presence, but that it’s a positive and mobile-accessible one, has never been more important as potential clients commonly visit websites and read online reviews before reaching out to speak with a human.

Baby boomers aren’t going anywhere right now, but insurance companies and agencies that don’t put systems in place to prepare for the onslaught of millennial clients (even if it’s still years away) will find themselves too far behind to catch up. Don’t forget that boomers are also widely tech-savvy and like to self-serve their needs via smartphones, too.

Either way you look at it, modernizing your insurance business as soon as possible will pay off for both current and future clients.

Focus on client attraction and retention by thinking like a startup

The Great Wealth Transfer may still be in question for some people, but what’s definitely not up for debate is just how competitive the insurance landscape will continue to be. For some products, rates are set (by carriers or state insurance commissioners for example) and not negotiable even by the most eager producer, or most flexible carrier. This means clients will choose to do business with you based on what you bring to the table, not just the price of the product.

So how do you attract loyal clients who’ll bring you all the new things they need to insure if and when they do benefit from baby boomer wealth? Think like a startup.

Just because you’re not a tech startup doesn’t mean you can’t add this mentality into your organization. Regardless of the age of your company, whether you’re an insurance carrier, agency, or any other type of business, making a conscious effort to prioritize your clients and their experience above all else will put you lightyears ahead of others in the industry. After all, there’s no shortage of options for consumers shopping for insurance. All things being equal, people will choose to work with people and companies that make them feel like valued customers.

A few keys to this “startup mentality” that you can put into practice include:

Make “customer love” a key component of your culture. Clients should never question whether you appreciate their business.

Be agile and flexible, responding to what your clients tell you they need even if it means thinking outside the box.

Empower your team to act like owners in all situations. Automating some (or all!) of the tedious, manual work goes a long way toward giving your staff the bandwidth to solve complicated customer problems using skills only humans have.

Whether The Great Wealth Transfer is happening now, next week, or turns out not to be as big a deal as everyone thinks it’ll be, there’s still truth to everything we’ve covered in this guide.

If you’re convinced it’s time to take steps toward modernizing your insurance company or agency so your producers can start selling more quickly, your compliance staff can work more efficiently, and your clients can have the best possible experience, then it’s time to see what AgentSync can do for you.

Topics

Market