Jeremy Siegel Says S&P Could Hit 6,000 in 2024

What You Need to Know

The S&P 500 could hit 6,000, Siegel says.

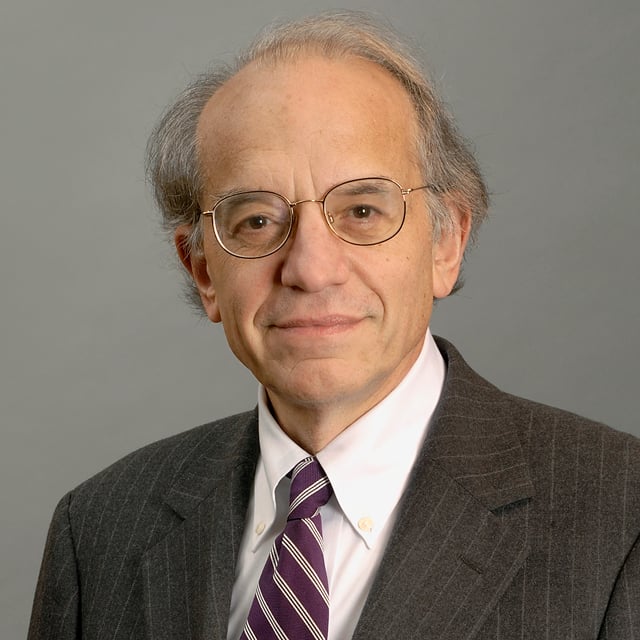

The Wharton emeritus professor says a lower recession probability is good for equities.

Next year’s stock market returns will likely be more subdued, he predicts.

WisdomTree economist and Wharton School emeritus professor Jeremy Siegel sees more room to run for stocks, given lower market expectations for recession, with the S&P 500 potentially hitting 6,000 — although he also anticipates more subdued returns next year.

Market sentiment indicates lower expectations for a recession based on recent economic data, with the 10-year Treasury yield pushing toward 4% last week, he wrote in his weekly commentary Monday. (The yield has moved beyond that level this week.)

Many advisors tried to lock in long rates now that the Federal Reserve is cutting, but long rates have gone higher, as should have expected since the central bank’s move, Siegel wrote. “I think bonds are likely to decline again over the next six months as the Fed pivot lowers the probability of a downturn turn in the economy,” he said.

“This lower probability of a recession is also good for equities, particularly the lower valued segments of the market like small caps which are very sensitive to recession fears. I can see 6,000 being a target that the S&P 500 hits, while also recognizing that 2025 will have more subdued returns than we’ve experienced in 2023 and 2024,” the economist wrote.

“Overall, the backdrop remains quite positive for equities,” Siegel wrote. “The Fed is on course for cutting five to six times by next summer, while the economy remains quite resilient.”

While last week’s jobs report exceeded economists’ expectations, hours worked fell to levels often associated with recessions, he noted. “This juxtaposition of more workers clocking fewer hours suggests that while employment figures are up, the quantity of work didn’t expand much.”