Is UK Health Insurance More Affordable Than You Think? For Working Professionals

The NHS backlog

Firstly, there is no doubt that we all love the NHS and those working in it. However, it’s not a secret that the NHS struggles under enormous weight, and people are suffering on increasingly long waiting lists.

An April 2022 report from the British Medical Association laid bare the NHS’s challenges.

“More patients than ever are waiting for treatment”

Source: British Medical Association

And it’s not just non-urgent and elective surgeries – critical services like cancer care are struggling too.

“Cancer targets continue to be missed”

Source: British Medical Association

Here are some other key findings from the BMA report:

In February 2022, the average patient spent 13.1 weeks waiting for treatment.The number of GP referrals to consultant-led outpatient services that have been unsuccessful because there are no slots available has jumped from 238,859 in February 2020 to a staggering 401,115 in November 2021 (an 87% increase).The total number of patients waiting over 18 weeks for treatment now exceeds 2 million, while the number of patients waiting over one year for treatment stands at almost 300,000.The shutdown of most non-COVID-19 services in the first wave, combined with changes in patient behaviour, has created a growing ‘hidden backlog’. These are patients that require care but have either not yet presented or who have had referrals cancelled.

Can you afford to wait 13 weeks or more for treatment?

For most of us, the simple answer is no; 13 weeks, 18 weeks or even, in the worst cases, over a year is unthinkable for many who rely on their health for their livelihoods and wouldn’t be able to cover the cost of living without working. We all like to think we’re untouchable, but the unfortunate truth is that illnesses or accidents can affect even the healthiest. Fortunately, private health insurance is relatively affordable, especially for young working professionals.

What is private health insurance, and how can it help?

Health insurance gives you access to private healthcare services in the UK in return for a monthly premium. You can receive faster treatment and avoid NHS waiting lists along with many other benefits.

What are the benefits of health insurance?

There are numerous benefits of health insurance; here are the primary ones you can expect from your policy:

Avoid NHS waiting lists and be treated soonerTreatment at high-quality private hospitalsAccess to drugs and treatments not routinely available on the NHSExcellent cancer cover with access to breakthrough treatmentsPrivate GP servicesFast access to mental health services (if added to policy)Exclusive discounts, including gym membership

What does health insurance cover?

All health insurance is designed to cover acute medical conditions that occur after you’ve taken out a policy. Here is what a policy will typically cover:

Treatment in private hospitalsPrivate consultationsAccess to a private GPsPhysiotherapy for muscle, bone or joint conditionsOutpatient care such as scans, tests, x-rays and hospital appointments where you aren’t admitted (with outpatient cover)

What’s not covered by private health insurance?

Chronic conditions, such as asthma and diabetes, aren’t covered by health insurance, although if you have a comprehensive policy, the initial diagnosis of the condition may be. Also, importantly, pre-existing medical conditions aren’t covered, health insurance only covers issues you have in the future. You should always consult your insurer’s policy documentation to find out what is and isn’t covered, but generally speaking, you can also expect the following to be excluded:

Cosmetic proceduresTreatment for drug or alcohol dependencyPre-existing conditions

“I recently got a family health insurance policy through myTribe and the service was excellent from start to finish. The adviser that I spoke to was very patient and took time to explain all of the intricacies to me so that I felt confident and informed when making a decision. The fact that they compare the market for you makes the process really quick and easy and I think I came away with not only the best policy for me but a much better understanding of how private health insurance works.”

“I recently got a family health insurance policy through myTribe and the service was excellent from start to finish. The adviser that I spoke to was very patient and took time to explain all of the intricacies to me so that I felt confident and informed when making a decision. The fact that they compare the market for you makes the process really quick and easy and I think I came away with not only the best policy for me but a much better understanding of how private health insurance works.”

by Chris Stratton – 12th May 2022

Compare Policies

The difference between basic and comprehensive policies

The cheapest and most basic policies will only cover treatments where an overnight stay in hospital is required (inpatient). With a basic policy, you will need to be diagnosed via the NHS before claiming private treatment under your health insurance. In contrast, more comprehensive policies will also cover tests and scans leading to a diagnosis and other outpatient treatments.

Basic health insurance = inpatient and day-patient treatment only

Comprehensive health insurance = inpatient, day-patient and outpatient treatment

With both of these types of health insurance, you can then opt to add several additional options, such as:

Physiotherapy, visits to the chiropractor and other alternative therapiesRoutine dental and optical visitsTravel coverMental health cover

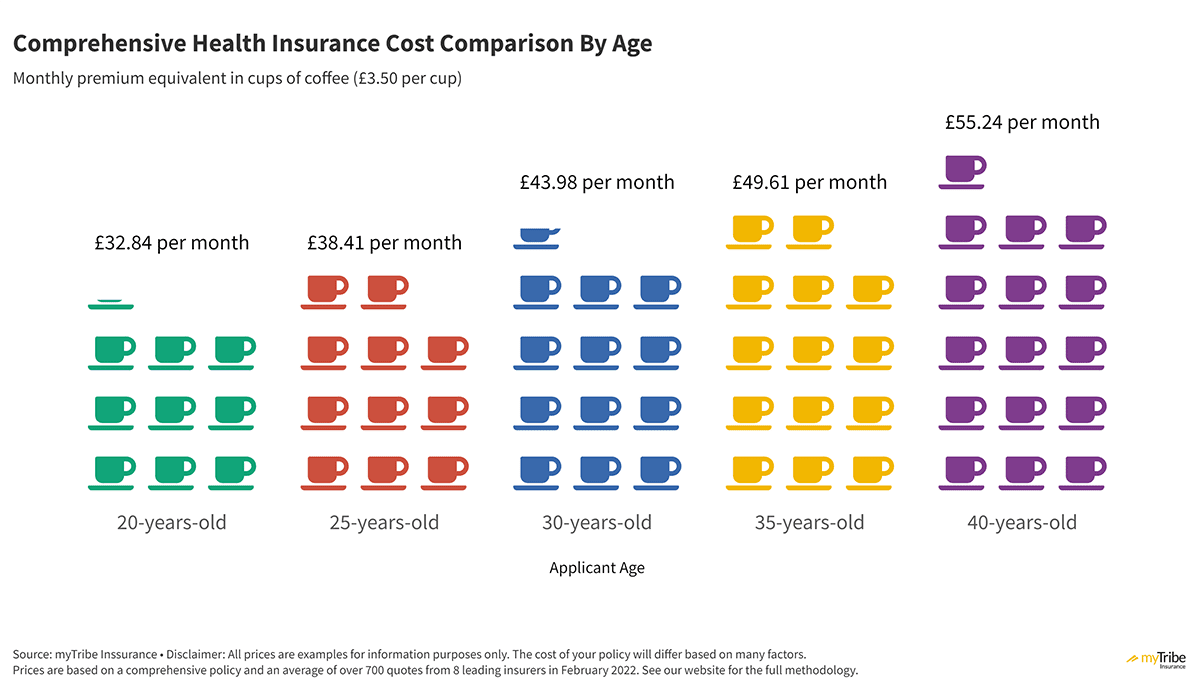

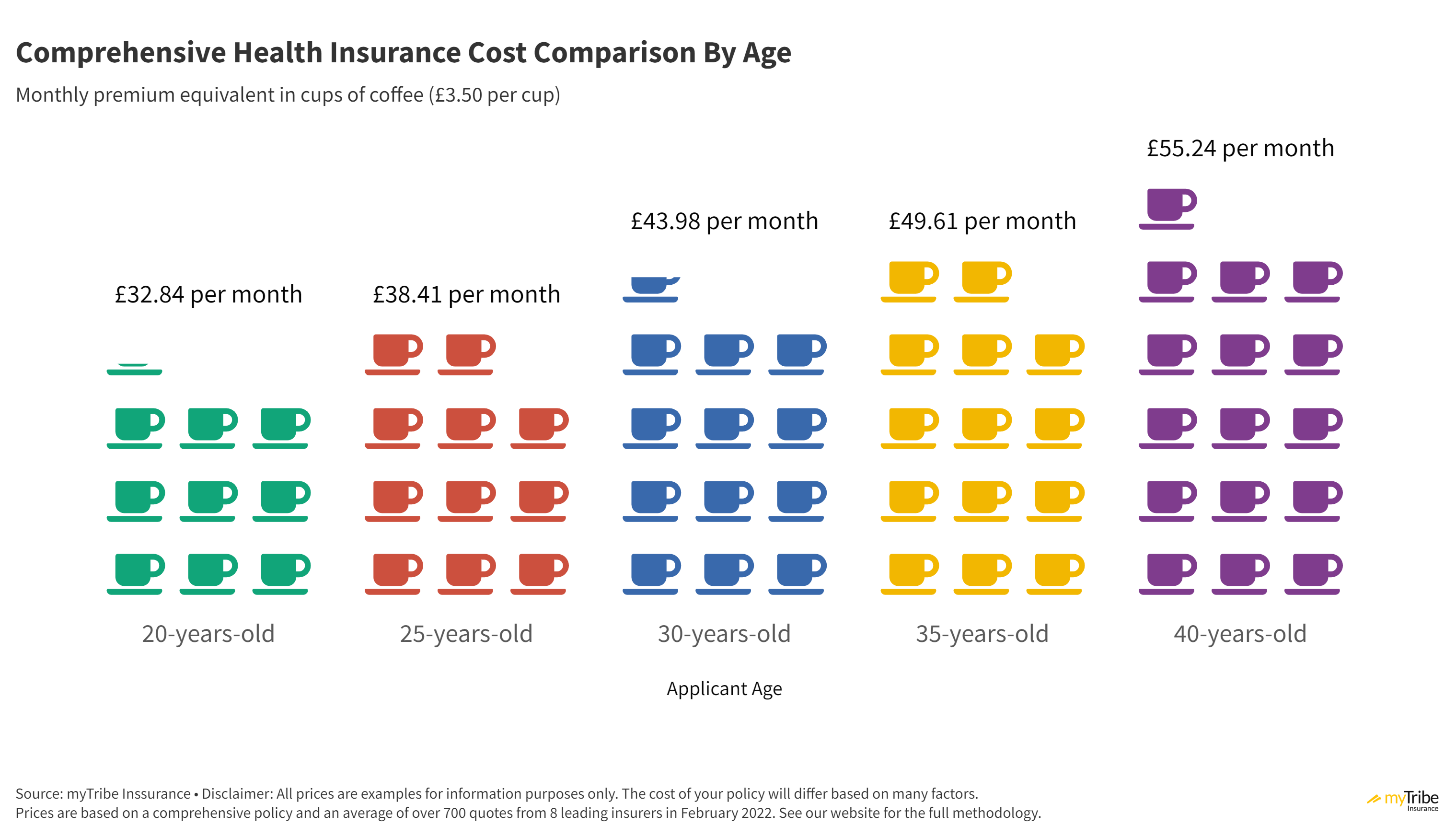

How much does health insurance cost for young professionals?

Health insurance costs increase as we age, regardless of our medical history, as older people typically have more health complaints than younger. Where you live in the country also has a significant impact on the cost of your policy, as hospitals in major cities typically charge more for treatment than those elsewhere in the country.

We recently got pricing from the eight leading health insurance companies for comprehensive policies in towns and cities all around the UK.

Average cost of comprehensive health insurance

To make our pricing as representative as possible, we opted for a comprehensive policy that covers inpatient, day-patient, and outpatient treatments. However, we limited the outpatient cover to £1,500 per year. The quotes we received were based on a policy with an excess of £250 (or as close as possible), and we included therapies cover, so things like physiotherapy. We also opted for “guided consultants”, which means the insurers will limit you to a smaller pool of medical professionals; this is typically 20% cheaper than unrestricted access. Finally, we opted to exclude mental health, dental, optical and travel cover.

Cost of private health insurance in the UK in equivalent cups of coffee (Feb22*)

Cost of private health insurance in the UK in equivalent cups of coffee (Feb22*)

*Average based on quotes from eight leading health insurers in 10 UK cities. We opted for a comprehensive policy, with a £250 excess (or as close as possible), outpatient cover limited to a maximum of £1,500 in claims per year, and we included therapies cover. We defaulted to each provider’s standard hospital list and used moratorium underwriting. Mental health cover, dental, optical and travel cover were all excluded. Prices accurate as of 16th February 2022. Please note these prices are purely illustrative; the cost of your policy will be different. Aviva, Axa, Bupa and Vitality offer discounts if you opt for “guided consultants”, which gives you less choice over who provides your treatment. Not all insurers offer this.

Who are the best providers of private health insurance in the UK?

The following eight companies are the UK’s best private health insurance providers (in alphabetical order). Please note that the best provider for you will likely be different from the next person, so it’s always sensible to get a comparison quote to find the right one.

Aviva – Healthier SolutionsAxa Health – Personal HealthBupa – Bupa By YouFreedom – Elite Health InsuranceNational Friendly – OptimumThe Exeter – Health+Vitality – Personal HealthcareWPA – Flexible Health: Premier and Elite