Individual Life Carriers Working On Digital CX Need to Improve Post-Issue Service

Annual Aite-Novarica Group report provides an overview of individual life carrier business and technology issues, and examples of recent insurer technology investments

Boston, MA (Apr. 14, 2022) – Individual life carriers are waking up to the importance of customer experience from the perspectives of the policyholder and the producer. As individual life carriers improve the agent and customer experience to meet their evolving expectations, transformation initiatives demand leaders and change agents who understand the customer, various distribution channels, and the end-to-end policy life cycle, while finding ways to marry new and existing technology to achieve success.

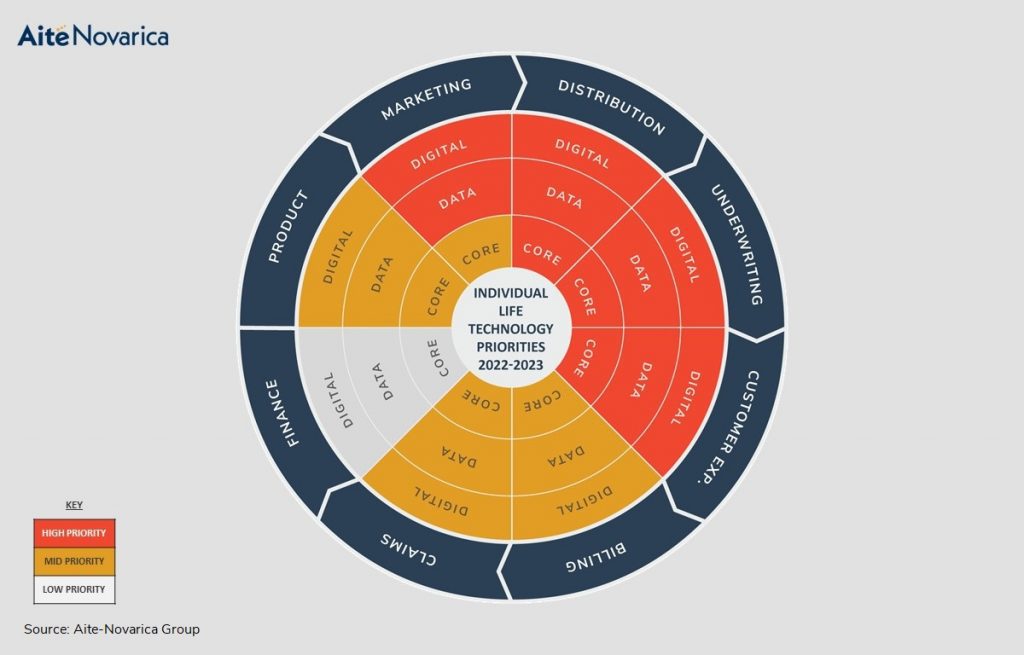

In a new Impact Report, Business and Technology Trends, 2022: Individual Life, research and advisory firm Aite-Novarica Group provides an overview of individual life carrier business and technology issues, marketplace data, and more than 10 examples of recent technology investments by individual life carriers.

“The COVID-19 pandemic has boosted interest in digital initiatives, and individual life carriers are investing in areas of straight-through processing,” said Nancy Casbarro, Senior Principal at Aite-Novarica Group. “But in regard to new business, carriers are lagging in easier and faster processes, simpler language, shorter applications, better explanations of terms and options, and better agent communication. Carriers need to pay attention to the entire agent and customer journey, not just e-signature and digitalization of application workflows.”

“Successful individual life carriers are expanding the use of AI, business intelligence, and analytics solutions to recognize and analyze market trends, product adoption, and producer performance,” adds Steven Kaye, Head of Knowledge Management at Aite-Novarica Group and co-author of the new report, “Carriers can even use analytics to flag unusual beneficiary or producer activity to address the potential for fraud as processes are digitalized.”

Click here to access the report.

Report Preview

Business and Technology Trends, 2022: Individual Life

Improved product modeling and management capabilities are vital to revenue growth in a highly competitive market

Individual life carriers are waking up to the importance of customer experience from the perspectives of the policyholder and the producer. This insight manifests most prominently in new business and underwriting, with continuing straight-through processing efforts and growing acceptance of underwriting without medical exams. As life insurers improve the agent and customer experience to meet their evolving expectations, transformation initiatives demand leaders and change agents who understand the customer, various distribution channels, and the end-to-end policy life cycle, while finding ways to marry new and existing technology to achieve success.

This Impact Report provides an overview of individual life carrier business and technology issues, marketplace data, and more than 10 examples of recent technology investments by individual life carriers. This report is part of a series on key business and technology trends in specific lines of business in the U.S. insurance industry, and it draws from conversations with Aite-Novarica Group clients and Insurance Technology Research Council members, as well as secondary published sources.

This 37-page Impact Report contains one figure and two tables. Clients of Aite-Novarica Group’s Life, Annuities, & Benefits service can download this report and the corresponding charts.

Click here to access the report.

This report mentions AAA Life, Afficiency, The Allstate Corporation, Allstate Life Insurance Company, American Family Life, Amica Life, American National Group Inc., Atlas Merchant Capital, Beneva, Bestow, Blackstone, Boston Mutual Group, Brighthouse Financial, Brookfield Asset Management Inc., Centurion Life Insurance Company, Cincinnati Life, Cornell Capital LLC, Ebix, Equisoft, Equitable, F&G, Fabric, Farmers New World Life, FAST Technology, FBL Financial, Gerber Life, Global Atlantic Financial Group, Hartford Financial Services Group, Haven Life, Human API, iPipeline, John Hancock, Kansas City Life Insurance Company, Lantern, Legal & General America, Lincoln Financial Group, MassMutual, Modern Woodmen, National Life Group, New York Life, Northwestern Mutual, Oracle, PolicyMe, Primerica, Principal Financial, Prudential Financial, Quility Insurance, Resolution Life Group Holdings LP, Sapiens, SBLI, Security Life Insurance Company of Denver Insurance Company, Sentry Life, SiriusPoint, Sixth Street Partners, State Farm, Symetra, Talcott Resolution, Western & Southern Financial Group, USAA Life Insurance Company, Voya Financial Inc., and Wells Fargo.

About Aite-Novarica Group

Aite-Novarica Group is an advisory firm providing mission-critical insights on technology, regulations, strategy, and operations to hundreds of banks, insurers, payments providers, and investment firms—as well as the technology and service providers that support them. Comprising former senior technology, strategy, and operations executives as well as experienced researchers and consultants, our experts provide actionable advice to our client base, leveraging deep insights developed via our extensive network of clients and other industry contacts. For more information, visit aite-novarica.com.

Source: Aite-Novarica Group

Tags: Aite-Novarica Group, customer experience (CX), Digital Innovation, Digital Insurance, digitization, Life Insurance, trends