5 Simple Tips for an Awesome Family Road Trip

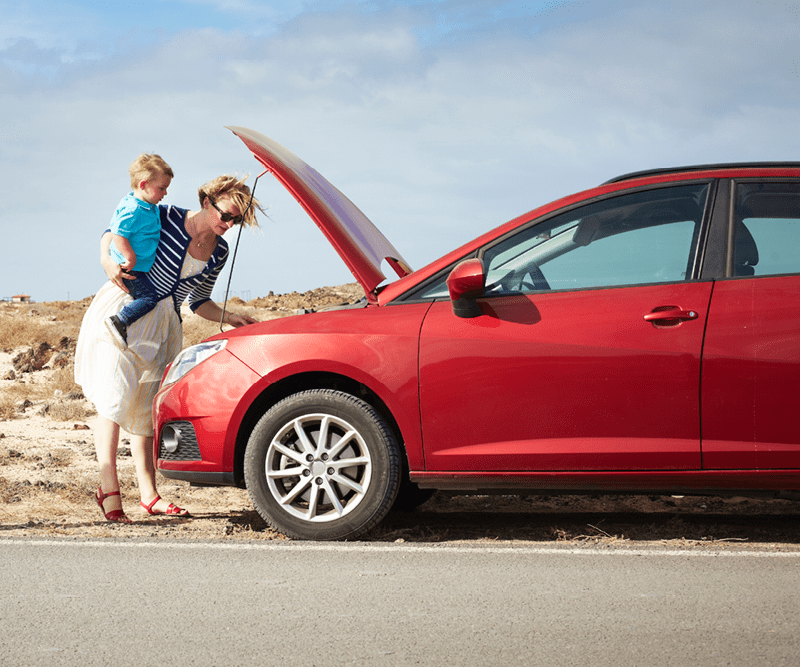

1. Take your vehicle in for maintenance

Oil changes, tire rotations and brake pad replacements are all great ideas before your big trip. Tell the mechanic about your road trip plans and approximately how many miles you plan to travel in your vehicle. They may be able to spot potential issues before you leave to avoid a problem on the road.

2. Review your auto insurance policy

It’s a good idea to review what your auto insurance covers before you hit the road. Things like road trouble service and rental car coverage may be important to know if they are included on your policy.

You may want to consider our Personal Automobile Plus endorsement which includes coverage if your car breaks down more than 100 miles from your home for things like overnight accommodations and meals. Even if you’re not over 100 miles away from home, it may also pay toward the cost of getting you to your destination by other means, whether that be a rental car, or public transportation. It’s also a good idea to save your Bolder Insurance agency phone number in your phone along with any applicable after-hours claim numbers.

3. Check the weather at home and your destination

In the days before your trip, you’ll probably watch the weather forecast for your destination and route. However, it’s also a good idea to check the upcoming weather for your home.

The last thing you want is to come home and find that a tree has fallen on your house, or that your basement has flooded. See what the forecast says and ask a neighbor to check on your house once a day, especially if there’s bad weather. Be sure you leave them a reliable contact number.

4. Renting a vehicle? Make sure it’s covered

If you decide to rent a vehicle for your road trip, contact your local insurance agent to learn about rental car coverages. Most rental companies will ask if you want to purchase insurance for your rental car. But, you may not need it. Your independent agent can check your existing auto policy for any coverages that may apply and can discuss coverages you may be able to add. One coverage to ask about is rental gap coverage.

Unless you’ve read the fine print on the rental contract you probably haven’t heard of this coverage. Your local insurance agent will know and can help you feel confident signing your rental agreement.

Rental Gap Coverage: Let’s say you crash your rental car and it’s worth $20,000, but the rental company decides to sell it for $10,000 instead of fixing it. Without rental gap coverage, you are responsible for the difference.

5. Arrange roadside help before you go

Roadside trouble service can be a vacation saver and you don’t have to be a member of an auto association to get it.At Bolder Insurance , we offer Emergency Road Service coverage that can easily be added to your auto policy. This service includes a 24-hour hotline if you need a tow, or if you have an emergency with your car battery, oil or gas. Our Road Trouble Service coverage extends across the country, and in most situations, you won’t have to pay for services out of pocket.

Taking steps to prepare for your road trip may be work now but will help you have a more relaxed and enjoyable vacation. Talk to your local independent Bolder Insurance Advisor to ensure your vehicle is covered for your adventures ahead.

Disclaimer: The analysis of coverage is in general terms and is superseded in all respects by the Insuring Agreements, Endorsements, Exclusions, Terms and Conditions of the Policy. Some of the coverage mentioned in this material may not be applicable in all states or may have to be modified to conform to applicable state law. Some coverages may have been eliminated or modified since the publishing of this material. Please check with your local Independent Bolder Insurance advisor for details.

Article provided by Auto-Owners Insurance, a Bolder Insurance partner.