Millions of Californians face increasing health insurance rates – KRON4

SACRAMENTO, Calif. (KRON) — A new analysis reveals millions of Californians will face a significant rise in health insurance premiums as the American Rescue Plan is set to expire at the end of the year.

According to Covered California, many will be forced to drop their health coverage and potentially reduce the benefits that they receive when they seek care.

The analysis comes as Congress considers extending the premium subsidies that are part of that law before they expire on December 31.

“The American Rescue Plan provided more financial help than ever before, and helped a record number of people get covered and stay covered,” said Peter V. Lee, executive director of Covered California.

“Without an extension, millions of people will face staggering premium increases, and many will be priced out of their health care coverage.”

Courtesy: Covered California

The analysis details the increased enrollment that the higher subsidies supported, the particular groups that benefited in California, the potential premium increases that consumers would face in October of this year if the subsidies are not continued, and the likely result of more than 150,000 Californians and 1.7 million people across the nation being priced out of coverage.

Premium Impacts of Removing Californians’ American Rescue Plan Subsidies

Lower-income consumers would see premiums go from $0 to $74 per month.Families of three would see premiums increase by $199 per month.Families of four would see their premium jump $240 per month.Middle-income couples in early retirement would lose all help and pay $1,720 more each month.

Starting in October, consumers would see the increased rates when they begin receiving their renewal notices for the 2023 coverage year.

“Whether you are one of Covered California’s record-high 1.8 million enrollees, or you get your coverage directly from a health insurance company, you will be paying a lot more next year if these subsidies are not extended,” Lee said.

House passes sweeping $1.5 trillion omnibus spending bill

Higher Health Insurance Premiums

Covered California’s analysis found that if the subsidies provided by the ARP were allowed to expire, enrollees who currently earn less than 400% of the federal poverty level ($52,000 for a single person and $106,000 for a family of four) would see their monthly premiums rise by an average of $70 per month, or 71 percent for 2023.

The analysis also found that Californians who could least afford the price hike — those earning between $17,775 and $32,200 a year for an individual and from $36,570 to $66,250 for a family of four — would be affected the most, with their health insurance premiums expected to more than doubling.

According to Covered California, a total of 1 million of its consumers are in this income bracket.

“While lower-income consumers would still be getting federal tax credits, many of those who would see their premiums double will be priced out of the coverage they want and need,” Lee said.

“A total of 1 million Californians, those who can least afford it, will be hit the hardest if these critical subsidies are allowed to expire.”

Courtesy: Covered California.

Courtesy: Covered California.

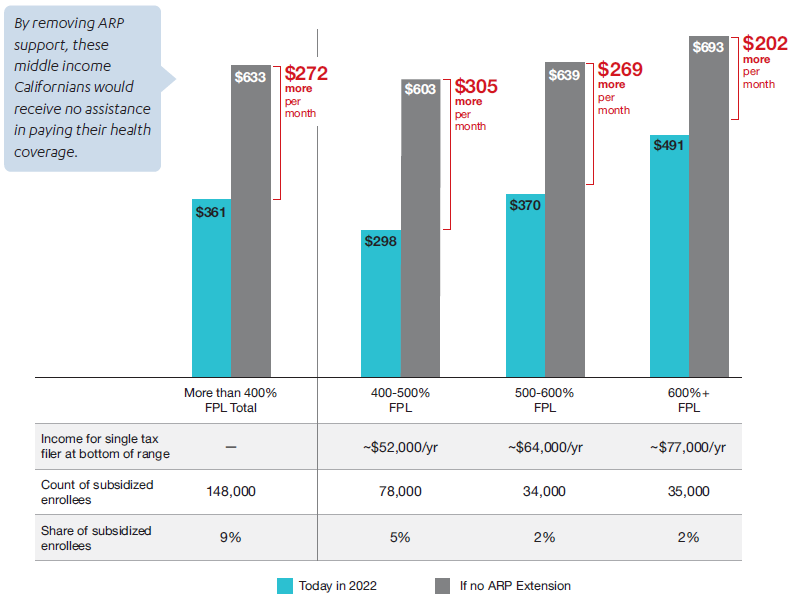

The expiration of the subsidies would also mean the return of the so-called “subsidy cliff” of the original Affordable Care Act terms that meant middle-income consumers — individuals who earn more than $51,520 per year and families of four who earn more than $106,000 per year — would not be eligible for financial help, no matter how much it cost them as a percentage of their income.

In California, nearly 150,000 middle-income consumers (9% of those getting subsidies) benefited from lower premiums due to the expanded financial help.

Youth mental health issues reach crisis levels during pandemic

According to the analysis — without an extension of these subsidies, these middle-income consumers would see their premiums increase by an average of $272 per member, per month in 2023 — with families getting subsidies facing far higher household premium spikes.

Millions of People Could Lose Coverage or Benefits

The Congressional Budget Office estimates that the rising premiums would price approximately 1.7 million Americans out of coverage.

In California, this could mean that more than 150,000 people could decide to drop their coverage due to the high cost.

The analysis shows that rolling back the increased subsidies would also have a disproportionate impact on California’s communities of color, who experienced significant increases in enrollment during the pandemic.

“The American Rescue Plan built on the Affordable Care Act and took a huge step toward expanding coverage and giving people the protection and peace of mind they deserve,” Lee said.

“Without congressional action, consumers will start seeing these higher premiums when they get their renewal notices in the fall, and they will be faced with tough decisions.”