Cancer Insurance In The UK > Find Out About Cancer Cover

What is cancer insurance?

Cancer insurance enables you to receive private treatment when you’ve been diagnosed with cancer. Whilst you might receive your diagnosis via the NHS after being referred by your GP, private medical insurance enables you to access private treatment after that. Most insurance companies offer health insurance cover for cancer treatment as a key part of their policies, although the way that cancer cover is offered can vary.

Some insurers include it as part of their core cover on comprehensive policies, while others only include it as an optional extra. The general idea is that you can opt for comprehensive insurance or tailor your cover to the things most important to you. Some policies will cover all of your private medical costs, whilst others offer an NHS cash benefit if you receive treatment via the NHS.

It’s important to check exactly what your policy covers. Your cover will typically include cancer-related treatment but may not include getting a cancer diagnosis. Most health insurance policies include inpatient and day-patient care as standard but only offer outpatient care as an optional extra. If you opt for outpatient care as well, you’ll be able to get your diagnosis privately too.

Full cancer cover can also provide treatment if your cancer spreads or you develop secondary cancers. Some cancer insurance plans will also offer pain relief and palliative treatment along with end of life care at home.

Benefits of private cancer cover

Cancer insurance can cover a whole range of treatments and other support. Depending on the insurance company and health insurance policy you choose, these could include:

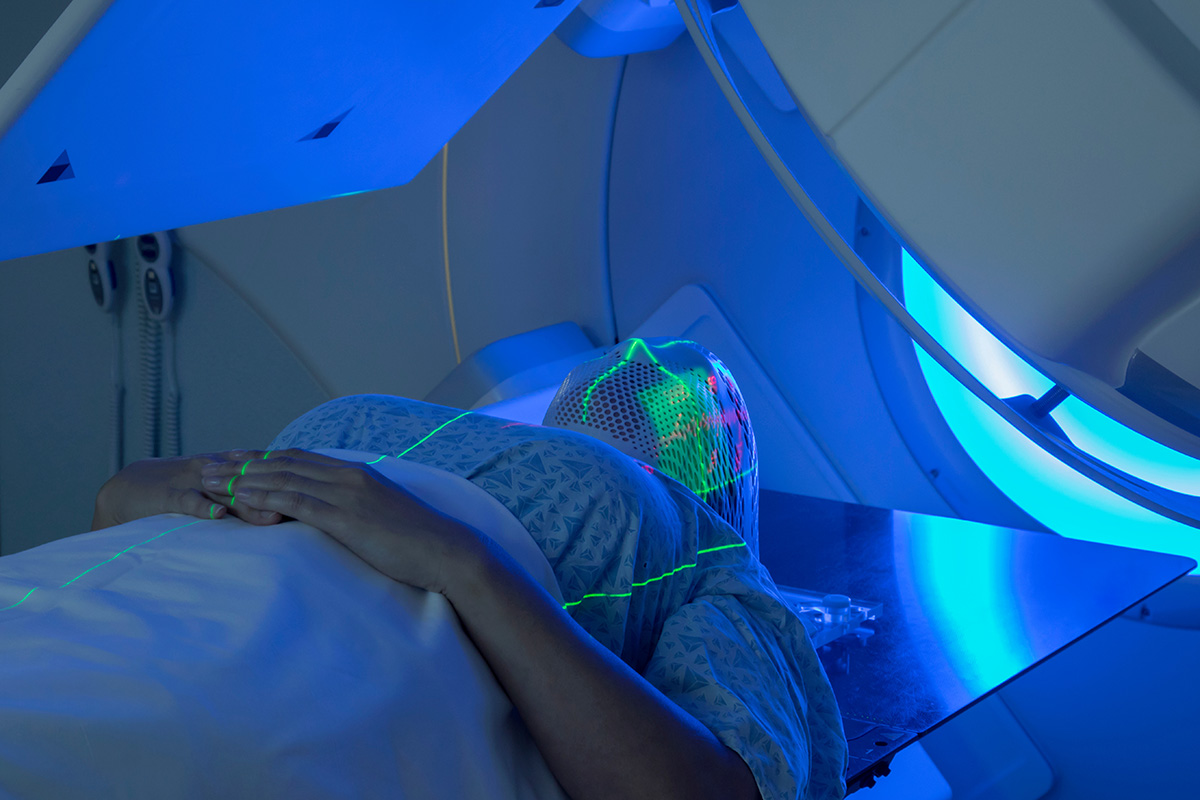

RadiotherapyChemotherapyCancer surgery, including reconstructive surgery,Access to new cancer drugs and treatments not available on the NHS.Investigations and diagnosis (if you add outpatient treatment)Biological, hormone and bisphosphonate therapiesStem cell therapyFollow up consultationsScalp cooling to help prevent hair loss.Wigs and prosthesesMastectomy bras for breast cancer patientsConsultations with a dietician or stoma nurseMental health supportGenetic testing for patients with a family history of cancerEnd of life nursing care at home

Some providers will also cover targeted screening for cancer cells, preventative treatment and therapies to combat the side effects of radiotherapy or chemotherapy treatment. If you choose to receive your end of life care in a hospice, some cancer insurance will donate to your desired setting.

One of the most significant benefits of cancer insurance is that it allows you to be diagnosed with cancer more quickly (if you’ve chosen outpatient cover) and speeds up your access to treatment. The sooner you’re able to access treatment, the better. You have a much better chance of fully recovering if your cancer is diagnosed early. Research has also shown that delayed treatment can significantly hamper your recovery prospects.

“I requested a policy review having been with Bupa for over 10 years and was astonished by the savings I’ve made on mine and my husband’s policy. If you’re thinking about reviewing your policy do it, you won’t be disappointed. “

“I requested a policy review having been with Bupa for over 10 years and was astonished by the savings I’ve made on mine and my husband’s policy. If you’re thinking about reviewing your policy do it, you won’t be disappointed. “

by Erica – 27th April 2022

Compare Policies

What’s typically covered by a cancer insurance policy?

Cancer insurance will usually cover you for treatment as an inpatient or day patient. This means that your health insurance will pay out if you need to be admitted to a private hospital, such as for surgery. It’ll also cover cancer treatment received in a day unit at the hospital or treatment centre. Most cancer insurance covers a specified list of treatments, however, it’s worth checking whether there are any exclusions based on the type of cover you have. Whilst chemotherapy is typically delivered in a hospital or day unit; radiotherapy is often provided on an outpatient basis.

Whilst your treatment will be covered, subject to your policy limits, your initial diagnosis often won’t be. Thankfully, there is a way to add a private diagnosis to your policy.

Receive your cancer diagnosis privately with outpatient cover

If you want to ensure that you can get a cancer diagnosis via your health insurance, you’ll need to add outpatient cover to your policy. This isn’t typically included in health insurance policies as a core benefit and needs to be chosen as an optional extra. Without it, you’ll need to start the process via the NHS by consulting with your GP and being referred to a consultant to be diagnosed with cancer. At that point, you can contact your insurance company to let them know you’ve been diagnosed with cancer and to arrange for your treatment to begin.

When you add outpatient cover to your policy, you’ll be able to have your diagnostic tests, scans and initial consultant appointments privately as well.

What is typically excluded from a cancer insurance policy?

Health insurance companies won’t cover you for pre-existing conditions. These are defined as any illnesses that you have when you take out the policy or have had in the five years before that. That means that if you take out health insurance when you’ve just been diagnosed with cancer, you won’t be covered for the treatment. This will also apply if you’ve had any cancer treatment or advice in the past five years, as it will be classed as pre-existing cancer. Some insurers go beyond the five-year exclusion and apply a ten-year exclusion period so it’s worth checking the small print.

Even if you aren’t able to access private medical care some insurers will still offer you an NHS cash benefit for cancer treatment. This means that you’ll receive a cash payment for treatment or if you spend a night as an inpatient in an NHS hospital.

This doesn’t mean that you won’t be able to get cancer cover included in your health insurance in the future. If you opt for moratorium underwriting pre-existing conditions are excluded for the first two years of your health insurance policy, but cover can be added if you don’t need any treatment or advice during that time. Alternatively, you can choose full medical underwriting where you complete a questionnaire giving details of your medical history at the start of your policy. Pre-existing conditions will still be excluded but it gives you more clarity on what is and isn’t covered.

Excluded treatments

Cancer insurance often includes access to drugs and treatments that aren’t routinely available on the NHS. However, there are limits to this. Many insurers exclude experimental treatments or those that aren’t currently licensed for use in the UK.

Some drugs and treatments are offered once you’re in remission to help you stay that way. These aren’t usually covered, mainly because your GP will typically have taken over your care and monitoring by this point.

Types of cancer

Cancer insurance will cover most types of cancer, however, there are a couple of exceptions. Treatment for non-melanoma skin cancer is excluded by some insurers unless it has spread to your lymph nodes or other organs. This is generally because non-melanoma skin cancer is considered to be non-invasive and won’t have a major impact on your life. However, if there is evidence that the cancer cells have spread to other areas, this would be covered as urgent treatment is more likely to be needed.

Prostate cancer is also sometimes excluded unless an NHS specialist has recommended active treatment. This will typically only be recommended where a ‘watch and wait approach isn’t appropriate.

Cancer treatment options

When you’re diagnosed with cancer, your treatment providers will make a plan for your treatment. Private cancer treatment offers you a range of options, some of which may not be routinely available on the NHS. You’ll also have access to specialist support if you need it.

Cancer cover allows you to bypass NHS waiting lists and start treatment more quickly, which gives you a better chance of making a full recovery. Depending upon the type of cover you choose, you may be able to get your cancer diagnosis more quickly too. Here are some of the treatments and support that your insurance policy could cover.

Cancer screening

The NHS will invite you for cancer screening, based on your age and sex, as part of its routine screening programmes. Cancer insurance allows you to go one step further. Many policies offer genetic testing if there’s a history of cancer in your family. This may allow you to take preventative measures if you’re at high risk of certain types of cancer. Some policies also provide cover for follow up monitoring and screening after you’ve had cancer treatment.

Access to breakthrough drugs and treatments

The NHS has a limited budget and has to use it wisely. This often means that breakthrough treatments aren’t immediately available on the NHS but will be offered if you receive private treatment. These might include new drugs or treatments such as stem cell therapy.

Whilst insurers will typically exclude experimental drugs and treatments, some will look at drugs that haven’t been licensed for use in the UK yet. They’ll consider whether they meet their criteria and will be of benefit in your specific circumstances.

Counselling

A cancer diagnosis and treatment can take its toll on your mental health and that of your family. It’s not unusual to experience depression or anxiety as a result of being diagnosed with cancer. Several insurers offer access to mental health support whilst you’re having treatment. This could include a telephone helpline or one to one counselling.

Private room in hospital

If you need to be admitted to a hospital for treatment, there are a few different options depending on your insurers’ hospital list. Some companies offer access to a network of private hospitals whilst others allow you to choose to be treated in an NHS hospital if that suits your needs best. Your health insurance allows you to opt for a private room in an NHS hospital so that you can rest and recover quietly, away from the main ward.

Specialist centres

Some insurers have specialist centres, with Bupa’s specialist breast cancer treatment centres being a notable example. These centres are dedicated to treating one type of cancer, so you’ll be looked after by consultants and specialists nurses who work with cancer patients on a day to day basis, and who have high-level knowledge, vast experience and access to the latest therapies and treatments.

Specialist health information

In addition to mental health support, private health insurance can also give you access to specialist cancer care advice and information. This usually includes access to telephone support from a specialist nurse who can answer questions about your treatment. They can also offer advice about any other symptoms that you might develop during your treatment. Cancer drugs can have debilitating side effects, and services like these can reassure you about what’s normal and offer guidance on ways to relieve your symptoms.

Best providers of cancer insurance in the UK

No matter which health insurance you choose, you’ll be able to include extensive cancer cover. Some include cancer insurance as part of their core cover whilst others offer it as an optional extra. Here’s our quick summary of the top 8 health insurance companies in the UK and the cancer insurance they offer.

1. Vitality

Vitality Health Insurance includes cancer insurance in its core cover and promises to pay all of your fees if you’re admitted to a hospital, although you’ll need to add on outpatient cover if you want them to cover your diagnosis.

2. The Exeter

The Exeter Health+ policy includes cancer cover as standard, with diagnostic services being offered as an optional extra via its outpatient cover.

3. Bupa

Bupa By You, uniquely, allows you to get a consultant referral for a diagnosis without needing to see your GP first. Treatment is included in their core cover.

4. Freedom

Freedom Elite includes inpatient cancer cover as standard and you can choose to add outpatient care to your policy.

5. WPA

WPA offers two different levels of policy. With Flexible health premier, you can choose cancer care and outpatient cover as optional extras, while their Elite policy includes both cancer cover and outpatient cover as standard.

Speak to a broker about your requirements

Finding the right cancer cover for you can be tricky. You might not have been diagnosed with cancer but have a family history of the condition, so you want to get cover in place so you can access private treatment in the future. You might also be unsure of the type of treatment you’ll need if you’re faced with a life-changing diagnosis. If you’ve had cancer in the past, you may be faced with exclusions or higher premiums depending on how long it’s been since you were last treated.

Different insurance companies offer different types and levels of cancer cover. Some include it as standard whilst others allow you to add it to your policy if you want to. You might find several policies that cover everything you’re looking for, but find that they’re beyond your budget when you get in touch. A health insurance broker has access to detailed information about each policy and can guide you based on your individual needs and budget. That could save you money as well as a lot of time making phone calls.

At myTribe, we offer straightforward information and guides that are designed to help you to find the right cancer cover for your needs. We’ll provide you with a comparison quote and connect you with highly rated brokers authorised and regulated by the Financial Conduct Authority so that you can access high-quality independent advice.

Cancer insurance FAQs

Does health insurance cover cancer treatment?

Yes. Most health insurance policies include full cancer cover, whether it’s as part of their core health insurance or as an optional extra. Cancer cover is one of the most important benefits of health insurance plans so all health insurance companies offer it somewhere within their policies. Whilst some will cover your medical costs for eligible treatment, others will pay you a cash benefit if you’re treated by the NHS. Some will even offer this if cancer cover is excluded because you’ve had cancer before.

Can you get health insurance if you have cancer?

If you’ve recently been diagnosed with cancer, you will be able to get health insurance, but it won’t cover your treatment as your cancer will be classed as a pre-existing condition. All health insurers exclude any condition you have when you take out the policy or that you’ve been treated for in the past five years. Some insurers exclude cancer for a longer period, of up to ten years. You’ll be able to get health insurance that covers you for other conditions and treatments, so it’s still worth having.

What does a cancer policy cover?

Cancer insurance covers your treatment and can provide other support including mental health support. Treatments can include radiotherapy, chemotherapy, surgery and other therapies depending on your insurer. You may also be able to access treatments that aren’t available on the NHS. Your health insurance policy may also cover genetic testing and end of life care at home or in a hospice. You can also opt to add outpatient cover to your policy, which will cover private tests, scans and consultations to enable you to be diagnosed more quickly.