Australia flood claims approach 100,000 as ICA estimates $1.45bn insured loss

The flooding in Southeast Queensland and New South Wales has now resulted in 96,844 claims, which based on previous flood events is an estimated insurance industry cost of $1.45 billion, according to the Insurance Council of Australia (ICA).

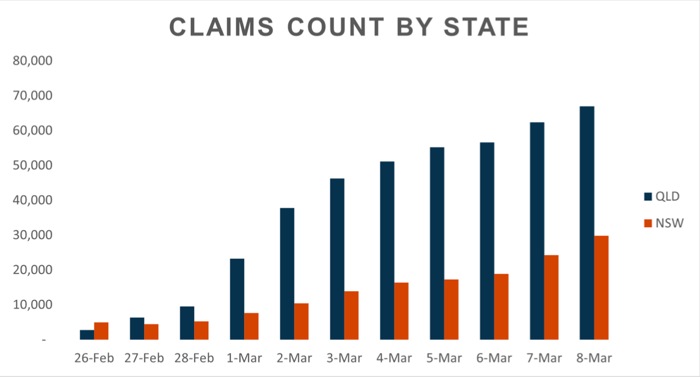

The ICA has been providing regular updates on the East Coast flood event. The March 8th, 2022, update represents a 12% increase in claims when compared with the previous day, driven by a 23% daily rise in the number of claims from New South Wales.

Currently, 31% of claims are from New South Wales and 69% of claims are from Queensland. The ICA notes that across both regions, 80% of claims are for domestic property, 17% for motor vehicle, and the remainder are commercial property claims.

The ICA says that while the insured loss figure remains subject to detailed assessment of claims as loss adjustors move in, based on previous flood events, the estimated current cost is now $1.45 billion, compared with $1.3 billion yesterday.

All in all, claims have been received from 80 local government areas. The chart below, provided by the ICA, details the claims count by state.

Andrew Hall, the ICA’s Chief Executive Officer (CEO), commented: “As we expected we are now seeing an influx of claims from New South Wales. Insurers are prioritising those customers whose situation is the most severe to support them getting back on their feet as soon as possible.

“This means it may take a few weeks for insurers to start the assessment process for less severe claims, but those customers can be assured their insurer is there to support them. Insurers rely on a network of specialists from across the country and around the world who are deployed when and where they are needed.

“I want to thank Immigration Minister Alex Hawke, his office, and department for their support in quickly processing a number of visa applications, which means those specialists will be on ground shortly assisting communities in their recovery.”

As claims continue to rise, reinsurance is expected to trigger, with many insurers already highlighting their maximum retentions and others saying they expect to make recoveries.

Early assessments suggest that reinsurers will bear the brunt of the costs and that the toll could reach towards A$2 billion.