Banner Life Insurance Review | Best For Standard Rates In 2022!

The best way to speed the underwriting process up will be to get your exam completed as early as possible so that your results get back to the insurance company faster.

If you need the most affordable rates and are fine with a 2 to 3 week turn around, then getting term life insurance rates and coverage from Banner is the best answer.

Who Is Banner Life Insurance?

Banner Life was founded in 1949 which makes it 70 years old.

An insurance company’s age is very important because it shows that they aren’t going anywhere and have longevity.

Banner is a subsidy of the parent company for Legal & General America and is known for their strong financial standing and great customer service.

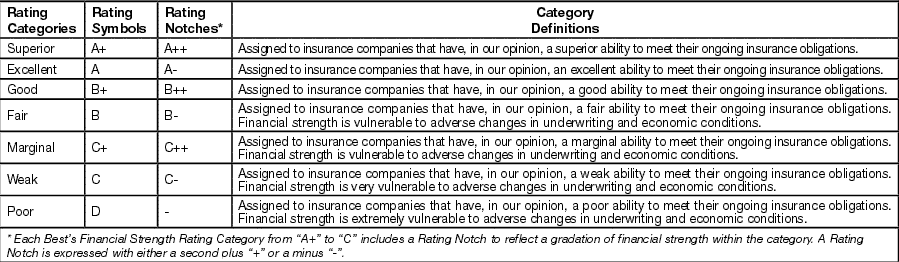

Banner Life Insurance Company has a rating of A+ (Superior) from A.M. Best.

Why Should You Care About A.M. Best?

I like to think of A.M. Best like the JD Power of the insurance industry, they have been around for over 117 years. They rate companies based mainly on their financial strength, which can be an indicator or claims-paying ability.

Claims Paying Ability “in plain English”: A Life Insurance Company’s ability to pay out on a policy.

Life Insurance made easy!

Agents not required.

Get quotes and sign up online without talking to an agent. But, we are here if you need us.

Unbiased, expert advice.

Get unbiased insurance education from licensed experts and also avoid dodgy sales calls.

Coverage in minutes.

You can get life insurance coverage within minutes of getting your quotes and applying.

What Makes Them Different?

What makes Banner Life Insurance Company different is that they offer life insurance up to age 95.

This is well above the industry standard of usually stopping between the ages of 65 or 75. They also offer very flexible payment options and multiple term limits for each policy type.

Banner is offering over $1 Million in life insurance coverage with a short online application and very agreeable underwriting.

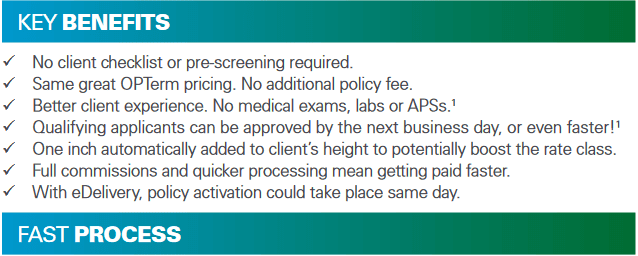

They are also trying to make some movements in the accelerated life application sector with their new APPcelerate Product.

Banner Life APPcelerate Term Life Option

Like most of the best term life insurance companies, Banner Life is attempting to move towards an automated and accelerated life insurance underwriting process.

Because of this, some applicants may not have to take an exam

They also might be able to avoid medical records requests as well.

You can apply for up to $500,000 if you are between ages 20-50 and may be approved for coverage without the need of exams, labs, or medical records.

The APPcelerate products features are:

Remember, “No Exam” doesn’t mean “No Underwriting,” there are still reports pulled to make sure you qualify for coverage such as:

Banner is working to give you the best of both worlds, if you can’t qualify for the APPcelerate option, you will probably be able to qualify for the fully underwritten option.

What Are The Best Banner Life Insurance Alternatives?

Life insurance companies you can trust.

How Does Banner Life Insurance Work?

Banner is focused on affordable life insurance rates with solid underwriting.

Their policies are usually good for people with pre-existing conditions or tobacco users.

Their life insurance process works like this:

Coverage To Age 95

There is no other product in the market that will allow you to apply for life insurance up to you are age of 95.

This means it doesn’t matter what part of life you are in you can apply for life insurance.

Electronic Application

The application process is electronic, simple and short, it will usually take less than 5 to 10 minutes to complete all the information and submit your application.

Accelerated Underwriting

This part of the process is straightforward, you are going to answer a few questions about your lifestyle and medical situation via a telephone interview.

Once you do that, Banners’s in-house underwriting system will decide how to proceed with your application.

If you qualify for the APPCelerate option you will be approved based on that interview and coverage can start immediately.

If you don’t qualify you will be sent into the traditional underwriting process.

Policy Delivered Via Email

Once your policy has been approved and issued you will receive a copy of it directly to your email address.

This is great because you don’t have to remember where you left your policy and will always have easy access to it.

What Does Banner Life Insurance Cover?

Banner life offers a few different policy options for you to choose from.

Each policy comes with coverage options from $100,000 up to $1,000,000+.

10 Year Term Life Insurance Policy

The ten year term life option is going to cover you for 10 years before it’s time to purchase a new policy.

This policy is going to be the most affordable option with low-range pricing and will be best for people who are looking at both their short term and long term needs.

The amount of life events that can happen in 10 years is massive and being prepared for them is very important.

A 10 year term is a great starting point and locking your low rates in is going to be essential.

15 Year Term Life Policy

The fifteen year term life option is going to cover you for 15 years before you have to purchase a new policy.

This policy is going to be the second most affordable and be best for people who are in the middle of life events like having a baby or switching jobs.

20 Year Term Life Insurance Policy

The twenty year term life policy will be the second most expensive of the 4; however, it will still be very affordable.

This term length is going to be best for someone focused very much so on their future and want to be covered for the most extended period of time with the maximum amount of savings.

The longer a term length a policy has, the more expensive it will be up-front; however, the more savings you will get over time.

If you know what you want and can afford the twenty year term option, then I would suggest you go with the 20 year term option.

30 Year Term Life Insurance Policy

The thirty year term life policy will be the most expensive of the 4; however, it will still be affordable.

This term length is going to be best for someone focused on their future and want to be covered for the most extended period of time with the maximum amount of savings.

The longer a term length a policy has, the more expensive it will be up-front; however, the more savings you will get over time.

If you know what you want and can afford the thirty year term option, then I would suggest you go with it.

It’s a really good option if you just purchased a home.

All Cause Death Benefit

All of these policies will pay out for all types of death from accidental death, terminal illness, critical illness or chronic illness.

With all insurance policies, there are some limitations so be sure to read the policy for things that aren’t covered.

Term Life insurance by state.

AL

AK

AZ

AR

CA

CO

CT

DE

FL

GA

HI

ID

IL

IN

IA

KS

KY

LA

ME

MD

MA

MI

MN

MS

MO

MT

NE

NV

NH

NJ

NM

NY

NC

ND

OH

OK

OR

PA

RI

SC

SD

TN

TX

UT

VT

VA

WA

WV

WI

WY

DC

Banner Life Free MediGuide Membership

Unlike any other life insurance company out there, Banner life offers free membership to MediGuide with all of their policies.

So, If you’ve been diagnosed with an illness that might involve any type of heart disease, cancer, or any other high-risk condition you can get a second opinion for free.

If you have never heard of MediGuide then you are in for a treat.

MediGuide is a service that allows you to get a second opinion from a qualifed doctor if you are diagnosed with a life-threatening illness.

Banner will help you find the top 3 medical centers that handle your condition.

After you and your primary physician have identified the appropriate medical center, MediGuide & Banner will get you the second opinion from a top medical center.

This center could have access to advanced technologies that your primary doctor may not have.

Best of all, again, it’s Free and why Banner is consistently in our list of top life insurance companies to work with.

Banner Life Insurance Products

One of their primary products is their OPTerm Life product which we detail below:

OPTerm

The OPTerm is Banner Life’s traditional term life insurance product and has some of the best underwriting outcomes for substandard health profiles.

This policy is renewable all the way until 95 and has guaranteed level premiums with the ability to convert the policy.

You can also convert this policy into a whole life policy by following the below guidelines:

If issued before age 66, the policy is convertible until the earlier of the end of the term period or up to age 70. If issued at age 66 or later, policies are convertible during the first 5 policy years.

Some of the optional riders available are:

Child Protection Rider – Provides life insurance coverage for all eligible children (up to their 25th birthday)

Waiver Of Premium Rider – If you become totally disabled as a result of a qualifying event, premiums are waived (after a 6 month waiting period). Rider ends at age 65.

Accelerated Death Benefit Rider – You can accelerate up to 75% of the death benefit (up to a max of $500,000) if you’ve been diagnosed with a qualifying terminal illness.

Life Insurance made easy!

Agents not required.

Get quotes and sign up online without talking to an agent. But, we are here if you need us.

Unbiased, expert advice.

Get unbiased insurance education from licensed experts and also avoid dodgy sales calls.

Coverage in minutes.

You can get life insurance coverage within minutes of getting your quotes and applying.

Banner Life Rates & Comparisons

Just to give you an idea, below I wanted to compare Banner life rates with multiple companies.

A 20 Year, 500,000 Term Policy for a 30 year old male in perfect health and a non-tobacco user, see the results below:

As you can see, Banner’s rates are right in line with other companies; however, their included benefits like the free membership to MediGuide makes it a much better deal.

If you want the lowest price and best value then the OPTerm product is your best option.

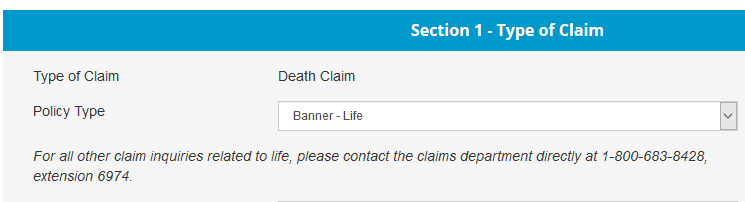

How Banner’s Claims Process Works

Banner offers a simple and clear explanation of how to handle a claim on their website.

You can also choose if they should follow up via email, fax, or phone.

Their claims process seems to be very easy, once you complete the online form they will send the claim’s packet out to you to complete the process.

Are There Any Claim Exclusions

There are a few exclusions when paying out on a life insurance claim.

The exclusions include death from suicide (within the first 2 years of coverage), which is standard for almost all life insurance policies.

As always, please read the policy specifics when it arrives in the mail; however, those are some general exclusions which is industry standard for most policies.

Banner Life’s Availability & Policy Options

To qualify for the Banner Term life insurance policy, you must:

How To Take Action

No other Banner Life Insurance Reviews are as long as mine; however, I wanted to make sure that I gave as much detail as possible.

If you have been holding off on buying life insurance for any reason, I say give the 30-day free look period a shot. With the accelerated underwriting process, you no longer have to be afraid of the life insurance buying process, it’s so fast, you won’t realize it’s over, and your coverage has started.

And guess what, if you don’t qualify for the accelerated process that is perfectly fine, you will still be able to get the lowest rates if you have to complete an exam.