Next-Gen Digital Underwriting in a World of Increasing and Changing Risk

When we think of P&C insurance, we often associate it with protection against natural disasters, such as wildfires, hurricanes, or other catastrophic events. But in 2006, the Marsh Global Risks Report sounded the alarm on pandemics and other health-related risks. In 2020, the threat of a pandemic became real.

We are now seeing increasing environmental, societal, and technology risks that potentially intersect and significantly disrupt people’s lives and businesses. The Marsh Global Risks Report 2021 notes that for businesses, the economic, technological, and reputational pressures of the present moment risk a disorderly shakeout, threatening to create a large cohort of workers and companies that are left behind in the markets of the future.

Increased extreme weather events and natural disasters have an unprecedented and increasingly significant impact. According to the National Oceanic and Atmospheric Administration, the US experienced 20 separate unique billion-dollar weather and climate disasters in 2021, placing it second to 2020 in terms of the number of disasters, 20 versus 22, and third in total costs of $145 billion, behind 2017 and 2005. [1]

Increased risks are impacting insurance profitability. Earlier this year, AM Best indicated an increase in losses and expenses were responsible for the P&C sector’s $4.1 billion net underwriting loss in 2021 and a weakened combined ratio of 99.6%.[2] AM Best estimated that the 2021 catastrophe losses accounted for 7.7 points on the combined ratio.

Already in 2022, the Marshall Fire in Colorado is expected to reach $1 billion in losses, with nearly 1,000 homes destroyed and hundreds more requiring damage repair. Tornadoes in Kentucky and other locations devasted both homeowners and businesses. Rising construction costs, strained supply chains, and lack of construction workers are driving up the cost of rebuilding, putting many insureds at risk of not having enough insurance coverage and insurers at risk of not knowing their overall portfolio of risk.

Lack of enough coverage has grown over the last few years due to the rapid rise in home prices as people relocated or sought homes to support work-from-home options. In November 2021 it was reported the median price of existing single-family homes rose in 99% of the 183 markets tracked by the National Association of Realtors in the third quarter, with double-digit price increases of 15% – 30% on average or even higher.[3] With a competitive housing market, many properties don’t get inspected, leaving unidentified risks unknown to the insured and insurer. I know this personally as my daughter bought a home without an inspection and had many costly repairs that could have resulted in risk to the house. Fortunately, we found out and fixed them!

Unfortunately, that is not the case for everyone. With all these changes, many property owners are underinsured, posing a potential customer experience and reinsurance coverage challenge for insurers. With the cost of insurance increasing and profitability impacted, insurers need to look at their broader portfolio and find ways to assess potential losses, predict their impact, and initiate loss prevention strategies more accurately and precisely. And while there’s not much customers can do to avoid disasters, other risks and potential losses may be preventable, offering an opportunity for insurers to create more value and trust with customers.

How should insurers adapt to these increased risks? How can they better understand their overall risk within a portfolio? How can they better serve their customers? Through next-gen digital underwriting.

Underwriting Digital Transformation

As we all know, P&C underwriting is at the heart of the insurance business. And the key to underwriting transformation is the use of digital technologies.

Over the last decade, the underwriting discipline focused on automating the workflow to gain efficiencies. But now underwriting is making major moves to change the way it is done by leveraging access to more data sources to gain new risk analysis insights for the specific risk and the portfolio while creating significantly enhanced agent/broker and customer experiences.

Technically and operationally, this requires a combination of digital business solutions – including next-generation core, digital loss control, digital underwriting workbench, AI/ML models – and the ability to ingest a range of data sources from customers, including unstructured, video, geospatial, social, IoT devices, and more, to create real-time risk management and insights.

Unfortunately, large gaps exist between today’s operations, business capabilities, and technology required to compete and drive profitable growth in an increasingly complex risk world. Exploring the gaps requires an assessment of today’s reality and the opportunities for not just operational improvement, but strategic innovation that sets leaders apart from others in the market.

Risk Management Strategies and Solutions – Focus on Preventable Losses

The old adage of “control what you can control” is now front and center for insurers as they look at new risk management strategies as a crucial component of their next-gen underwriting and customer experience strategy. Industry leaders increasingly focus their time and resources on better assessing risk and preventing losses, the impact on the portfolio, and how it influences the risk appetite, which together impact underwriting profitability and customer experiences.

Insurance has always been a data-driven business, but access to new data sources with AI/ML is redefining the industry. Likewise, a shift from paying the claim to minimizing or avoiding the claim is top of mind for insureds and insurers. Today’s increased catastrophes, market environment, and pressure on profitability demand a greater focus on preventable losses and better outcomes through underwriting profitability, proactive risk mitigation to minimize or eliminate claims, and enhanced customer experiences.

In order to achieve these outcomes, intelligent digital underwriting, digital loss control, and AI/ML solutions are rising in investment priority for insurers, as reflected in Majesco’s 2022 Strategic Priorities research. Between 25-30% of insurers have implemented, or are implementing, digital underwriting workbench, digital loss control, and AI/ML, and nearly 50% of insurers are considering or planning on them – reflecting a significant increase in digital risk management strategies and solutions (Figure 1).

Figure 1: Insurers’ digital underwriting priorities

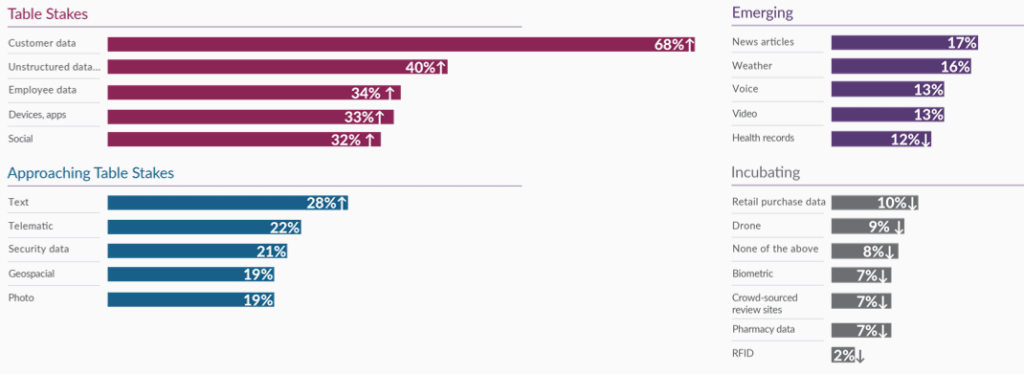

To support digital underwriting, insurers are focused on leveraging new sources of data. In our Strategic Priorities 2022 research, we found data sources could be categorized into table stakes, approaching table stakes, emerging, and incubating, based on usage levels. The results show expansion from customer data to unstructured data, such as loss runs and loss control reports, to new digital data sources from devices, video, photos, text, telematic, geospatial and more, as reflected in Figure 2 below.

Figure 2: Data sources stages of adoption

Risk management, underwriting, and loss control all involve gathering and using data needed for AI/ML models to accurately assess, identify, manage, and reduce risks by providing differentiated customer service. An increased focus on loss control has increased the volume, variety, and velocity of structured and unstructured data sources. Loss control has moved from surveys completed by adjusters with questions, checklists, and photos, to leveraging real-time data from smart devices, video, images of labels, and more through customer self-surveys and video-guided surveys. Insurers can use the richer data captured with advanced AI/ML for improved risk assessment, appetite analysis, underwriting, and pricing.

Even more important, by identifying hazards and providing recommendations from the data collected, insurers can create more value and trust with the customer by proactively addressing issues and providing recommendations to help them reduce or eliminate risk, creating a new, compelling customer experience.

For decades, the creation and evolution of insurance markets and products unfolded at a slow and steady pace. But today’s increasing risk environment coupled with an outdated underwriting business model and technology approach are unresponsive to market shifts or opportunities, particularly given the disruption and need for innovation.

Should you only assess high-value properties? Only with actual adjusters on site? What if you could do your whole portfolio digitally through self-survey or video? Imagine what a better risk assessment you would have for your portfolio and for negotiating your reinsurance! And what if you used the risk assessment to offer access to new services to your customers, creating a new engagement and potential revenue opportunity that can drive trust and loyalty, enhancing customer retention?

Anyone would agree that innovation and disruption are related topics. Innovation deals with creating an entirely new approach that adds value to something. Disruption deals with accepting the reality that something new will change our current approach.

Your competition is adapting to a new world of risk. They are adopting next-gen digital underwriting business models and digital technologies. Are you?

Your customers demand and expect it.

[1] Smith, Adam, “2021 U.S. billion-dollar weather and climate disasters in historical context,” NOAA Climate.gov, January 24, 2022, https://www.climate.gov/news-features/blogs/beyond-data/2021-us-billion-dollar-weather-and-climate-disasters-historical

[2] Baker, Katie, “US P&C industry records $4.1bn net underwriting loss in 2021: AM Best,” Reinsurance News, March 25, 2022, https://www.reinsurancene.ws/us-pc-industry-records-4-1bn-net-underwriting-loss-in-2021-am-best/

[3] Bahney, Anna, “78% of US markets hit with double-digit home price increases,” CNN Business, November 10, 2021 https://edition.cnn.com/2021/11/10/homes/home-prices-increase-third-quarter-feseries/index.html