Critics say Australia's private health insurance system is broken. Here's what they say we can do to fix it – ABC News

It’s a question many Australians are asking when confronted with their private health insurance payments these days: why are the premiums so high?

The answer is complex, but many in the health sector put it down to basic maths.

That is, there are too many older patients in the system — expensive older patients that utilise more resources — and not enough young people to balance the ledger.

And during COVID-19, the situation has worsened, with an uptick in older patients taking up insurance but younger people questioning its overall value.

Those in the sector believe reforms are needed in this month’s federal budget to improve the three main levers the government uses to encourage health insurance uptake.

Private health cover uptake has worsened during the pandemic. (ABC News: Brendan Esposito)

These are the Medicare levy surcharge, the private health insurance rebate and lifetime health cover loading.

These three schemes are supposed to act as a carrot and stick approach to encourage those who can afford private health cover to take it up.

But, over time, critics say a combination of low wages growth, premium rises, government tinkering and social changes have made these incentives ineffective.

They say the levers, in their current forms, are locking young people out of private health instead of encouraging them in.

The public-private divide

Debate about reforms has become more important after COVID-19 restrictions led to an explosion in public hospital waiting lists for elective surgery in the eastern states.

As Rachel David, chief executive of peak body Private Healthcare Australia explains, nearly two-thirds of elective surgeries are done in the private system.

Rachel David says the private system plays a critical role. (ABC News: Fletch Yeung )

Rachel David says the private system plays a critical role. (ABC News: Fletch Yeung )

“If people are in need of essential non-emergency surgery like a hip replacement and they choose to get it in the private sector, it will free up space on public waiting lists,” she said.

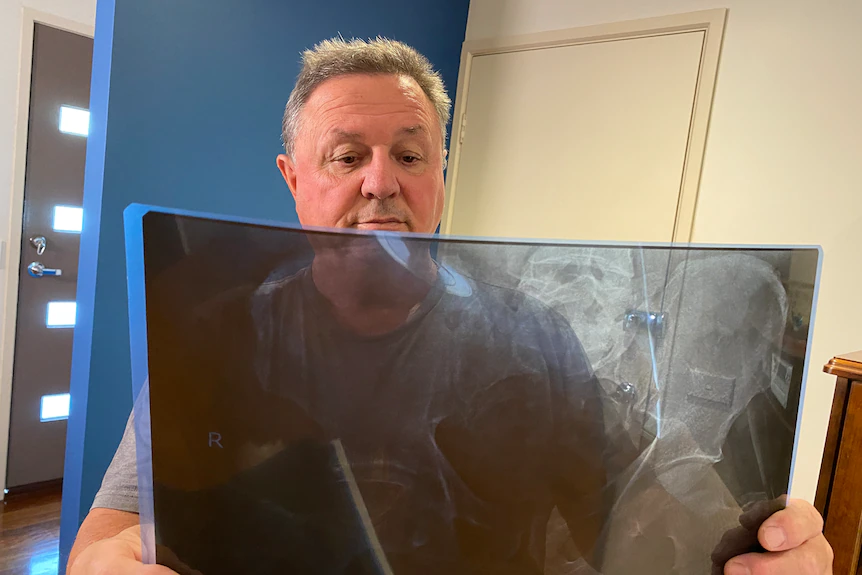

No-one understands that better than former plumber Peter Szugatto.

The 65-year-old, who used to have private health cover, has been waiting three years for a hip replacement.

Mr Szugatto dropped his cover because of rising premiums. He is now is on a waiting list in Victoria’s COVID-stretched public hospital system.

Peter Szuggato got rid of his private health cover.(ABC News: Darryl Torpy)

Peter Szuggato got rid of his private health cover.(ABC News: Darryl Torpy)

“To me, it just doesn’t weigh up, you’re better off on the public system even though you have to wait,” he said.

So why are these levies and rebates so important to insurance affordability?

And how do they affect you?

Medicare levy surcharge

It’s the weird little box some people tick on their tax return — but it packs a punch.

Australians without private health insurance who earn more than $90,000 a year, or $180,000 a household, face a 1 to 1.5 per cent levy on their annual tax bill.

If you do the maths, that can start at $900 and rise to more than $2,700 extra a year in tax.

It’s deceptively named after Medicare because the funds collected go back into the public system to cover this uninsured group. It’s not to be confused with the Medicare Levy.

Do you know more about this story? Email Specialist.Team@abc.net.au.

Rachel David said when the surcharge was introduced two decades ago, it was designed to encourage those in the top tax bracket to take up health insurance.

But according to the Australian Medical Association, government failure to have the tax threshold keep pace with wages means the surcharge now hits those from the middle tax bracket up.

“The Medicare levy surcharge now applies at a more average wage than it did when it was first introduced,” AMA president Dr Omar Khorshid said.

AMA president Dr Omar Khorshid says private health reform is desperately needed. (ABC News: Glyn Jones)

AMA president Dr Omar Khorshid says private health reform is desperately needed. (ABC News: Glyn Jones)

At the same time, health insurance premiums have been rising well above inflation.

A basic policy can set a single person back about $1,000 a year, with more costly policies for households.

Consumer Health Forum chief executive Leanne Wells said many consumers did the sums and realised it was cheaper to pay the surcharge, rather than than actually taking out health insurance.

Or failing that, younger people took out a basic or bronze-level policy to avoid the tax, but still relied on the public hospital system for actual treatment.

“It’s a bit problematic,” Ms Wells said.

Ms David said it was definitely time for the income threshold to be reviewed.

“Raising the income threshold is a good idea, but also probably considering putting the [rate] up for those people that are very high income earners.”

In a statement Health Minister Greg Hunt said the government had made a number of private health reforms including increasing the age children can stay on their family policy to 31.

He said the government had also removed the age limit people with a disability could remain on the family policy.

Private health facts

45 per cent of Australians are covered by some kind of hospital private health insuranceLast year 119,000 people aged 50-plus took up private health, but only 61,000 under 50 Average premium rate rises have totalled nearly 50 per cent since 2012, on average 4.45 per cent a year

Private health insurance rebate

It might not seem like it on face value, but most Australians who take out private health actually get a federal government rebate on their premiums.

It’s automatically calculated by insurers when a customer takes out cover.

The rates range from 8 per cent to 33 per cent, depending on age and income.

But it’s the way these rates are structured that critics claim is incentivising the wrong groups and not helping young people enter the market.

People aged over 70 receive up to 33 per cent off their premium. But Australians under 65 get a maximum of 25 per cent off, and much less if they’re on higher incomes.

Older people, who use more health resources, are taking up private health in more numbers than younger people.(Pixabay, CC0)

Older people, who use more health resources, are taking up private health in more numbers than younger people.(Pixabay, CC0)

Private Healthcare Australia said the government should restore an earlier system, introduced by the Howard government in 1999, where everyone got a maximum of 30 per cent. It was scrapped by the Gillard government in 2012 in favour of means testing.

The Consumer Health Forum disagreed, arguing older people — who needed health insurance the most — should get a bigger discount.

“We think on the whole, the tiering is good,” Ms Wells said.

The AMA argues that government tinkering with thresholds over time has forced younger age groups out.

“A good thing the government could do to help Australians afford private health insurance is to lift that levy back up to 30 per cent where it first started,” Dr Khorshid said.

Lifetime health cover loading

This penalty has a benign name — but it has a serious sting in the tail.

Under the federal government scheme, those who haven’t taken out private health by the age of 31 must pay a 2 per cent loading on premiums once they sign up.

It builds every year they were out of cover over 30, for up to 10 years.

So if a private health customer were to sign up at age 35 there’s a 2 per cent loading five times over, or 10 per cent.

Federal Health Minister Greg Hunt says the government has made a number of reforms to private health cover.(ABC News: Matt Roberts)

Federal Health Minister Greg Hunt says the government has made a number of reforms to private health cover.(ABC News: Matt Roberts)

It was designed to encourage people to take up health insurance early in their life, but since this was introduced two decades ago, a number of factors have significantly changed.

The first is the rising cost of the premiums, which the Consumer Health Forum said was making it harder for people still in their thirties to afford insurance.

It’s a penalty so steep advocates fear it actually locks young people out for longer, or entirely.

“It’s at that age that young people are really struggling to pay off [university] HECS debts, to save for housing, they’re planning for families,” Ms Wells said.

Further, advocacy groups report some people in their fifties taking out cover for the first time.

By doing this, they’ll take the hit of paying the loading for a decade, just to order to set themselves up for retirement when they’d need private health cover more.

AMA president Dr Omar Khorshid said the loading needed to be adapted to accommodate low wages growth and its effect on younger cohorts.

“We think that there’s a good argument for this lifetime health cover threshold to be raised to 35 or maybe even 40 so that it’s not a disincentive,” he said.

After Peter Szugatto dropped his private health cover, these loadings now stop him getting back into the private health insurance system.

Peter Szugatto is unsure when he’ll get his surgery. (ABC News)

Peter Szugatto is unsure when he’ll get his surgery. (ABC News)

“The fees we were looking at, about $700 a month for my wife and I, we thought, ‘Oh, that’s just ridiculous. We can’t afford that,'” he said.

Private Healthcare Australia said it would support raising the age to higher than 30.

“This was a lever that was established in the late nineties when the demographics of the population were different,” Rachel David said.

The federal government commissioned a review of Lifetime Health Cover in 2021 but it is yet to be released.

And the worst part is…

As Leanne Wells from the Consumer Health Forum explains, when it comes to private health insurance reform, the biggest challenge is getting anyone to agree.

An independent inquiry is needed, says Consumer Health Forum’s Leanne Wells.(ABC News)

An independent inquiry is needed, says Consumer Health Forum’s Leanne Wells.(ABC News)

“When there’s a lack of consensus, it makes it incredibly hard for governments to take an agenda forward,” she said.

That’s why the forum is calling for an independent inquiry by the Productivity Commission.

Health Minister Greg Hunt said the government had just finished reforms to the cost of medical devices which should save insurers $900 million over four years.

“We’ve also invested an additional $30 million over four years as part of the 2021-22 Budget to improve and support the private healthcare sector to deliver quality care,” he said in a statement.

Peter Szugatto can’t go back to his new job as an aged care support worker until he gets his new hip.

But when his operation actually happens is anybody’s guess.