Near-record cat bond spreads opportunity may persist to Q3/4: Leadenhall

An opportunity for investors to enter or upsize allocations to the catastrophe bond asset class at a time of near-record high spreads could persist right through into the third and fourth quarter of the year, according to Leadenhall Capital Partners.

London headquartered specialist insurance linked securities (ILS) and reinsurance related investments manager Leadenhall Capital Partners LLP has provided an update on the state of the catastrophe bond market and focused on the opportunity for investors.

As we’ve been explaining, catastrophe bond spreads have widened considerably on mismatches in the market, as well as broader reinsurance conditions and investors demand for improved returns following a number of years of losses across some insurance-linked securities (ILS) investments.

The supply-demand mismatch in the cat bond market is persisting and perhaps being accentuated because of the robust pipeline of issuance, which is now resulting in some sponsors finding they cannot get the protection they want, at the price they desired it.

But this situation presents an opportunity as well, with spreads widened and the cat bond market therefore implying higher yields are available to fresh investor capital deployed into the space.

“The Catastrophe Bond market has hardened in 2022,” Leadenhall Capital Partners explained.

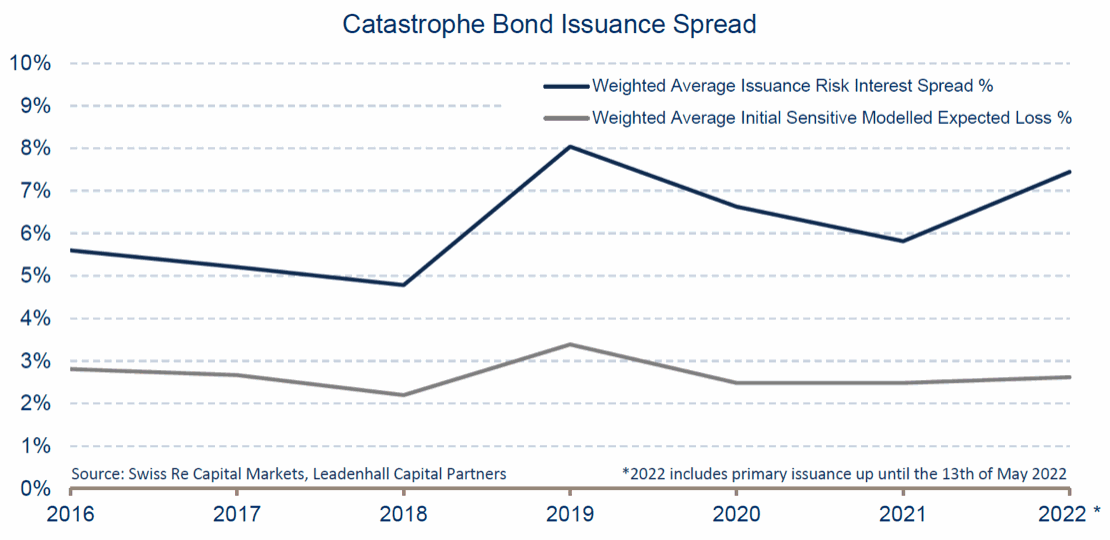

The specialist ILS manager continued, “Margins are the highest in recent years, with average issuance spreads up +25% from the prior year (approaching the 6-year high) and with modelled risk levels remaining relatively constant.”

The spread between weighted average risk interest or coupon and expected loss has been rising steadily, which on the basis Leadenhall has analysed it now shows it near a six year high.

Our own, less scientific analysis on issuance spreads, which is not weighted and takes base expected loss at issuance, currently shows spreads at the highest level seen since 2013.

Issuance of new catastrophe bonds remains strong, Leadenhall explained, with the range of insurance and reinsurance sponsors of cat bonds continuing to expand.

All of which makes for an attractive investment opportunity, which is now evident across the marketplace, Leadenhall said.

“Prospects for investors have improved due to a local imbalance between supply and demand. Both spreads at issuance and spreads in the secondary market have increased for every peril, opening a window to deploy capital at higher yields,” the investment manager explained.

“Looking ahead, the window of opportunity is expected to last until Q3/Q4, as there is broad market consensus for additional strong issuance activity,” Leadenhall continued.

Also explaining that, “Further hardening in the traditional reinsurance market is expected as we approach the 1st of June and 1st of July renewals.”

Some analysts of the market have been expecting the elevated cat bond spreads will become less apparent once issuance slows for the summer, but that may not dampen the size of this opportunity for investors, Leadenhall believes, with attractive cat bond investment conditions to remain available.

We discussed many of these trends in our recent interview with Leadenhall Capital Partners CEO Luca Albertini.