Will my rates go up?

May of this year marked the highest rate of inflation in four decades. Consumers are feeling the pain at the pump, the grocery, and when shopping for virtually any good or service. But what impact does record-breaking inflation have on the cost of a property and casualty insurance policy?

To carefully determine an accurate price for policy coverage, insurance companies examine various factors to calculate the total dollars required to effectively hedge those insured against the risk of unexpected financial loss.

The examination of these factors provides a prediction of 1. Claims frequency—the number of claims within a given period, and 2. Claims Severity—the monetary loss associated with each insurance claim.

Historical fluctuations in Claims Frequency have been impacted by a myriad of shifts in cultural behavior. For a simple example, consider the impact of mass-market texting adoption on the frequency of car accidents (NHTSA reports show that 25% of all auto accidents in the US are caused by texting and driving).

There is, however, a shorter list of elements that ultimately affect the severity of a claim:

The cost to repair the covered property (materials + skilled labor)

The cost to replace it (availability of materials + skilled labor)

The market value of the insured property

When the cost to repair/replace covered property increases, more premium is required to maintain adequate provisions for loss.

Why is More Premium Required now?

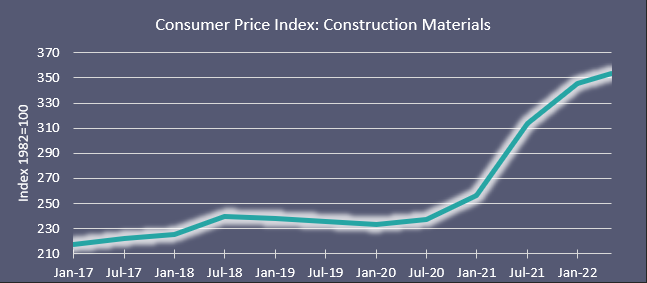

1. Policies Insuring Real Estate:

Due to supply-chain issues, the price of building materials, skilled labor, and home values have skyrocketed over the past year. When a claim is paid based on the cost to repair or rebuild, these rising costs directly increase the dollar amount of each claim payment. Read: How Blanket Insurance Premiums are Calculated.

Data Source: Federal Reserve Bank of St. Louis Economic Resources & Data

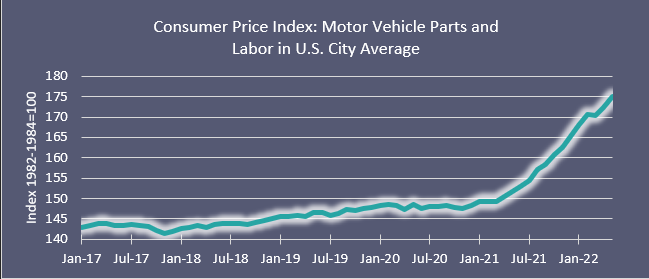

2. Policies Insuring Automobiles:

a.) Limited new car availability has driven up both new and used car prices. As the cost of cars rises, so does the amount of a claim paid on the amount required to replace a totaled vehicle

b.) Increase in cost of auto repair costs: new car scarcity has forced more people to drive older vehicles for longer, ultimately increasing the overall demand for automotive maintenance. The increased demand coupled with a shortage of mechanics has driven up the cost of automotive labor.

Data Source: Federal Reserve Bank of St. Louis Economic Resources & Data

The takeaway: If your collateral protection insurance agent communicates the need for a rate increase, take a moment to understand why rates are rising. Insurers are not trying to profit more by taking advantage of rising prices in unrelated markets. Most companies operate on margins as low as 2-3%. The remaining premium collected is allocated to support staff and to pay claims. The increased costs in the auto and housing industry mean more premium is now required to maintain the same level of coverage quality.

How can you keep costs low?

Interested in exploring our breakthrough approach? Let’s talk!