The Bottom Line: Lawmakers, medical groups call for Pritzker administration to investigate Blue Cross Blue Shield – wcia.com

SPRINGFIELD, Ill. (NEXSTAR) — The contract dispute that disrupted continuity of care and sent medical bills skyrocketing for Springfield Clinic patients with Blue Cross Blue Shield insurance plans impacted several state and federal lawmakers living in Central Illinois.

“I know I speak on behalf of my constituents, but you know I have health insurance, too,” state senator Doris Turner (D-Springfield) said on Wednesday. “I have family members that have health insurance coverage, so it becomes very personal.”

In a recent radio interview, Turner described how the disruption in coverage and benefits nearly complicated the pregnancy of a member of her family. When Blue Cross Blue Shield kicked Springfield Clinic’s 650 doctors out of its network, patients who relied on that insurance plan suddenly learned they’d have to pay much higher out-of-network prices to continue seeing their favorite doctor or specialist.

“It created a lot of anxiety,” Turner said. “When people have insurance, they just assume that that health care is going to be accessible to them whenever they need it.”

Blue Cross Blue Shield, the largest health insurer in the state, said it “cannot and will not arbitrarily overpay” Springfield Clinic under the terms of their old contract. The two sides have not shared specific details underlying the contract dispute, but a spokeswoman for Blue Cross said medical costs in Springfield are “among the highest in the state – as much as 16% higher than Chicago.”

In its push to drive costs lower, Blue Cross is driving Springfield Clinic patients to other doctors, and in many cases, it is driving its own paying customers to cancel their insurance plans.

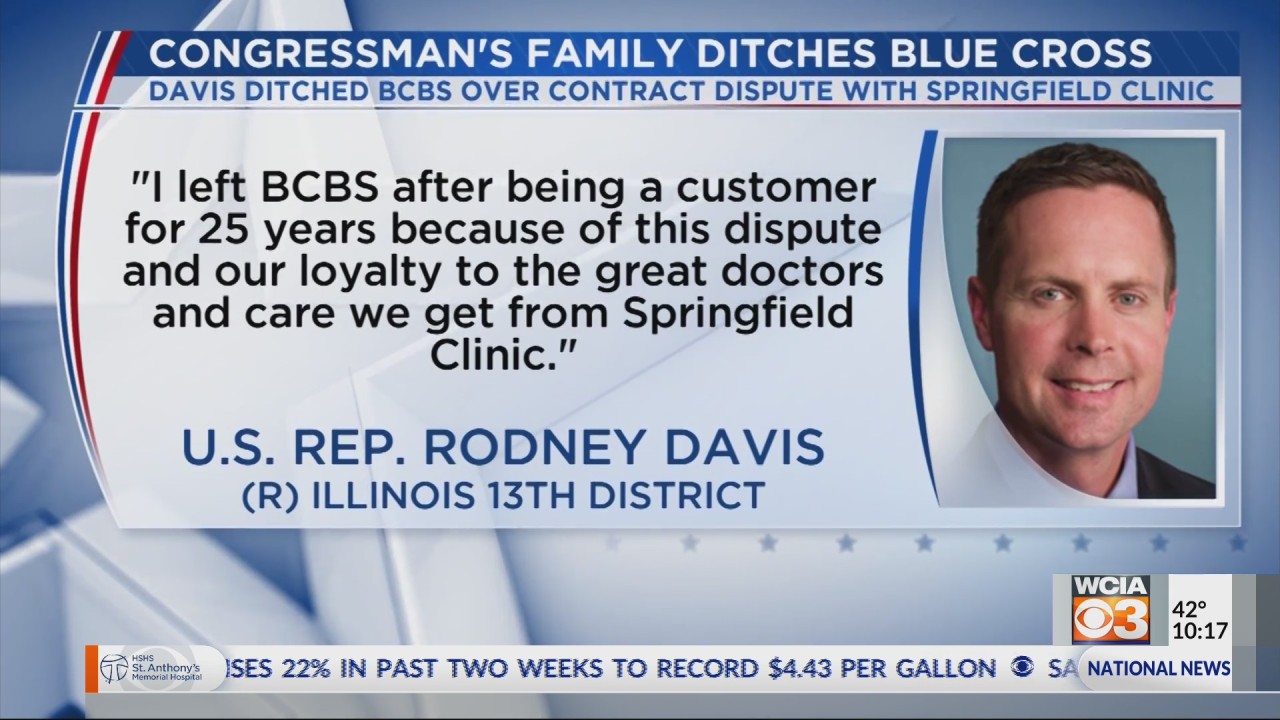

Congressman Rodney Davis (R-Illinois 13th District) and state senator Steve McClure (R-Springfield) were among the patients to cancel their insurance coverage with Blue Cross over the dispute.

“I left BCBS after being a customer for 25 years because of this dispute and our loyalty to the great doctors and care we get from Springfield Clinic,” Davis said through a spokesman. “In fact, my wife received her own cancer treatments from the health care community in Springfield under BCBS coverage 23 years ago.”

Davis often refers to his wife’s personal story of her bout with cancer in his comments about access to affordable health care. She works at Springfield Clinic after going through treatments there years ago.

“Continuity of care and the doctor-patient relationship are paramount in these situations,” Davis said. “My staff and I have had numerous conversations with BCBS urging them to reach an agreement with Springfield Clinic. Patients, particularly those who are undergoing life-saving treatments, deserve to have continued access to their family doctor.”

Other Blue Cross Blue Shield customers wanted to switch insurance plans, but could not convince their employers to dump Blue Cross.

“It’s one of those things like nobody wants to fuss with,” Morgan Kaplan said after asking her employer to switch insurance providers. “The answer was, ‘No. This is what we’re doing.’”

“Nobody wants to mess with calling the insurance companies, or even the brokerage that deals with them,” Kaplan said. “I get it. It’s a hassle.”

She was one of several mothers in the Springfield area who ran into frustrations trying to find a specialist in the Blue Cross network who was taking new patients in the area. Instead, she opted to pay out-of-network prices to keep her doctor.

A recent Target 3 investigation revealed Blue Cross Blue Shield of Illinois was advertising a dead-end directory of doctors in a “ghost network” that over-inflated how many providers were actually available to see new patients within a reasonable driving distance. Removing Springfield Clinic’s doctors from the available provider list drastically diminished the number of options for patients on Blue Cross insurance.

“We continue to explore opportunities to expand our network offerings,” Blue Cross Blue Shield spokeswoman Colleen Miller said in an email.

McClure called it “very troubling” that “people that need health care — that have what is supposed to be a fantastic plan — can’t get reasonable coverage for things that they need, and trying to go to a provider, that is nowhere near them, that maybe doesn’t exist before they get coverage.”

“If that were my mom and dad, they wouldn’t have a way to go to a specialist in Chicago or or St. Louis,” state senator Sally Turner (R-Lincoln) said. “They wouldn’t be able to get there unless I personally could take them there.”

Regan Thomas, a Northwestern doctor who serves as the President of the Illinois State Medical Society, responded to the Target 3 investigation in a statement.

“The doctors of Illinois are concerned about recent reports of “ghost networks” perpetrated by state-regulated private health plans in Illinois,” Thomas said. “Insurance company provider directories often list doctors who are unavailable, not taking new patients, are located far away or who don’t work at the listed medical facility. This isn’t happening in just one part of Illinois, it’s a statewide problem.”

Senators McClure and Sally Turner echoed calls from the Illinois State Medical Society urging the Pritzker administration to investigate Blue Cross Blue Shield’s network adequacy to make sure it isn’t selling a plan that shortchanges patients and consumers or that deprives them of access to health care.

“We call on the Illinois Department of Insurance to enhance its enforcement of the ISMS-initiated Network Adequacy and Transparency Act, signed into law in 2017, including putting forth strict enforcement guidelines and penalties for non-compliance,” Thomas said. “This law provides important protections for patients, including continuity of care for those with ongoing and urgent medical care needs, such as cancer patients and expectant mothers.”

Other patient advocacy groups also raised concerns about the limited access to affordable health care.

“We are keeping a very close eye on this issue because of the impact we’re seeing for patients,” Shana Jo Crews with the American Cancer Society’s Cancer Action Network said. “Cancer is hard enough to fight. We don’t need to make extra hurdles for cancer patients, including extended travel times, while you’re fighting your cancer or getting bills that are terrifying to open up in the mail.”

State and federal laws empower the Department of Insurance to open a market conduct exam to investigate insurance companies. If necessary, the state can order an insurance company to issue reimbursements to patients whose continuity of care or coverage benefits were disrupted. A spokesperson wouldn’t confirm whether the state agency had taken steps in that direction, but did recently order Blue Cross to resubmit a new network list that accounts for the removal of the Springfield Clinic doctors.

“The network adequacy filing is under review, and the Department does not comment on filings that are under review,” Department of Insurance communications director Caron Brookens said in an email. “However, if/when a provider network is found to be inadequate, the Department will take the appropriate steps to ensure that consumers have proper and timely access to care in accordance with federal and state statues.”

Blue Cross insists it did not trigger a “material change” in its network when it kicked Springfield Clinic out, though the Department of Insurance said it did.

Despite the disagreement, Miller said, “BCBSIL will continue to collaborate with the Department of Insurance and provide appropriate information.”

Agency officials at the Department of Insurance have expressed some reluctance to intervene in a private business dispute for fear it could show favoritism to one company over another.

“Regarding the contract negotiation between Springfield Clinic and BCBS, the Department plays no role in the private contracting process between insurers and providers,” Brookens said. “Through private contract negotiations, both the insurers and providers are incentivized to bargain over rates, which in turn benefits the consumers through competitive provider rates and insurance premiums. It would be inappropriate and unethical if the Department were to require an insurance company to contract with a particular provider, favoring that provider over others.”

While the state attempts to avoid becoming entangled in a private contract dispute, the hardball negotiations turn patients away from their favorite doctors, drive costs higher, and threaten access to health care in the capital city.

“Many insurers have asked patients to receive care in clinic settings to lower the cost of care, but now patients in central Illinois are being put in terrible situations because of an impasse like this,” Davis said. “Hopefully BCBS and Springfield Clinic can resolve this as quickly as possible so patients can keep the doctors who they know and trust and resume their care.”