Medical debt 'doom loop' regularly plagues Americans, CFPB report details – Yahoo Finance

Medical debt keeps worsening for Americans around the country.

A new report from the Consumer Financial Protection Bureau (CFPB) found that U.S. consumers hold $88 billion in medical debt as of June 2021. Medical debt also accounts for 58% of all third-party collection tradelines (i.e., the credit accounts listed on a credit report).

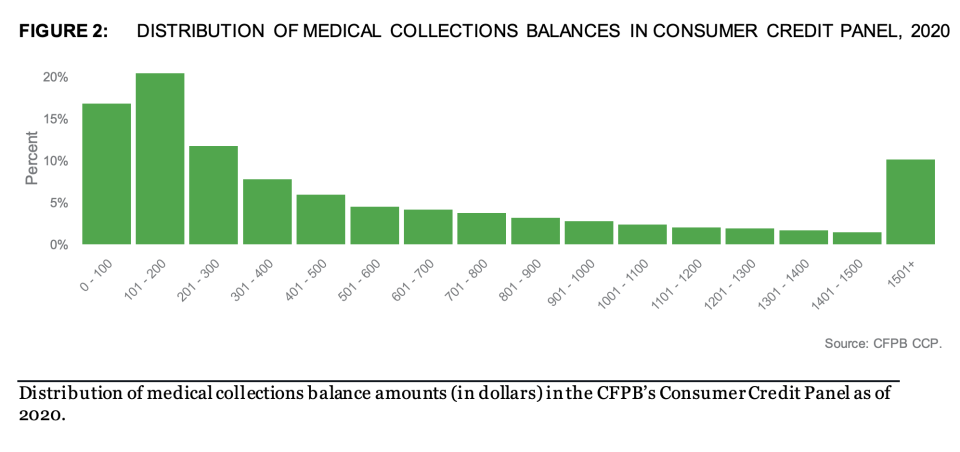

Most medical debts are under $500, though the report did note that many of the individuals with this type of debt have multiple collection accounts. This can affect how Americans receive health care as well as other aspects of financial well-being, like access to credit.

“When it comes to medical bills, Americans are often caught in a doom loop between their medical provider and insurance company,” CFPB Director Rohit Chopra said in a statement. “Our credit reporting system is too often used as a tool to coerce and extort patients into paying medical bills they may not even owe.”

Wenzle Hufford and his wife Lucynda Hufford both have severe health problems and have incurred large medical debt that they’ve been unable to pay, July 17, 2019. (Photo by Michael S. Williamson/The Washington Post via Getty Images)

‘They want to avoid the costs’

Part of the problem is that health care costs have largely increased over the past decade.

A report from the Commonwealth Fund found that health insurance premiums and deductibles for Americans with employer-sponsored coverage accounted for 11.6% of the median income in 2020, a 9.1% increase from 2010.

These high costs often leave consumers forced to make a difficult choice — seek the care they need and risk falling into debt or defer care in order to save money.

“What we’ve found that it does for people with lower and moderate incomes is that it’s a disincentive for people to get care,” Sara Collins, vice president for health care coverage and access at The Commonwealth Fund, previously told Yahoo Finance. “People with higher deductibles are less likely to get health care when they need it because they want to avoid the costs associated with it. We also know that when people do get health care when they have high deductibles, they’re more likely to report they carry medical debt or are having difficulty paying their medical bills.”

Story continues

The CFPB report found that Black and Hispanic individuals are more likely to have medical debt, along with young adults and low-income individuals. This is partly due to the fact that uninsured individuals or those receiving out-of-network care are faced with higher charges since there is no insurance company to shoulder some of the cost.

Medical debt is also more prevalent in the southern half of the United States, particularly in states that haven’t adopted the Medicaid expansion offered by the Affordable Care Act (ACA). Those in debt who live in non-expansion states have on average $375 more in debt than those in states that did expand Medicaid and are more likely to report difficulty in paying off the balance.

‘A uniquely American injustice’

According to Eva Stahl, director of public policy at RIP Medical Debt, the report comes “at an important moment” for the U.S.

“We view medical debt as a uniquely American injustice that prevents millions from achieving financial stability and subjects them to emotional anguish,” Stahl told Yahoo Finance. “While the report does not fully explore the inadequacies of the health insurance coverage system, it spotlights the deep inequities of medical debt and the long-term barriers to health and economic security that medical debt creates.”

These issues can also trickle into other parts of the economy. A survey by HealthCare.com found that approximately 25% of millennials and Gen Zers skipped their rent or mortgage payments because of medical debt.

Most medical debt is below $500. (Chart: CFPB)

Consequently, medical debt has also had a negative impact on people’s credit scores.

In 2020, according to the CFPB report, 17.8% of credit records had at least one medical debt in collections. Additionally, data from July 2021 showed that nearly 18% of Americans held medical debt that had been sent to collection agencies.

“The effects of medical debt on a credit report cause intense harm,” Stahl said. “Our beneficiaries commonly ask for resources on credit repair and/or confirmation that RIP’s abolishment will help them improve their credit scores so they can purchase a home, get a job or buy a car … While we can provide relief and help in the moment, it is not a long-term solution to a broken and inequitable health care financing system.”

Adriana Belmonte is a reporter and editor covering politics and health care policy for Yahoo Finance. You can follow her on Twitter @adrianambells and reach her at adriana@yahoofinance.com.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Instagram, YouTube, Facebook, Flipboard, and LinkedIn