Meet the insurtech: Onuu

It’s pronounced “on-you.”

Onuu, a startup banking, credit and life insurance platform founded in September, is preparing to launch this summer with a mission to serve 166 million Americans of modest means who may be excluded from traditional insurance and financial services.

Asked why “on you,” co-founder and CEO Felix Ortiz says the name stands for the idea that “We’re basically betting on you. We’re wanting to grow you.”

Felix Ortiz, co-founder and CEO of Onuu

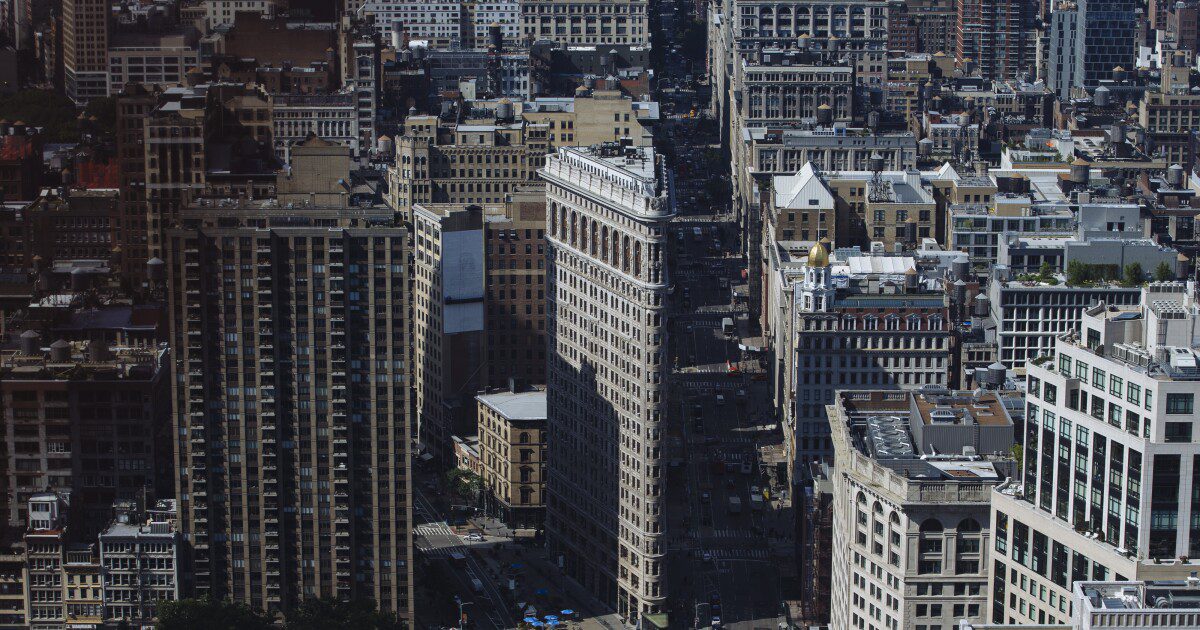

Ortiz grew up in Sunset Park, Brooklyn, N.Y. living with eight family members together in one apartment. “I experienced firsthand how frustrated my grandma Candi would get, not having access to products,” he says. “We would go to the local bank and the products she had access to weren’t the ideal products. Also, there was a lack of insurance.”

He served in the U.S. military and came into contact with USAA, the insurer that specializes in covering military members, veterans and their families. Ortiz also had experience working for an HMO in the healthcare industry. “I wanted to create something that truly democratizes access to insurance and financial products for the demographic segmentation that needs it the most, but that has often been overlooked because they either have a thin credit file or they live in a zip code that due to actuary data, they are a higher risk.”

Onuu is currently inviting potential customers to join its waitlist for life insurance that will start at $12 per month, a credit card with a line up to $3,000, a savings account and financial planning resources. Ortiz himself recalls being frustrated with “seeing the community that I grew up in being taken advantage of by these payday lenders, these predatory companies, and knowing that at the end of the day that it’s all the same products just packaged a different way.”

The first step to make insurance easier to get is reducing the requirements and bureaucracy, Ortiz points out. Onuu takes away weeks-long delays for underwriting and extensive medical exams and blood work, digitally accessing existing prescription records, with the insured’s consent, to help determine what coverage will be provided. Life policies will be issued by AAA Life Insurance Company.

Cheryl Neal, chief insurance and financial services officer, Onuu

“There will be instant decisioning for those who pass [the prescription review],” says Cheryl Neal, chief insurance and financial services officer of Onuu. “They get an offer of bona fide life insurance. Others, without any interruption of process, will get an AD&D policy. So everyone is guaranteed a life insurance offer. That’s a little bit different than what the other players are focused on. They’re focused on the higher-income population.”

AAA Life Insurance’s average customer income ranges between $75,000 to $90,000, according to Ortiz. Onuu will open up a different customer base for AAA. “What makes AAA a great partner is their ability to push the boundaries and think outside the box, and not look at things in a legacy way, but in an innovative forward-looking way,” he says.