UCITS cat bond fund index only fell 0.42% on hurricane Milton

It’s now clear that catastrophe bond funds fell far less than the market benchmark on the first pricing after hurricane Milton, with the Plenum CAT Bond UCITS Fund Indices only falling 0.42% at Friday October 11th and the majority of cat bond funds absorbing the initial mark-to-market impacts of the storm within two weeks of returns.

As we reported after the first pricing of outstanding catastrophe bonds following the hurricane’s landfall in Florida, the Swiss Re Global Cat Bond Total Return Index, that tracks the entire outstanding catastrophe bond market, fell by 1.34%.

As we reported last week, across a sample of UCITS structured catastrophe bond funds we had managed to source net asset value (NAV) information for, the average decline for hurricane Milton was lower at a -0.77% mark-down.

But, we were also told that some cat bond funds fared even better, with lower mark-downs seen.

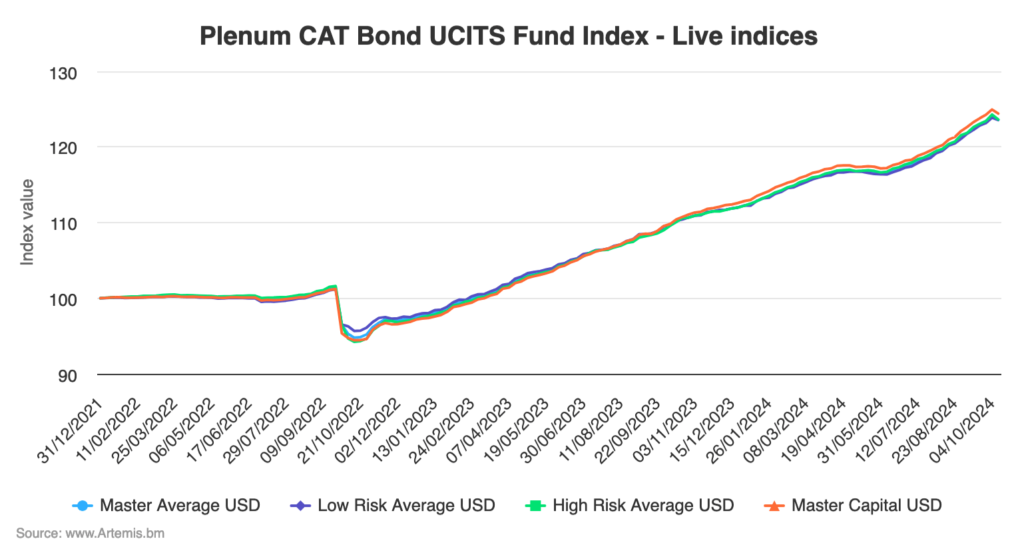

Now, the weekly data for October 11th is available for the full cohort of cat bond funds in the UCITS format, as a result of which Plenum Investments AG has updated its Plenum CAT Bond UCITS Fund Indices.

As hurricane Milton had only made landfall in Florida late on October 9th, the Friday 11th pricing of catastrophe bonds was the first clear insight into the potential for cat bond market losses from the storm.

UCITS fund managers operating catastrophe bond strategies will have marked their positions and NAVs based on this early cat bond pricing.

The upshot was a just -0.42% movement in the Plenum Master Average UCITS cat bond fund index, with declines averaging -0.25% for lower risk cat bond funds and -0.52% for the higher-risk funds.

Impressively though, looking back at two weeks of returns for these cat bond fund indices, all are positive versus the pricing on September 29th, showing that practically every cat bond fund has absorbed hurricane Milton’s initial mark-to-market impact within two weeks of returns.

Analyse cat bond fund performance using the Plenum CAT Bond UCITS Fund Indices, which tracks the performance of a basket of cat bond funds structured in the UCITS format and provides a broad benchmark for the performance of cat bond investment strategies.

Click on the chart below for an interactive version and to analyse index development by week:

Impressively, the average return for the UCITS catastrophe bond funds over the closest month, from September 13th through October 11th, is a positive 0.91% performance, which again demonstrates just how easily the cat bond market has absorbed the initially expected impacts of hurricane Milton.

In fact, the lower-risk cohort of UCITS cat bond funds are up by 1.06% over the last month, while higher-risk funds are up by 0.82%.

Year-to-date, the return of the UCITS cat bond funds now average 10.13% at October 11th, which is only slightly down on the 10.60% return reported a week earlier.

While the 12-month rolling return now stands at a still very healthy 12.23% average across all the UCITS cat bond funds, again showing that hurricane Milton has not dented the attractiveness of this market as a diversifying alternative asset class.

We expect that, given the bounce-back seen in Swiss Re’s cat bond market Index that we reported earlier today, this UCITS cat bond fund focused Index may also bounce-back and regain most of the initial hurricane Milton decline seen.

Analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

Analyse catastrophe bond market yields over time using our new chart.