Everything You Always Wanted to Know About Rate of Return

Podcast: Play in new window | Download

I’ll be honest with you—writing this post makes me feel a bit like Jack Nicholson’s character in the movie “A Few Good Men”. Remember when Nicholson is being questioned by Tom Cruise in the most memorable scene from the movie and Cruise is demanding the truth?

Nicholson replies, “You can’t handle the truth!”

So, what in the heck does that have to do with calculating compound annual growth rates?

Well, one of the biggest secrets within the investment industry is that mutual funds, variable annuities, and countless other products tied to the whims of the stock market, advertise their average return numbers in a very misleading way.

What’s worse? They’re not breaking any laws by doing it.

I know…there’s a collective gasp sweeping its way across everyone reading this.

What am I talking about?

Having been in the financial services industry since 2000, I’ve noticed that almost all investment product companies (mutual funds, ETFs, stock market indices, variable annuities, closed end funds, REITs) love to cite their “average annual rate of return” figures which always inflate what the particular investment actually returned to its investors. And it really bothers me.

2+2 always equals 4…except on Wall St.

This problem isn’t complicated nor is it nuanced in any particular way,(as the investment industry would have you believe) it really comes down to basic math.

Average annual return, as is always stated in investment literature, (marketing pieces, prospectuses, etc.) is simply a deliberate shell game meant to confuse your perception of the returns by stating simple arithmetic mean calculations when the only return that matters is the compound annual growth rate (CAGR).

Now, I know it sounds like I’m splitting hairs here but hang with me through an example and you’ll understand my beef.

Example: Let’s say that Bill invests $100,000 into his investment account at J.T. Marlin (some of you may get the Boiler Room reference) and for the 1st year his account grew by 25% but the account returned a negative 25% the second year.

The stock market muppets would say your average return is 0%…and they’d be telling the truth…in the same vain that President Clinton swore he did not have sex with that woman.

But they are clouding the truth with nonsense–because who cares what your average rate of return was?

Year 1— 100,000 x 25% = 125,000

Year 2— 125,000 x (-25%) = 93,750

If Bill started with 100k and now at the end of year two his account is worth $93,750 his actual compound annual growth rate (cagr) was -6.25%.

But didn’t I prove in the example that his average annual rate of return was 0%?

Then, how can Bill have less money than what he started with?

Welcome to the wonderful world of investments and the Imagineers of Wall St.

I found this little tidbit online when looking around to see what others were talking about regarding CAGR.

Investopedia.com says:

“CAGR isn’t the actual return in reality. It’s an imaginary number that describes the rate at which an investment would have grown if it grew at a steady rate. You can think of CAGR as a way to smooth out the returns.”

Honestly, I’m speechless.

The Enron accountants have obviously taken up residence on Wall Street and are firmly rooted in content publishing for the financial media.

I beg to differ with Investopedia…

Your real return is the only kind of return that matters at all. What’s imaginary is telling Bill (see above) that his account averaged 0% over the last two years!

Completely insane.

Who cares what I “averaged” over the last two years. If my stack of money is shorter than when I started, that’s not a zero-sum game.

That’s the kind of talk that would get you killed anywhere but Wall Street.

So, why would the investment world always quote the average return numbers?

I’m gonna give you a minute to figure that one out on your own.

Done?

Because average annual returns always look better than actual, real returns.

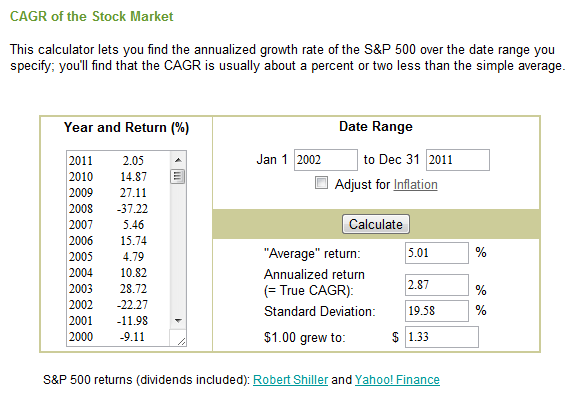

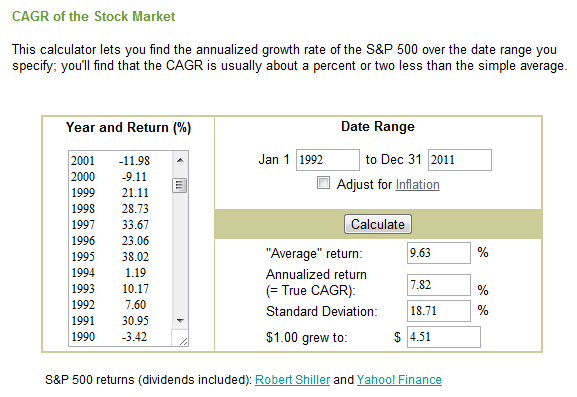

If you go over to moneychimp.com, they have a neat tool that lets you look at the numbers as they really are. You can play with different time frames, adjust for inflation, etc.

To give you a little shortcut, I’ve taken a few screenshots to show you the difference in actual return (cagr) vs. average annual return over the last 10, 15, and 20 years.

10-year averages

10-year averages

15-year averages

15-year averages

20-year averages

20-year averages

The fact is that most stock market investments are volatile and showing you the average return (arithmetic mean) makes them more attractive. Just look back at the pictures, they speak for themselves really.

What makes the average return so misleading is that there have actually been periods of time in the market where the “average return” is positive but the actual return on your money was negative.

Who cares what the average is?

That’s like talking about a company’s gross revenue…

If you own a share of XYZ corporation, the only number that matters is net profit. Who cares if the company’s earnings were $1.25 per share but the net profit to shareholders was a penny?

Here’s a great quote from “The Essays of Warren Buffett: Lessons for Corporate America“:

Over the years, Charlie and I have observed many accounting-based frauds of staggering size. Few of the perpetrators have been punished; many have not even been censured. It has been far safer to steal large sums with pen than small sums with a gun.

Take to heart what Buffet is saying in this quote, it applies here.

Of course also consider that I’ve not even factored in the effect that inflation has on the returns, which is another great feature of the moneychimp site—you can include the return numbers adjusted for inflation as well.

Obviously, inflation has an eroding effect on the returns in regard to both the actual and the average numbers. No big surprise there.

What’s really unfortunate about this whole situation, is that I think the majority of people who perpetuate this lie, have no idea they’re doing anything wrong! The calculations ignoring compound annual growth rates are so embedded that even advisors, CFPs, investment advisers, and other financial professionals spout off the numbers without questioning their validity.

I can’t say they are being deliberately dishonest but I can say that most are just ignorant of the facts.

And I’m not sure which is worse?

My advice is to do the math yourself and ask lots of questions. Only then can you be confident that you’ve made a wise decision.