Cat bond market index falls 1.34% on hurricane Milton. US wind down 3.64%

Responding to the potential impact of losses from hurricane Milton, the catastrophe bond market has fallen by just 1.34% at the end of week pricing of the index calculated by Swiss Re Capital Markets, while the US wind specific version of the cat bond index fell by only 3.64%.

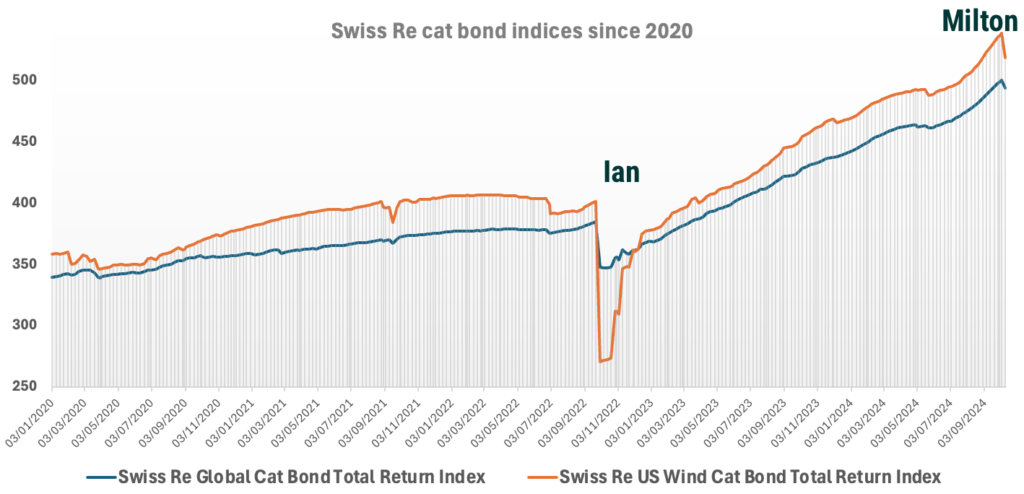

It’s a stark contrast to how the Swiss Re Global Cat Bond Index behaved after hurricane Ian in 2022 and while these figures fall into the range of catastrophe bond market impacts anticipated, it shows that (absent future surprises) overall losses from hurricane Milton are set to be very manageable for cat bond fund managers and their investors.

At yesterday’s pricing, the Swiss Re Capital Markets team has marked the Swiss Re Global Cat Bond Total Return Index down by 1.34%.

That index tracks the entire outstanding catastrophe bond market, so across the full range of perils and regions. It’s the best proxy for the hit or drawdown to the catastrophe bond market after an event like hurricane Milton.

Swiss Re also calculates a separate catastrophe bond index focused solely on US hurricane risks, given this remains the most prevalent peril in the cat bond market.

The Swiss Re US Wind Cat Bond Total Return Index fell by 3.64% at its pricing yesterday, so as you’d expect a more meaningful decline than the Global index, but still very manageable.

As we said, this is a stark contract to how the catastrophe bond market responded to hurricane Ian in 2022.

As we reported at that time right after Ian, the Swiss Re Global Cat Bond Index dropped by a considerable 10%, while the Swiss Re US Wind Cat Bond Index plummeted by roughly 32%.

As our readers will be aware, the vast majority of those mark-to-market declines were later recovered, as actual catastrophe bond losses from hurricane Ian remained minimal and very manageable by the market.

Remember, the industry loss from hurricane Ian has been estimated $50 billion to as much as $60 billion.

You can compare the hits to the cat bond market from each hurricane in the chart below:

Hurricane Milton continues to be discussed in a range from $20 billion to $50 billion, although sources continued to point to $40 billion or so as the potential top-end.

So still a significant loss and one where some cat bond principal losses would be anticipated.

What has changed today, such that another hurricane though initially to have caused an industry loss in the tens of billions of dollars has not knocked the cat bond market by a commensurately large level?

Since Ian, the reinsurance market continued to harden and we saw higher attachment points coming into the cat bond market, as well as a continued reduction in cat bond features such as aggregate coverage, top and drop, and at the same time industry loss trigger cat bonds saw attachments generally rising as well.

So that has made a significant difference in the market and will be one reason the hit to the cat bond market does not look commensurate with Ian, in relative terms.

Many people discuss the cat bond as a reinsurance and retrocession product designed to cover major loss events only, say $50 billion and higher, so with Milton being discussed as below that level it’s perhaps no surprise that the cat bond impact looks manageable.

But, there have perhaps also been some lessons learned in the way the cat bond market marks its book, after major catastrophes. The Ian experience, of a 10% market decline that recovered to a decline of around 1%, or perhaps less, was not something investors wanted to see repeated and in the case of Milton the marking of bonds in the secondary market appears much more realistic.

All this said, it remains very early days after a catastrophe and so things could change, so it will be interesting to watch the Swiss Re cat bond indices over the coming weeks to see if there is any further markdowns that occur.

It takes time for catastrophe losses to become clear for the sponsors of catastrophe bonds, so can take time for loss implications to be understood. Hence those marking cat bond prices, for the secondary market, have a key role to play in being as realistic as possible, without being too negative and causing an unnecessary market drawdown.

It’s encouraging to note that projections for the hit to the catastrophe bond market have proved accurate.

On October 10th, cat bond fund manager Icosa Investments projected it would be below 5%. Then yesterday, on October 11th, specialist investment manager Twelve Capital projected a cat bond market loss of up to 4% from hurricane Milton.

Euler ILS Partners said it did “not expect a substantial notional impact on our portfolios and the ILS market in general.”

While Jeffrey Davis of Elementum Advisors, LLC warned that a drawdown would be expected for the cat bond market, but that some of this is typically seen to be recovered.

While drawdowns tend to see a strong recovery in the catastrophe bond market, at least historical experience suggests that is typically the case, given this one from hurricane Milton, at only 1.34%, is perhaps smaller than many people had anticipated it might suggest there could be less recovery to come in future.

Of course there is also typically a chance of some bonds getting marked down in future that have not yet been today, as we’ve also seen with hurricane Ian as some cedents loss positions worsened so far that they made reinsurance recoveries.

So there remains plenty of uncertainty and the catastrophe bond market’s pricing can remain more volatile for a time, after any major catastrophe event.

Finally, it’s worth looking how this fall in the catastrophe bond market has impacted investment performance.

While the Global cat bond index is down 1.34% for the week on Milton, since September 13th so the nearest price date to one month, this index is still up by 0.39% thanks to the strong seasonal cat bond performance that has been seen.

Which means, at this stage, the catastrophe bond market has absorbed the initial mark-to-market impact of hurricane Milton within a single month of returns, a quite remarkable feat and this may be surprising for some.

Year-to-date, the Swiss Re Global Cat Bond is still up by 11.89%, again reflecting the very strong returns still possible in the cat bond market and the fact the market can be very resilient to mid-sized loss events.

For the Swiss Re US Wind Cat Bond Index, which was down 3.64% at yesterday’s marking, over the most recent month the decline is just 1.56% thanks to the strong performance being seen, while year-to-date the US Wind cat bond index remains up 10.72%.

Of course, cat bond funds will experience a range of drawdowns on hurricane Milton, depending on portfolio mix and exposure to US wind and in particular to the cat bonds that have been marked down the most at yesterday’s pricing.

We’ve seen some pricing sheets now and we’ll bring you more on Monday on this. But for now, it’s worth highlighting that the cat bonds with some of the biggest price declines yesterday, such as the riskiest of the FloodSmart Re NFIP cat bonds (being down roughly 53%), are also some with the biggest uncertainty around them given there is no indication of claims from FEMA yet and likely won’t be for some time.

More to come next week, but for now it’s clear the overall impact to the catastrophe bond market from hurricane Milton is likely to prove to be perhaps up to 1.5% if there is loss creep to deal with. Or, if things improve over time as we’ve seen before, it actually could end up another catastrophe with a 1% or less hit to the entire cat bond market (remember that uncertainty though, a lot can happen as the loss picture clarifies).

Note: We’ve seen the Swiss Re Index data on Bloomberg and we don’t know why there is a different value, with a slightly higher market decline of 1.4%. The figures in this article are the official data points for the Index.

Also read:

– Hurricane Milton estimated a 0% – 4% principal loss to the cat bond market: Twelve Capital.

– Cat bond market drawdown expected, yields likely to rise after Milton: Elementum’s Davis.

– Hurricane Milton loss $30bn – $50bn. Substantial ILS impact not expected: Euler ILS Partners.

– Mutual cat bond and ILS funds recover ground as hurricane Milton impact clearer.

– Milton loss below $50bn may not be sufficient to move pricing: Jefferies.

– Milton could drive property catastrophe reinsurance rates up at 1/1 2025: KBW.

– Most mutual cat bond & ILS funds slid a little further on Milton’s final approach.

– Cat bond funds can still finish the year positively: Twelve Capital’s Wrosch.

– Hurricane Milton losses likely below a 5% cat bond market impact: Icosa Investments.

– Hurricane Milton: Pre-landfall broker loss estimates ranged $15bn to $40bn.

– Hurricane Milton Cat 3 landfall in Sarasota. Worst case Tampa loss scenarios avoided.

– Hurricane Milton: Insurance, reinsurance, cat bonds, ILS ready to respond.

– Some mutual cat bond and ILS fund NAVs fall further on hurricane Milton threat.

– Hurricane Milton industry loss at $25bn+ changes pricing narrative: Goldman Sachs.

– Hurricane Milton cat bond loss potential still in wide range: Icosa Investments.

– Hurricane Milton seen denting cat bond market -1.4% (excl. surge): Plenum.

– 33% chance hurricane Milton loss above $50bn. Would drive hard market: Euler ILS Partners.

– Hurricane Milton Cat 5 again. Tracks slightly south. Uncertainty still high, loss range wide.

– Safe to say hurricane Milton likely a $20bn+ insurance market event: Siffert, BMS.

– Hurricane wind speeds forecast across entire Florida Peninsula as Milton approaches.

– Mexico’s catastrophe bond presumed safe from hurricane Milton.

– Stone Ridge leads managers cutting mutual cat bond or ILS fund NAVs on hurricane Milton.

– Hurricane Milton could be a huge test for the entire (re)insurance market: Evercore ISI.

– Hurricane Milton losses could amount to tens of billions, but uncertainty high: BMS’ Siffert.

– As hurricane Milton intensifies, Mexico’s catastrophe bond comes into focus.

– Material hurricane Milton losses could change 2025 property reinsurance price trajectory: KBW.

– Cat bond & ILS managers explore options to free cash, as hurricane Milton approaches.

– Hurricane Milton: First Tampa Bay storm surge indications 8 to 12 feet.

– Hurricane Milton is biggest potential ILS market threat since Ian in 2022: Steiger, Icosa.

– Hurricane Milton forecast for costly Florida landfall. Cat bond & ILS market on watch.