Some mutual cat bond and ILS fund NAVs fall further on hurricane Milton threat

The net asset values (NAVs) of a number of the 1940’s Act registered US mutual investment funds that allocate to catastrophe bonds and other insurance-linked securities (ILS) declined again yesterday, with some cutting for the second day running, others for the first time.

Investment managers are working to incorporate their projections and estimations of potential losses from major hurricane Milton into their catastrophe bond and ILS portfolios.

Managers of 40’s Act registered US mutual fund structures need to mark their portfolios with a fund price daily, based on net asset value.

This is a challenge given the catastrophe bond market only marks its positions on a Friday and other less liquid ILS positions, such as most quota shares, sidecars and collateralized reinsurance or retrocession, do not tend to have their valuations marked frequently, if at all.

Which means the investment manager’s operating mutual catastrophe bond funds and mutual ILS funds must make best efforts to incorporate the data and insights, as well as loss projections they are seeing, into their portfolios.

Once again, alternatives specialist Stone Ridge Asset Management has marked its two mutual ILS funds a little lower yesterday.

As we reported yesterday morning, the investment manager Stone Ridge had led the way, making the most evident cuts to NAV for its more catastrophe bond focused mutual fund and its more quota share and collateralized reinsurance interval-style fund.

The NAV of the largely catastrophe bond investment focused Stone Ridge High Yield Reinsurance Risk Premium Fund fell -3.13% on the 7th October, which we presume was due to hurricane Milton’s threat.

Yesterday, October 8th, the NAV for this cat bond focused mutual investment fund was down a further 2.9%, making the total decline since the 4th October -5.94%.

Next, the Stone Ridge Reinsurance Risk Premium Interval Fund which allocates across the spectrum of ILS and reinsurance-linked assets with a particular focus on sidecars and private quota shares, as well as other collateralized reinsurance arrangements.

The Stone Ridge interval ILS fund fell -3.63%, in net asset value terms on the 7th October, but then has been marked down by another -2.96% yesterday (8th). As a result, this fund’s NAV is now -6.47% since October 4th, which again we presume is due to the threat of Milton losses.

As we also reported yesterday, asset manager Amundi US had taken a different approach, only reducing the NAV’s of its Pioneer CAT Bond Fund and Pioneer ILS Interval Fund by -0.1% each as of pricing on the 7th.

But yesterday, October 8th, Amundi US marked the NAVs down for both its mutual dedicated ILS funds.

The Pioneer CAT Bond Fund saw its net asset value priced -2.08% down yesterday, while the Pioneer ILS Interval Fund that invests more broadly across reinsurance quota shares and private ILS positions was -2.05% down for the day.

We’d also reported that the Ambassador US mutual catastrophe bond fund strategy, operated by advisor Embassy Asset Management, has gone with a more Stone Ridge-like approach and its net asset value (NAV) fell -2.41% on October 7th.

At yesterday’s fund pricing, on the 8th, this manager had actually marked the NAV back slightly higher, rising 0.99%, so now only being -1.45% down since October 4th.

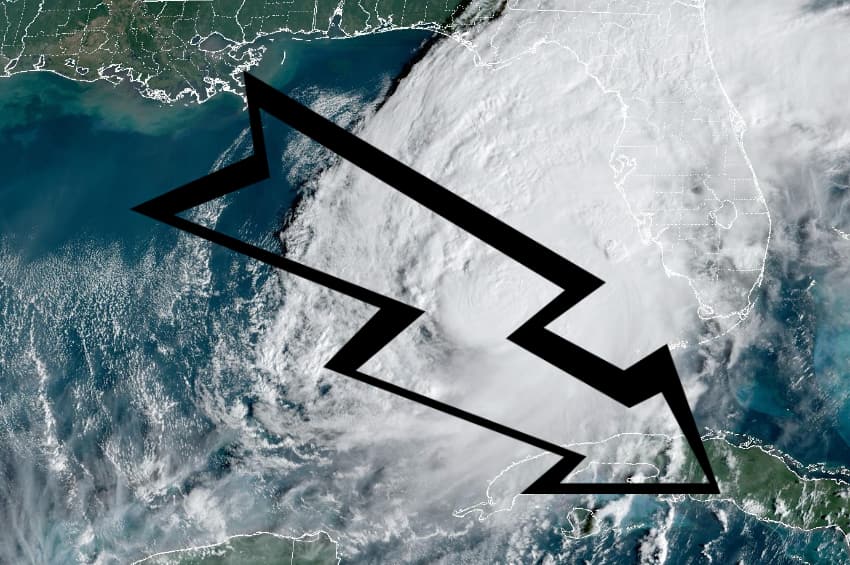

As we’ve reported earlier today, loss projections for hurricane Milton remain in a very wide range, dependent on its landfall location, intensity, the size of the storm, and the path it takes inland.

As a result, we’re hearing figures from $20 billion up still, which makes it very challenging for these investment managers to mark their own modelled expectations into their cat bond and ILS funds, to keep investors informed on the potential ramifications of the storm.

It also shows how investment managers can have different approaches and methodologies for how to handle live catastrophe events.

Also, it’s important to note again that these are not realised losses in any way, but rather appear to be managers trying to mark their portfolios in the best way they can to reflect the threat of future losses from the storm.

As we also said yesterday, UCITS catastrophe bond fund managers will be looking to end of week pricing sheets from catastrophe bond trading desks, to help inform their marks after Milton’s landfall.

Those cat bond pricing sheets are also consumed by managers of private ILS funds, as they offer valuable insights into where actual losses may fall, as well as the mark-to-market impacts from a major catastrophe event.

Remember though, the difference between mark-to-market and actual realised losses to the catastrophe bond market can be considerable, as was seen in 2022 with hurricane Ian.

You can track this and every Atlantic hurricane season development using the tracking map and information on our dedicated page.

Also read:

– Hurricane Milton industry loss at $25bn+ changes pricing narrative: Goldman Sachs.

– Hurricane Milton cat bond loss potential still in wide range: Icosa Investments.

– Hurricane Milton seen denting cat bond market -1.4% (excl. surge): Plenum.

– 33% chance hurricane Milton loss above $50bn. Would drive hard market: Euler ILS Partners.

– Hurricane Milton Cat 5 again. Tracks slightly south. Uncertainty still high, loss range wide.

– Safe to say hurricane Milton likely a $20bn+ insurance market event: Siffert, BMS.

– Hurricane wind speeds forecast across entire Florida Peninsula as Milton approaches.

– Mexico’s catastrophe bond presumed safe from hurricane Milton.

– Stone Ridge leads managers cutting mutual cat bond or ILS fund NAVs on hurricane Milton.

– Hurricane Milton could be a huge test for the entire (re)insurance market: Evercore ISI.

– Hurricane Milton losses could amount to tens of billions, but uncertainty high: BMS’ Siffert.

– As hurricane Milton intensifies, Mexico’s catastrophe bond comes into focus.

– Material hurricane Milton losses could change 2025 property reinsurance price trajectory: KBW.

– Cat bond & ILS managers explore options to free cash, as hurricane Milton approaches.

– Hurricane Milton: First Tampa Bay storm surge indications 8 to 12 feet.

– Hurricane Milton is biggest potential ILS market threat since Ian in 2022: Steiger, Icosa.

– Hurricane Milton forecast for costly Florida landfall. Cat bond & ILS market on watch.