What's it like working in RSA's claims team

Authored by RSA

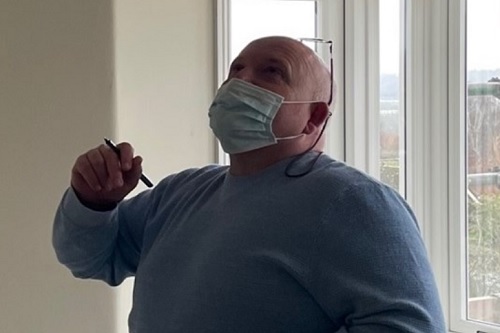

Our home insurance claims team play a vital role in supporting our customers. For a sneak peek into what their role entails day to day, we spoke with Kevin George, Project Managed Adjuster at RSA.

We recently announced that we’re investing millions of pounds in expanding and enhancing our home insurance claims team, but you may be wondering what it’s like working in the team and what they get up to day to day.

The team play an important role in supporting our customers, but to give you a better picture of what this means in practice, we spoke with Kevin George, Project Managed Adjuster (PMA), who took us through what his job is about.

How would you describe your role?

As a PMA, I’m one of RSA’s first responders to incidents where our customers have suffered significant damage to their home.

This typically involves damage caused by flood, fire or escape of water, with repairs costing up to £100,000. My role is to look after some of these claims, seeing them through from start to finish, while acting as the customer’s sole point of contact.

Considering the scale of the damage affecting their home, customers are understandably distressed. The most important part of my job is to be there for them, helping to put their mind at ease, while also explaining, agreeing and progressing the steps we will take to get their home back to normal.

What does a normal day look like?

Every day is different. Some days I’ll spend on the road visiting customers. Other days I might be in the office, making arrangements behind the scenes to keep claims moving, but I’m always in constant contact with customers and suppliers to keep them updated and ensure that claims are progressing smoothly.

My day can also quickly change if a new claim comes in where I need to go and visit the customer. Additionally, if there is a significant flood event impacting multiple customers in an area, I’m part of the emergency response team that goes out to that area to support those affected, whether they need help with their claim or just a cup of tea and a sit down.

What do you like most about your role?

I enjoy speaking with customers and building up a rapport with them. It’s probably the most important part of my job, but it’s also the most rewarding. I get to meet lots of different people from all walks of life, and I’ve had customers tell me that they want to stay in touch even after all the repairs are completed.

I also like helping people. If someone’s home floods or burns down, it can be one of the worst things they have ever experienced, and I take a lot of pride in supporting them through such a difficult time in their lives.

What do you find the most challenging?

My priorities are often moving and changing depending on what claims come in, so it can sometimes be challenging to juggle my responsibilities. You need to be organised to keep on top of everything. But I’m surrounded by a large team and we always help each other out, balancing tasks out between us and they are always there for me if I need any help or advice.

The nature of the claims I deal with are also very interesting but can sometimes be challenging due to the severity of the damage and the repairs needed. But, at the same time, that’s one of the things that I like most about my job too.

What would you say to anyone who might be considering joining the team?

Go for it! You won’t regret it. It’s an exciting and rewarding job. You get to see some interesting claims and meet even more interesting people. There are also lots of opportunities to progress, whether it’s within the same team or across a different speciality.

There are multiple positions currently available in our home insurance claims team. Visit our careers page if you’d be interested in joining us, and remember to check this regularly, as we’ll be gradually opening more roles over the coming months.