Narrow networks: love ’em or hate ’em?

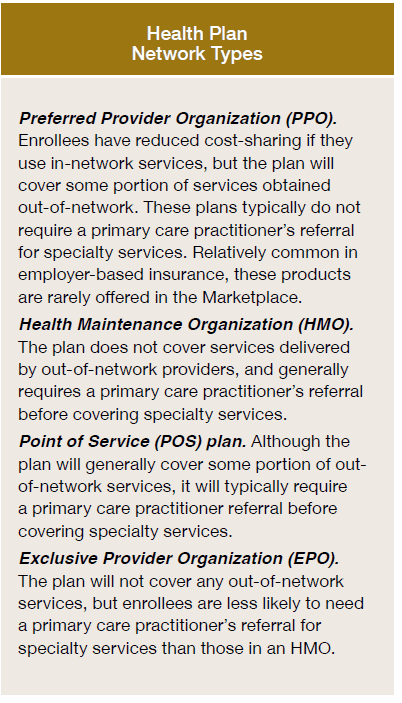

Are narrow networks a good thing or a bad thing? The first thing you need to know is what is a “narrow network”. Narrow networks is an informal terms which basically means that your health plan either places restrictions over the providers you are able to see and/or you certain providers that are out of network have much higher cost-sharing levels.

On the one hand, narrow networks could be a good thing. If provider network restrictions make it more difficult to see low quality or high cost providers, this could result in lower premiums and no impact on patient care. However, if these provider network restrictions limit choice and quality is difficult to measures, then patients may be worse off with narrow networks.

A RWJF Issue Brief by Corlette et al. (2022) aims to define what would constitute and adequate network. One common hierarchy is shown in the table below.

There are four main criteria for measuring network adequacy:

Time and distance. Establishes a maximum travel time to see a given provider (measured in miles or travel time). Provider-to-enrollee ratio. A minimum ratio of the number of providers of a given type for each enrollee.Appointment wait times. Sets a maximum waiting time for patients to access care (for both urgen and non-urgent cases). Acceptance of new patients. Establishes a minimum number or percentage of providers willing to accept new patients.

State Medicaid Agencies are required to specify standards for network adequacy and enforce them for any Medicaid managed care organizations (MCOs). The Affordable Care Act (ACA)

established the first national standard for network adequacy, but this standard applies only to qualified health plans (QHPs) in the commercial insurance market sold through the health insurance exchange marketplaces. The RWJF brief notes that these standards are often very different. Medicaid MCOs allow enrollees to leave plans if there is an inadequate network, there is a quantitative access standard, and there is required state enforcement; the ACA QHP’s require none of those things to occur.

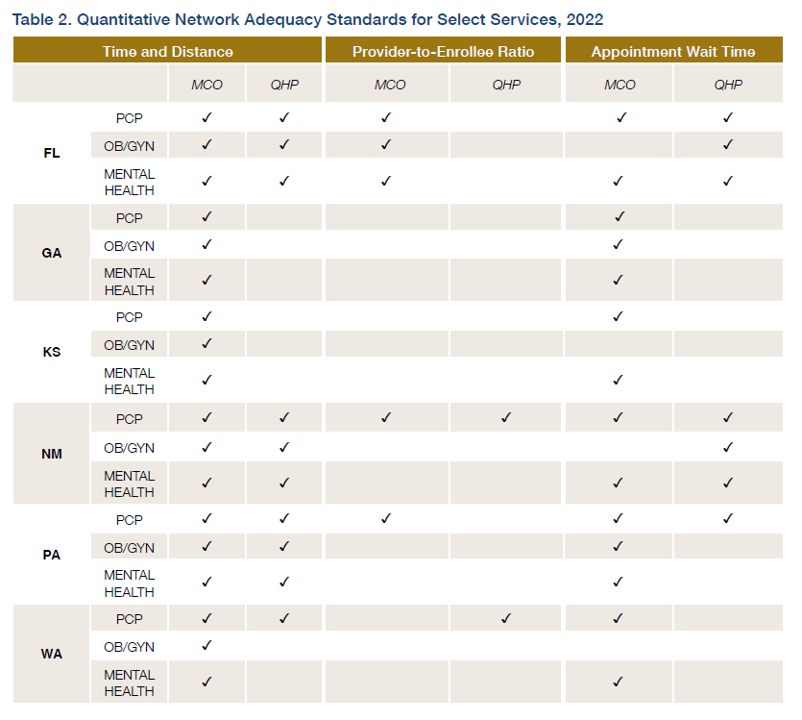

Further, different states have different network adequacy standards for different providers. In the study, the authors the authors reviewed federal laws, regulations, and subregulatory guidance for both MCO and QHP programs. The table below provides and overview of their findings from 6 state case studies.

The recommendations from the report are largely based on more regulation: (i) more oversight, (ii) more consumer protections, (iii) more transparency, and (iv) more enforcement. It is not clear, however, how effective these enforcement mechanisms are. What would be helpful would be increased transparency and standardized reporting so that Medicaid MCO beneficiaries and commercial QHP enrollees are better able to show across different plan offerings.